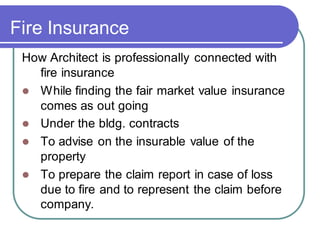

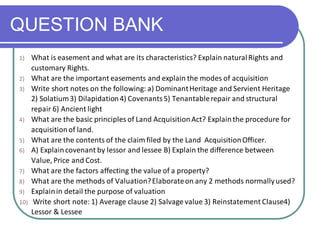

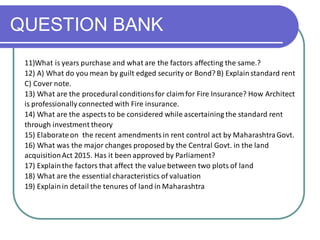

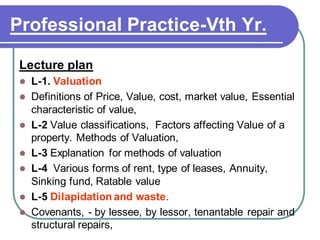

The document provides an overview of topics to be covered in a Professional Practice lecture plan, including valuation, types of leases, dilapidation, repairs, easements, land acquisition, rent control, and fire insurance. Key points include:

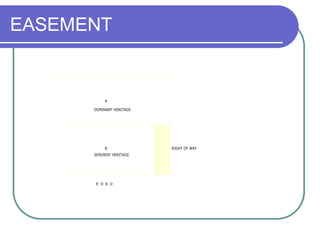

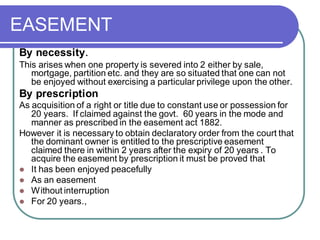

1) Easements are rights over another's land that allow the use or enjoyment of one's own land, such as rights of way. They have dominant and servient lands.

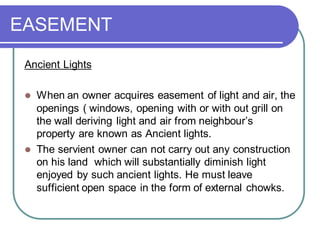

2) They can be acquired by grant, necessity, or prescription of continuous use for 20 years. Ancient lights protect long-standing windows from new obstructions.

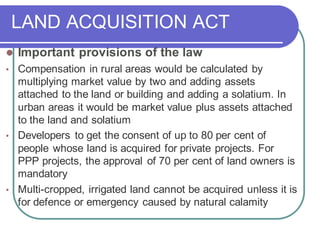

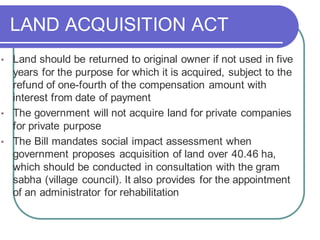

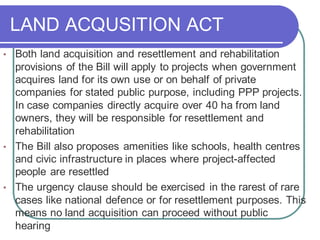

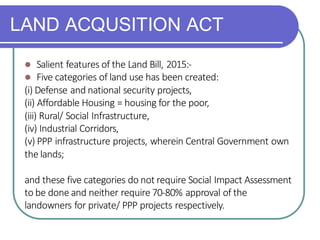

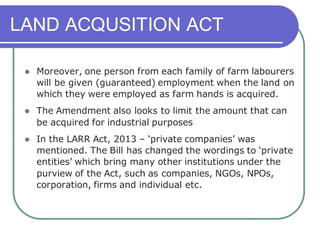

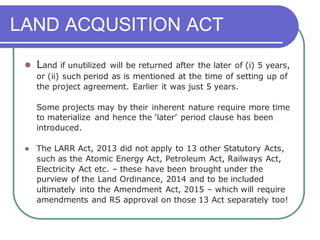

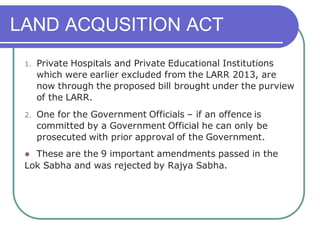

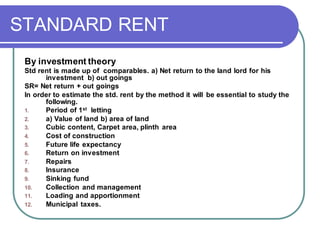

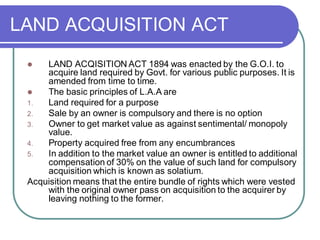

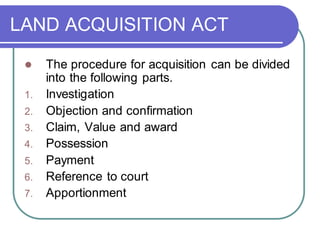

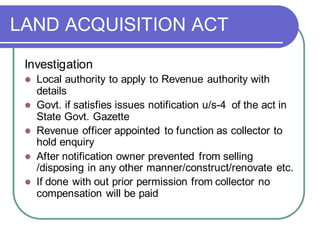

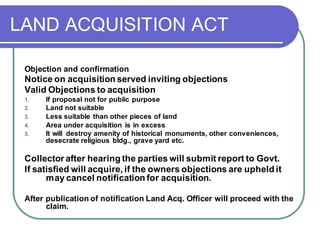

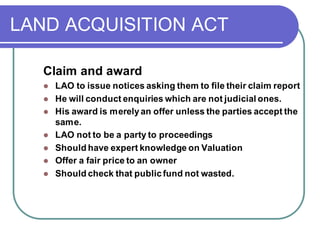

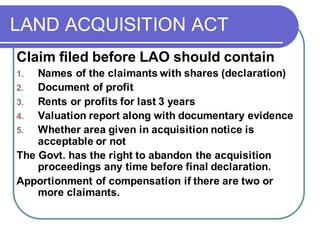

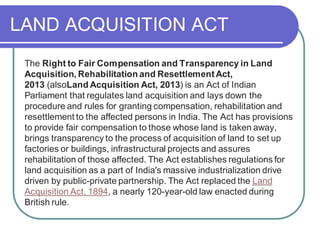

3) The Land Acquisition Act allows compulsory land acquisition for public purposes, with compensation at market rate plus 30

![LAND ACQUISITION ACT

The Land Acquisition, Rehabilitation and Resettlement

Bill, 2011 was introduced in Lok Sabha on 7 September

2011.The bill was then passed by it on 29 August 2013

and by Rajya Sabha on 4 September 2013. The bill then

received the assent of thePresident of India, Pranab

Mukherjee on 27 September 2013.[4] The Act came into

force from 1 January 2014.

An amendment bill was then introduced in Parliament to

endorse the Ordinance. Lok Sabha passed the bill but

the same is still lying for passage by the Rajya Sabha.

On 30 May 2015, President of India promulgated the

amendment ordinance for third time.[5]](https://image.slidesharecdn.com/professionalpracticevthyear1-210630121001/85/Professional-practice-vth-year-24-320.jpg)