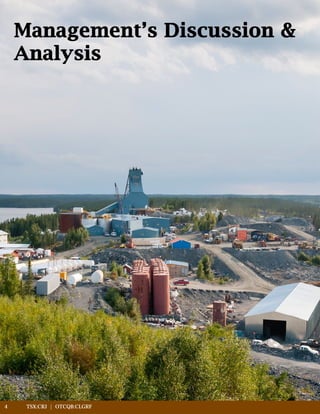

- Claude Resources Inc. is a Canadian gold mining company that owns and operates the Seabee Gold Operation in Saskatchewan and owns the Amisk Gold Project.

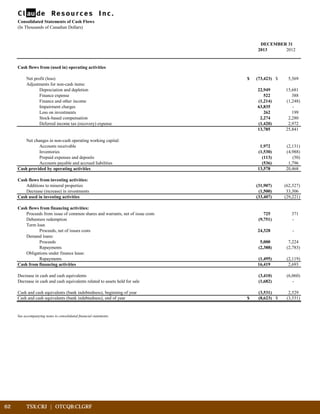

- In 2013, production at Seabee was 43,850 ounces, revenue was $63.8 million, and the company reported a net loss of $73.4 million due to impairment charges.

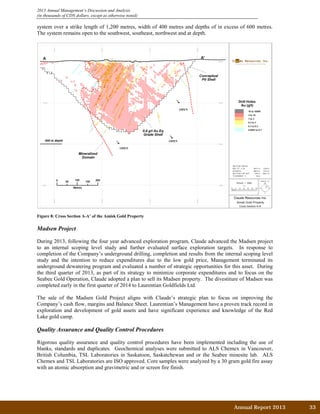

- Key events in 2013-2014 included the sale of the Madsen Project, the retirement of the CEO, an amendment to the term loan agreement, and the sale of a gold royalty to improve the company's financial position.