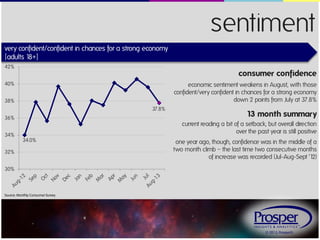

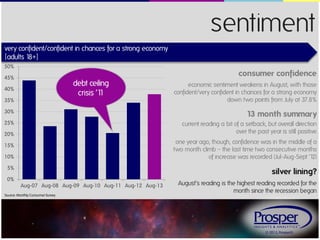

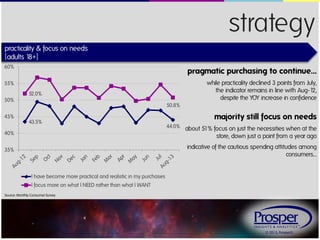

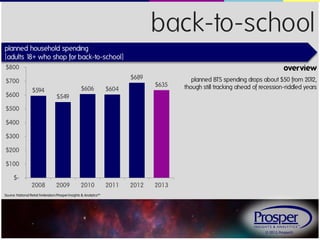

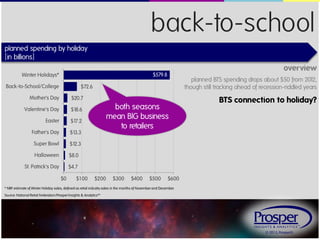

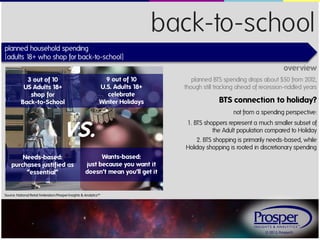

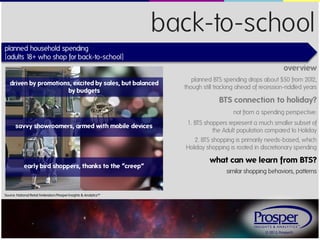

The document summarizes consumer sentiment and spending trends in August 2013 based on a monthly consumer survey. It finds that economic confidence weakened slightly from July, though remains higher than a year ago. While practical purchasing attitudes declined a bit from July, consumers continue to focus on necessities over wants when shopping. Planned back-to-school spending is projected to drop around $50 from 2012 but remains above recession levels.