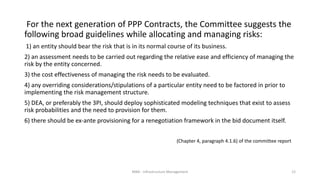

The committee, headed by former Finance Secretary Vijay Kelkar, submitted a report with recommendations to improve India's public-private partnership (PPP) model for infrastructure projects. The committee recognized PPPs as valuable for speeding up infrastructure development in India. However, it noted that PPP contracts need to focus more on service delivery rather than just fiscal benefits. The report called for changes to improve governance and reduce risks for private partners in PPPs. This includes clarifying rules on corruption, establishing an institution to support PPP capacity building, and better allocation of project risks between public and private entities. The recommendations aim to strengthen India's PPP framework and rebuild capacities to facilitate more effective private investment in infrastructure.