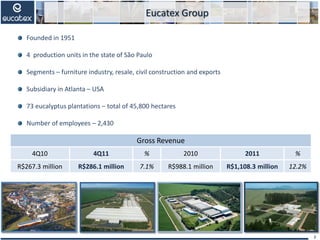

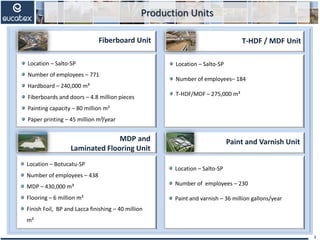

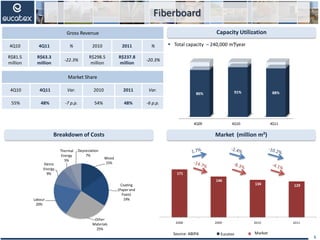

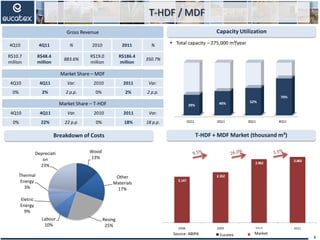

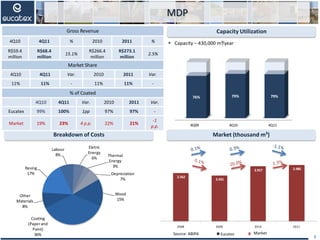

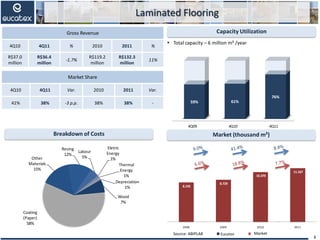

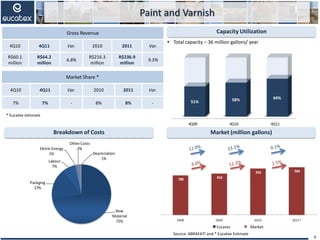

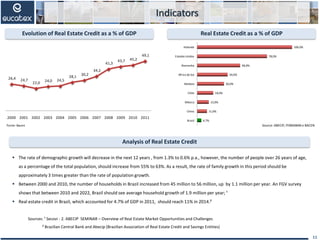

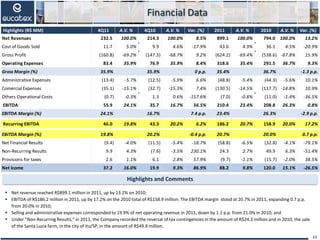

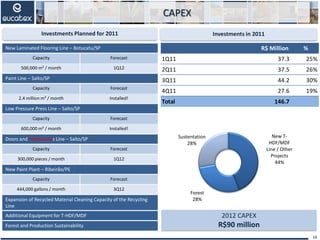

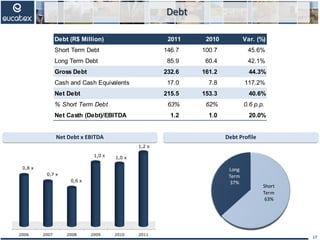

Eucatex Group is a Brazilian company founded in 1951 with 4 production units in São Paulo. It has 73 eucalyptus plantations totaling 45,800 hectares. In 2011, the company had 2,430 employees and gross revenue of R$1.1 billion, up 12.2% from 2010. The document provides details on Eucatex's business segments, production capacity and utilization rates, market share, costs, sustainability initiatives, and key financial indicators for 2010-2011.