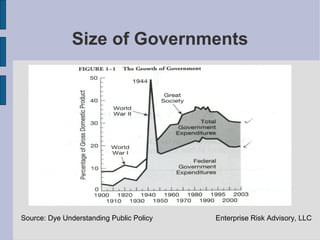

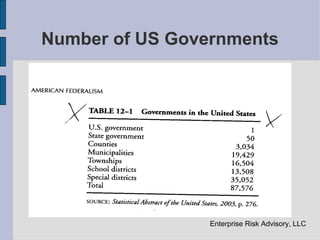

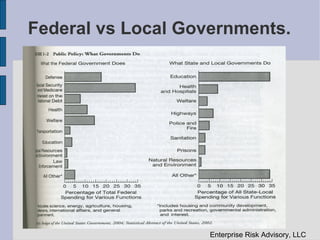

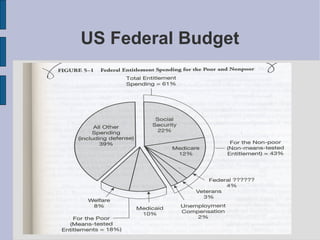

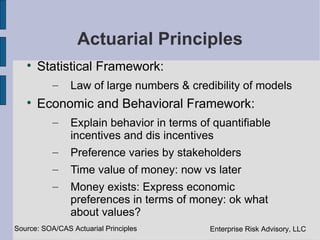

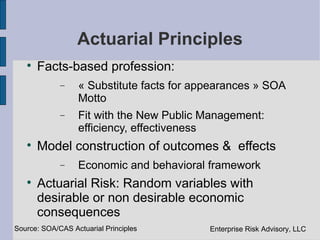

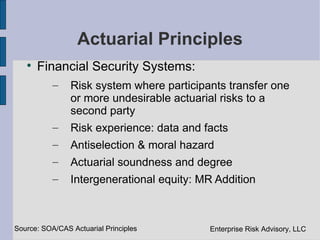

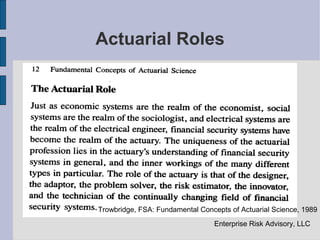

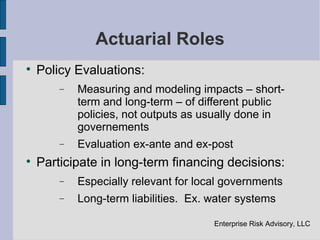

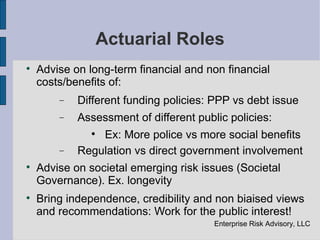

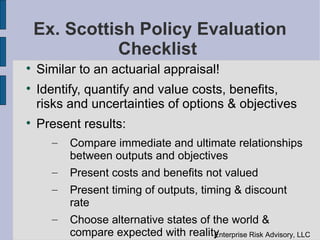

This document discusses public finance and the role of actuaries. It defines public finance as the economics of paying for governmental activities and administering those activities. It describes types of government expenditures and sources of funding. Charts show the size of governments and number of governments in the US. The document outlines actuarial principles of statistical frameworks, economic behavior, facts-based analysis, and risk transfer. It proposes actuarial roles in policy evaluation, long-term financing decisions, and advising on costs and benefits of policies, funding, and emerging societal risks.