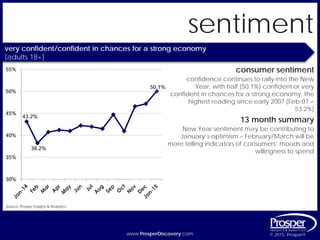

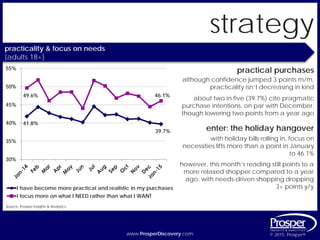

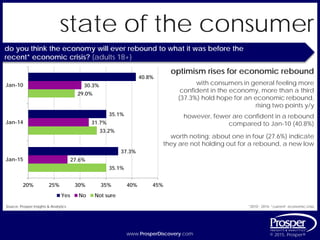

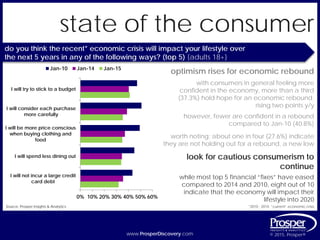

Consumer confidence continues to rise heading into 2015, with half of consumers confident in the economy's strength, the highest level since 2007. However, consumers remain practical in purchases and focused on needs over wants. While optimism about an economic rebound is up slightly year-over-year, fewer are confident compared to 2010, and many believe the crisis will continue impacting lifestyles for years. Cautious consumerism is expected to persist as most financial strategies adopted since the recession have only slightly eased.