The document is a monthly consumer snapshot report from January 2014 published by Prosper Discovery. It contains the following key points:

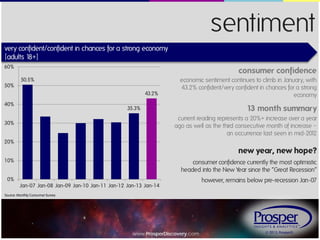

1) Consumer confidence continued to climb in January 2014, with 43.2% of adults feeling confident or very confident about the economy. This is a 20% increase from a year ago and the third consecutive monthly increase.

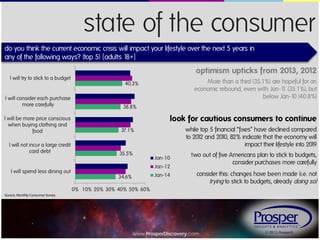

2) While consumer confidence is rising, practicality in purchases is decreasing slightly. However, consumers still focus on buying only what they need rather than wants.

3) More than a third of consumers are hopeful the economy will rebound to pre-crisis levels, though this is below optimism levels in 2010. Most consumers believe the economic crisis will impact their l