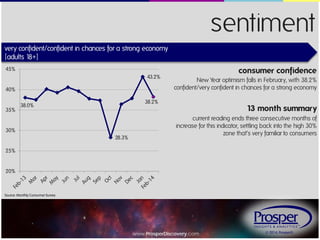

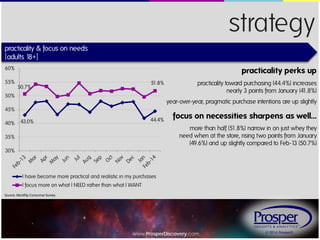

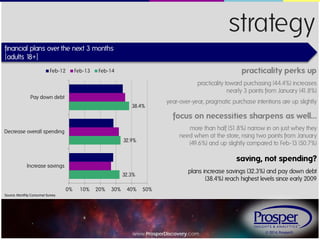

Consumer confidence fell in February according to a Prosper survey. Only 38.2% of adults felt confident or very confident in the economy, down from January. Sentiment has improved since the recession but remains below pre-recession levels. Purchase strategies focused more on practicality and necessities in February. Over half of consumers narrowed their shopping to just what they need, and plans to pay down debt and increase savings reached high levels. Amazon received the highest "shopper security score" of retailers rated, while department stores scored lower on average.