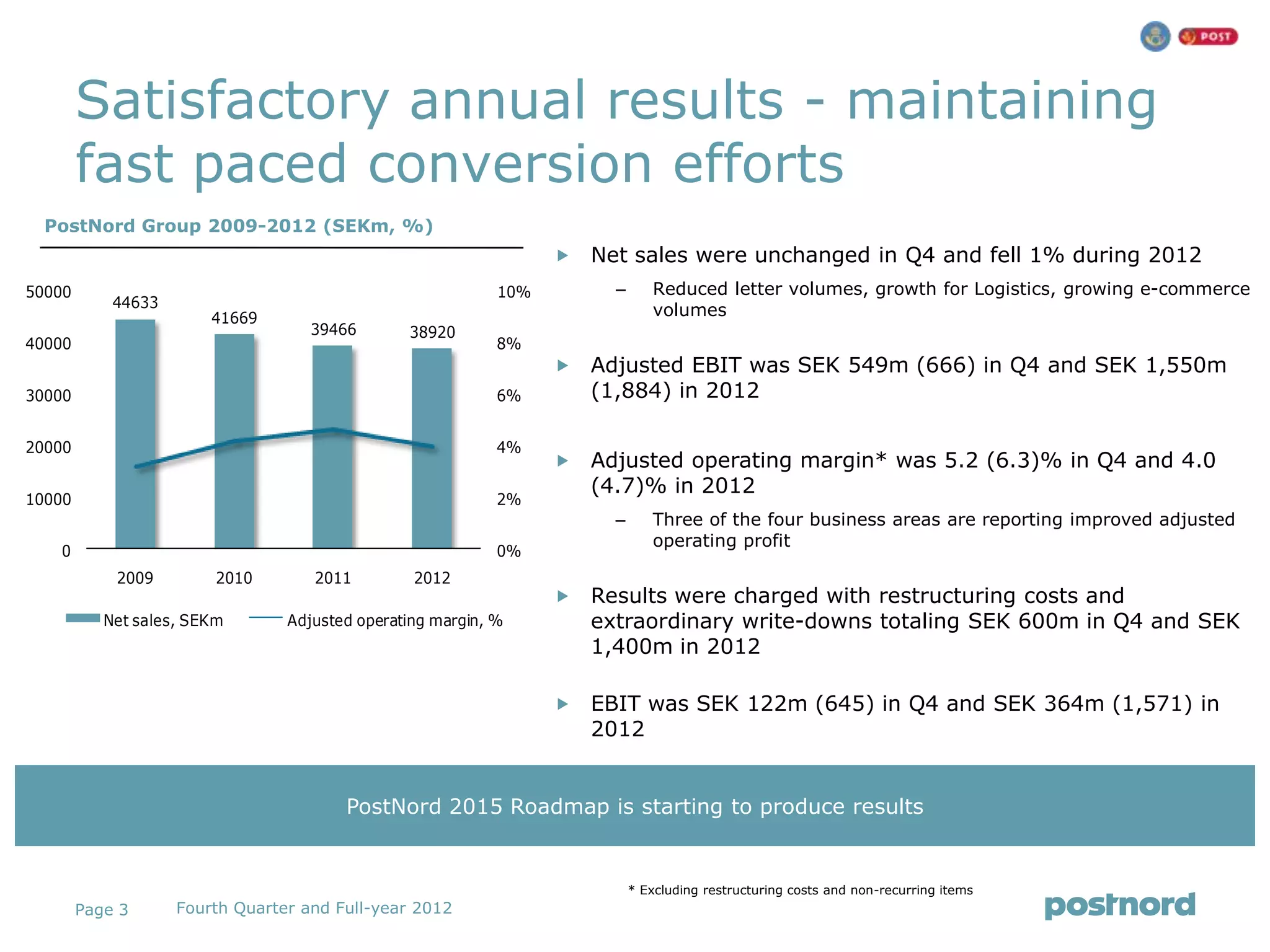

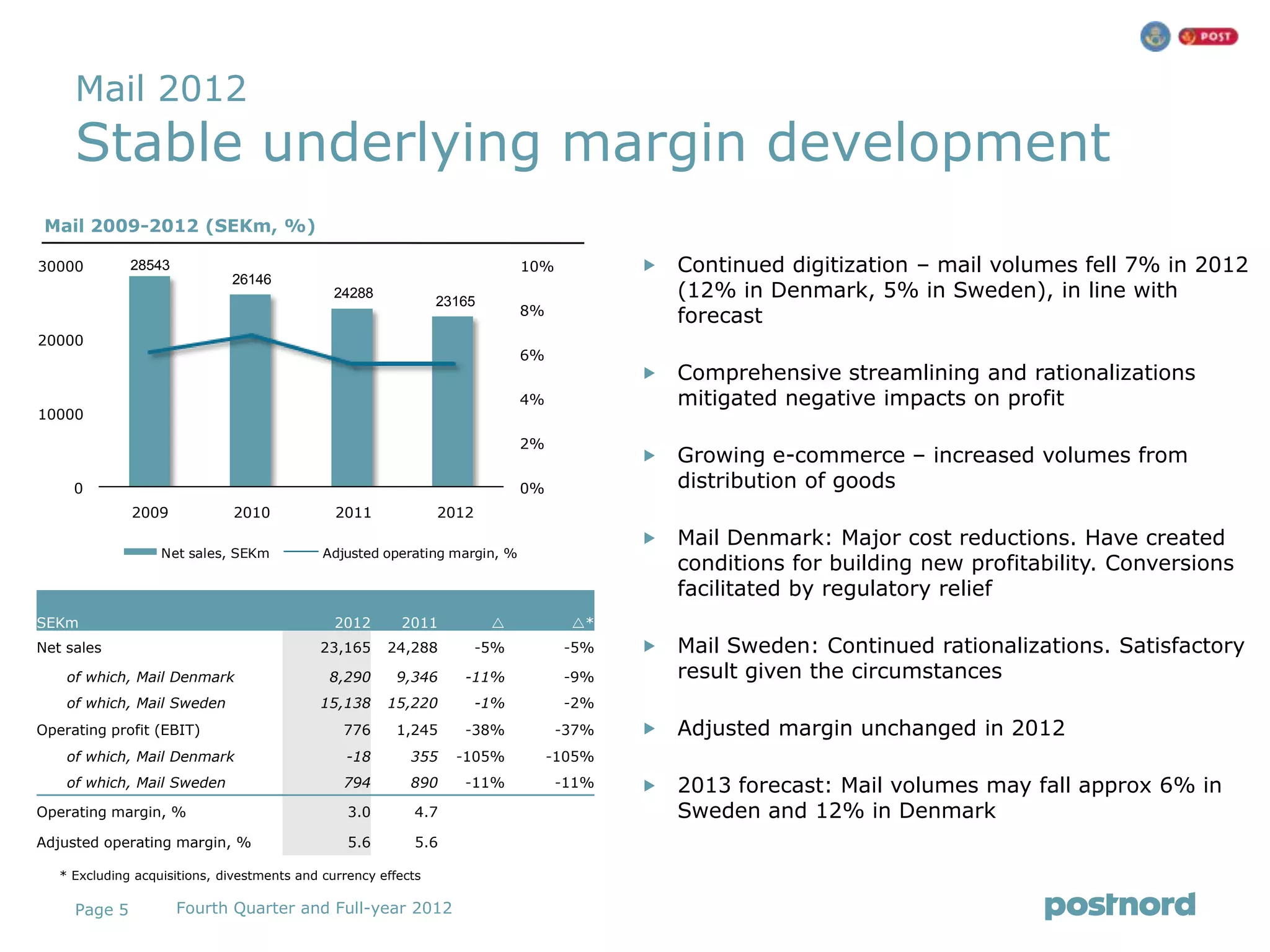

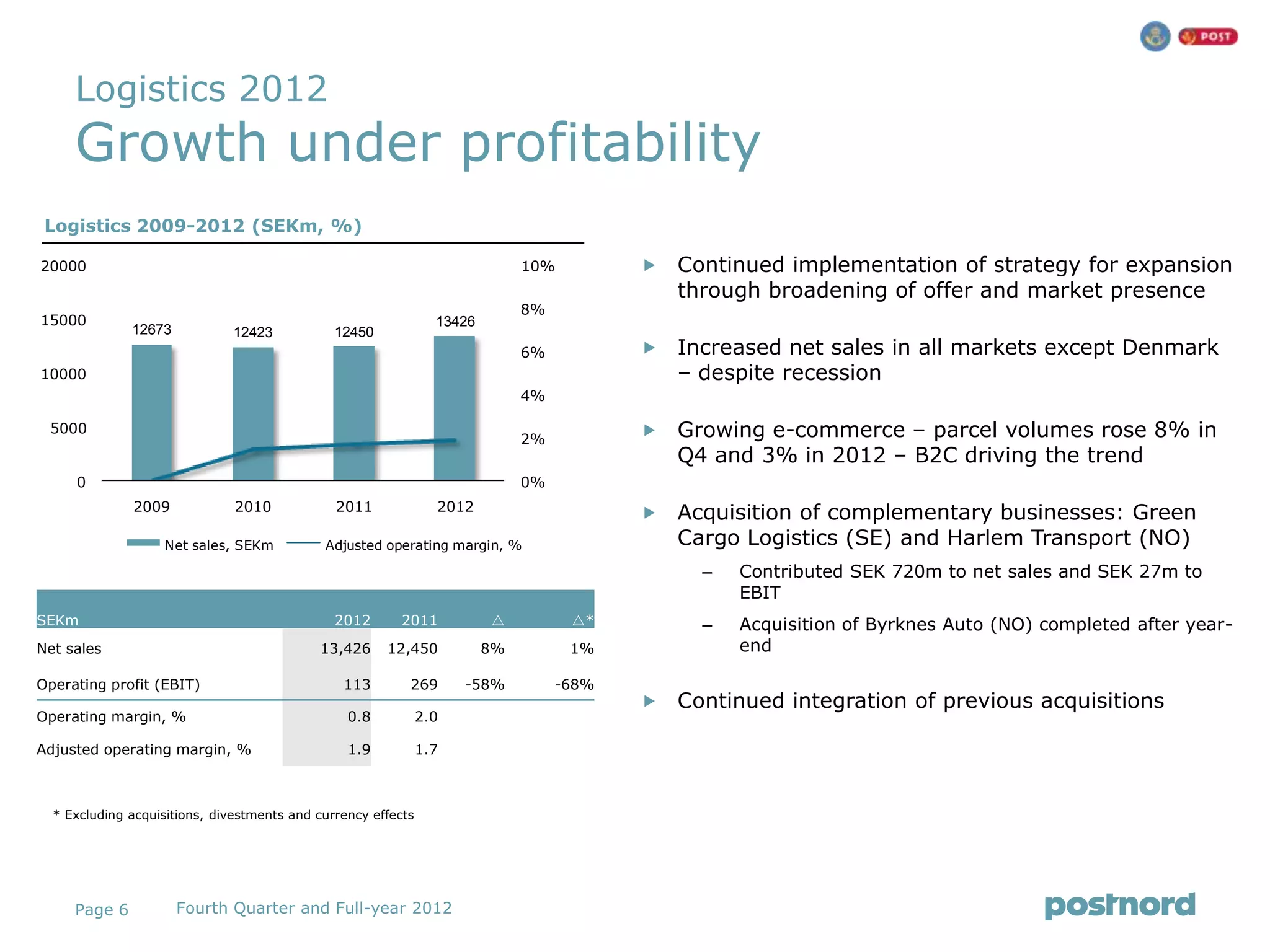

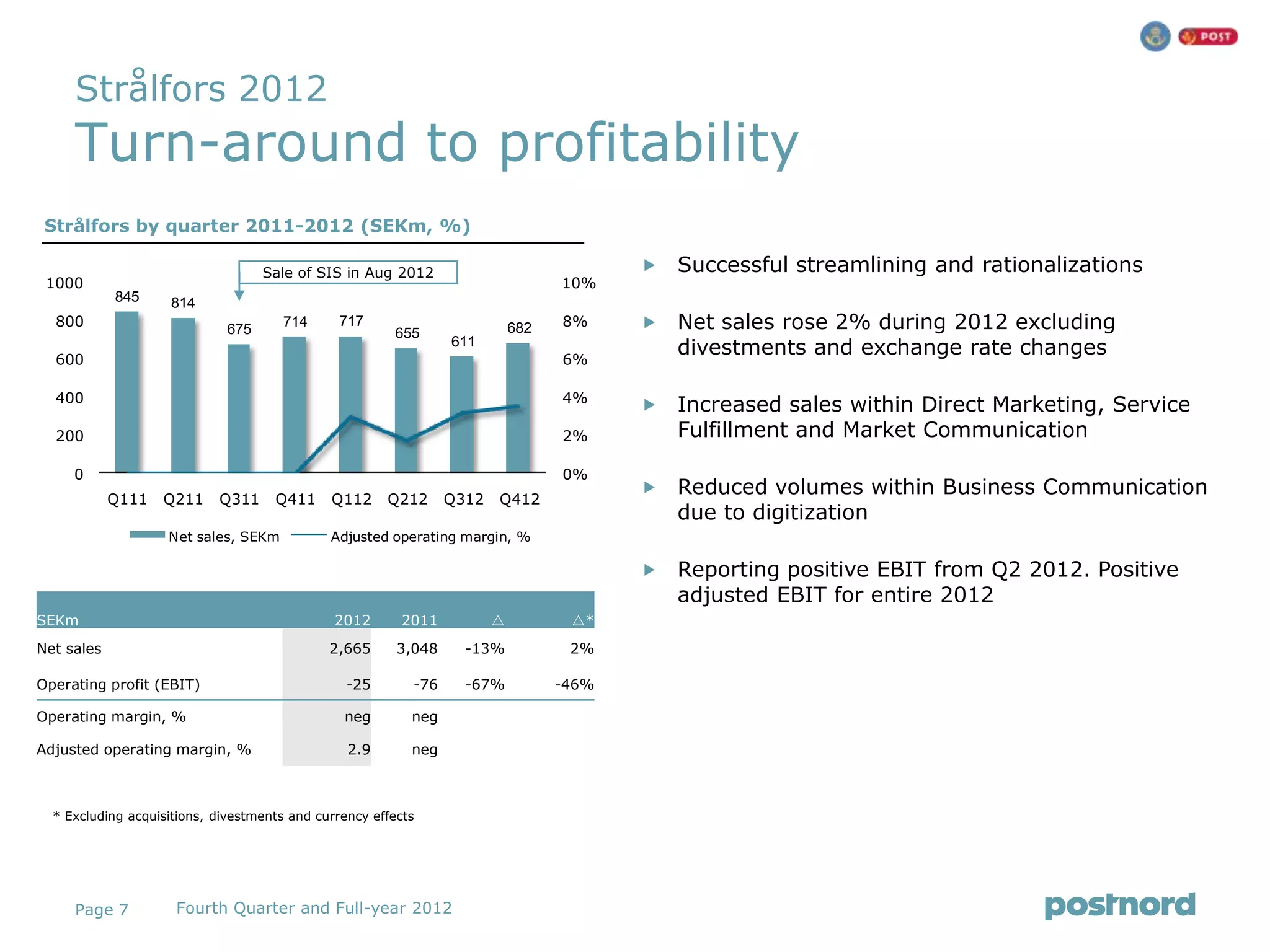

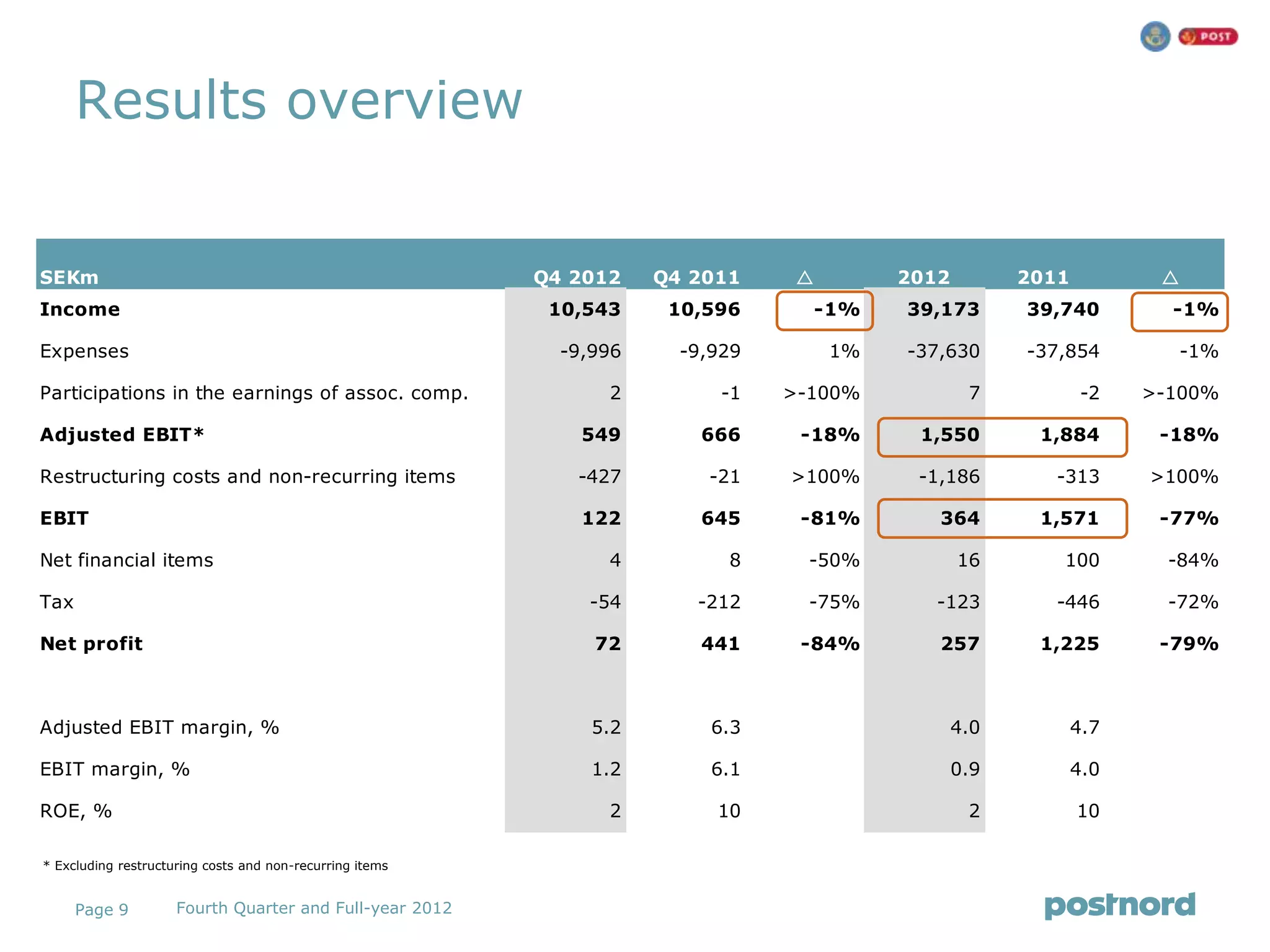

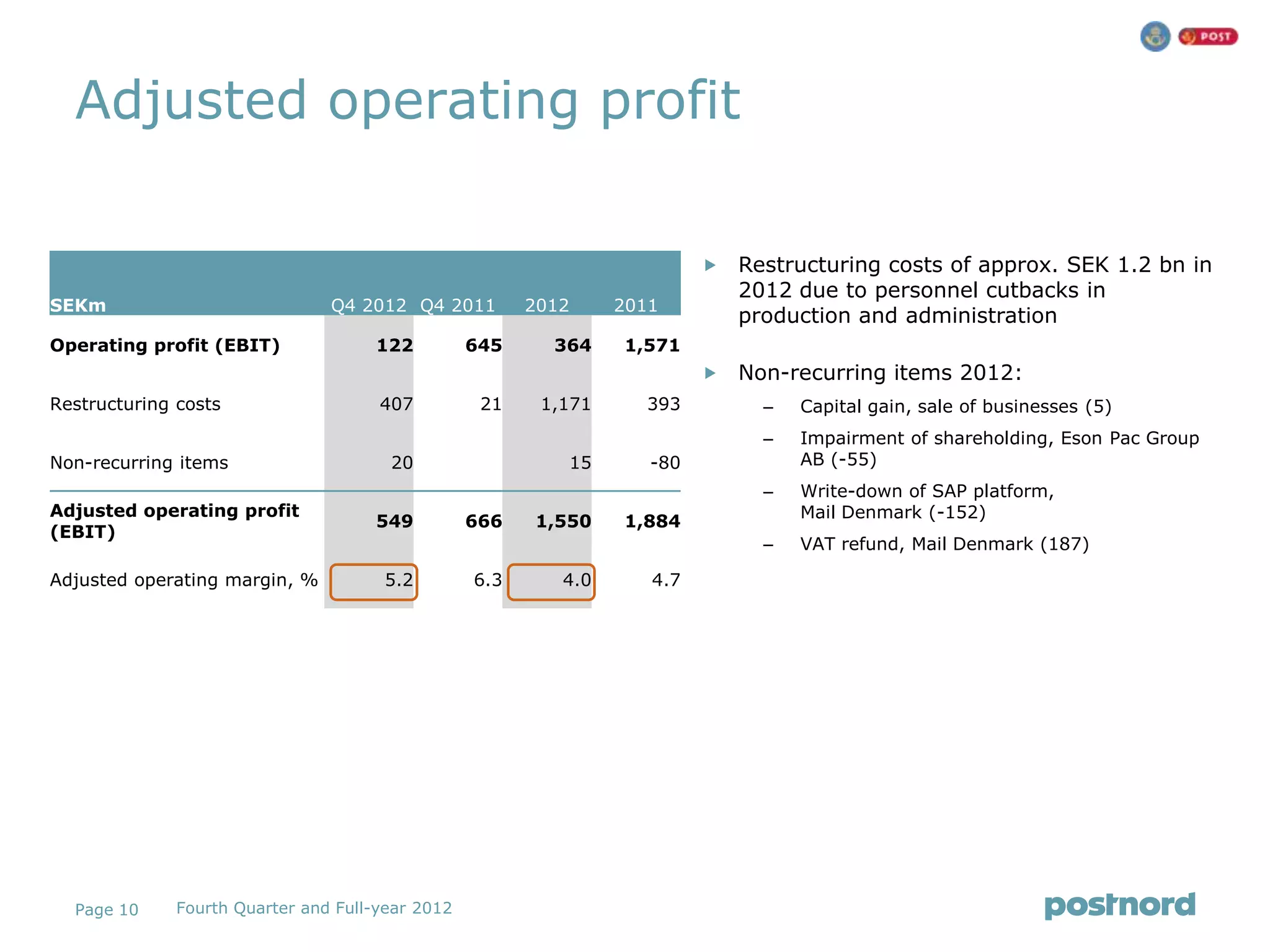

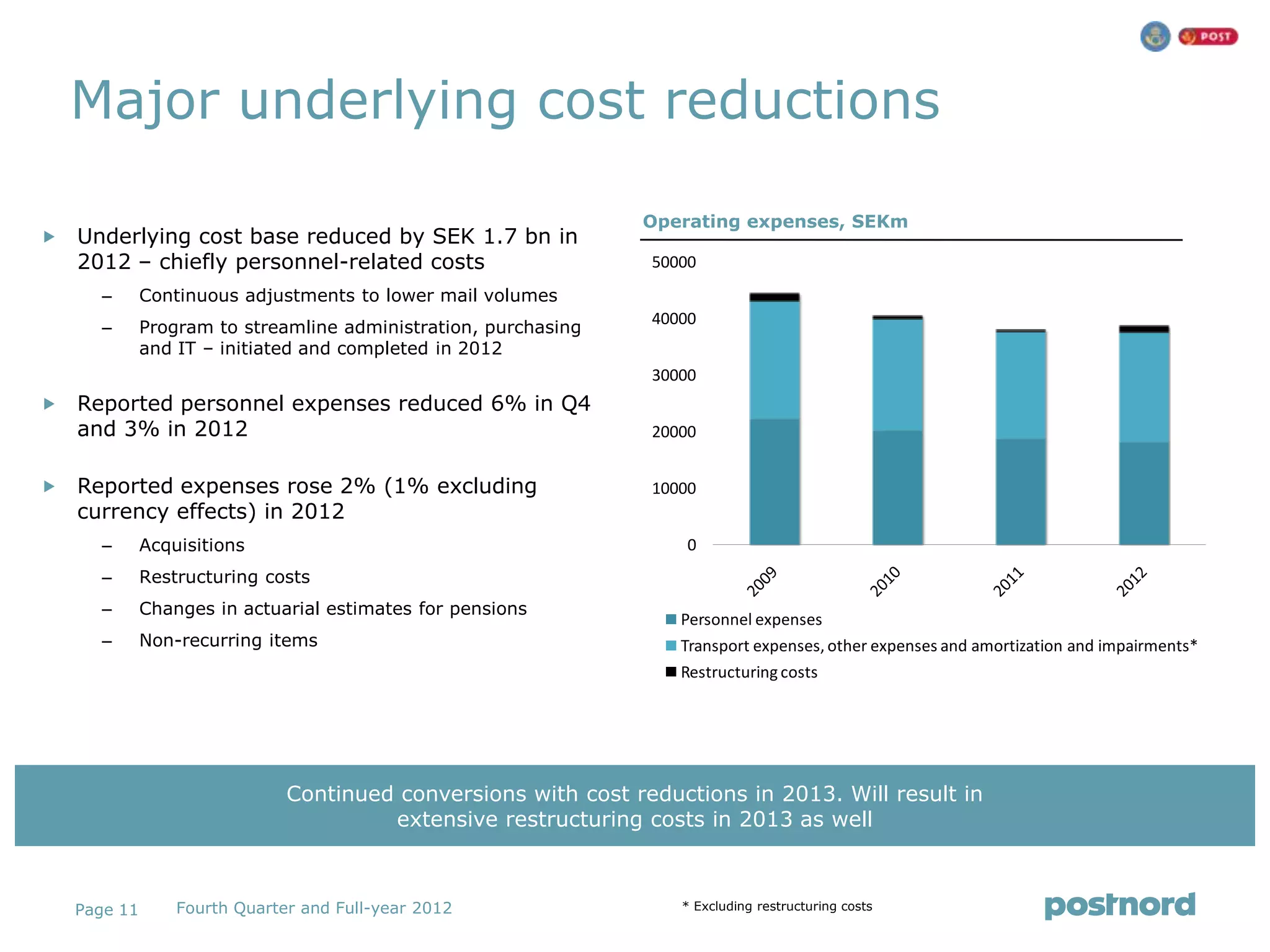

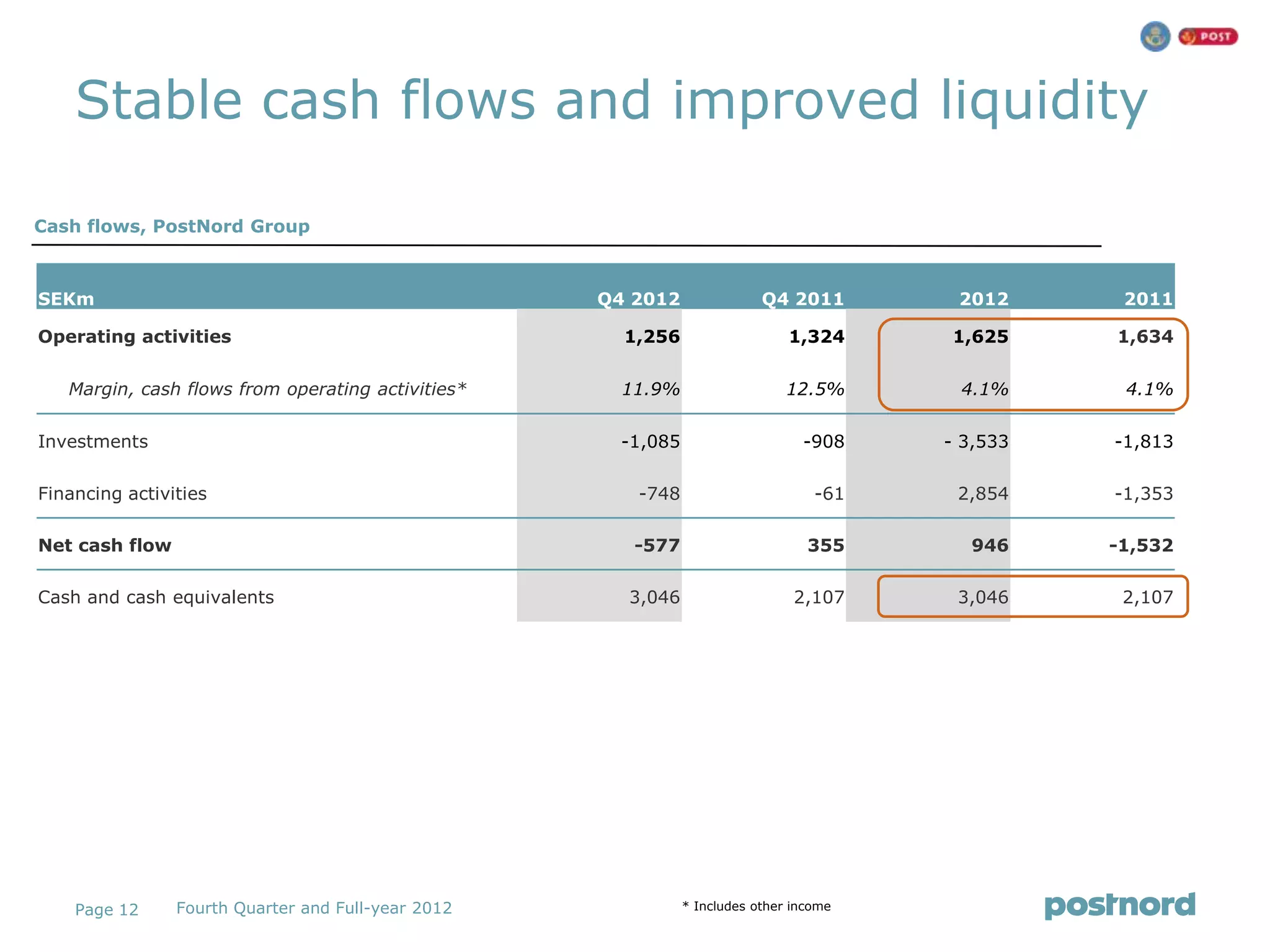

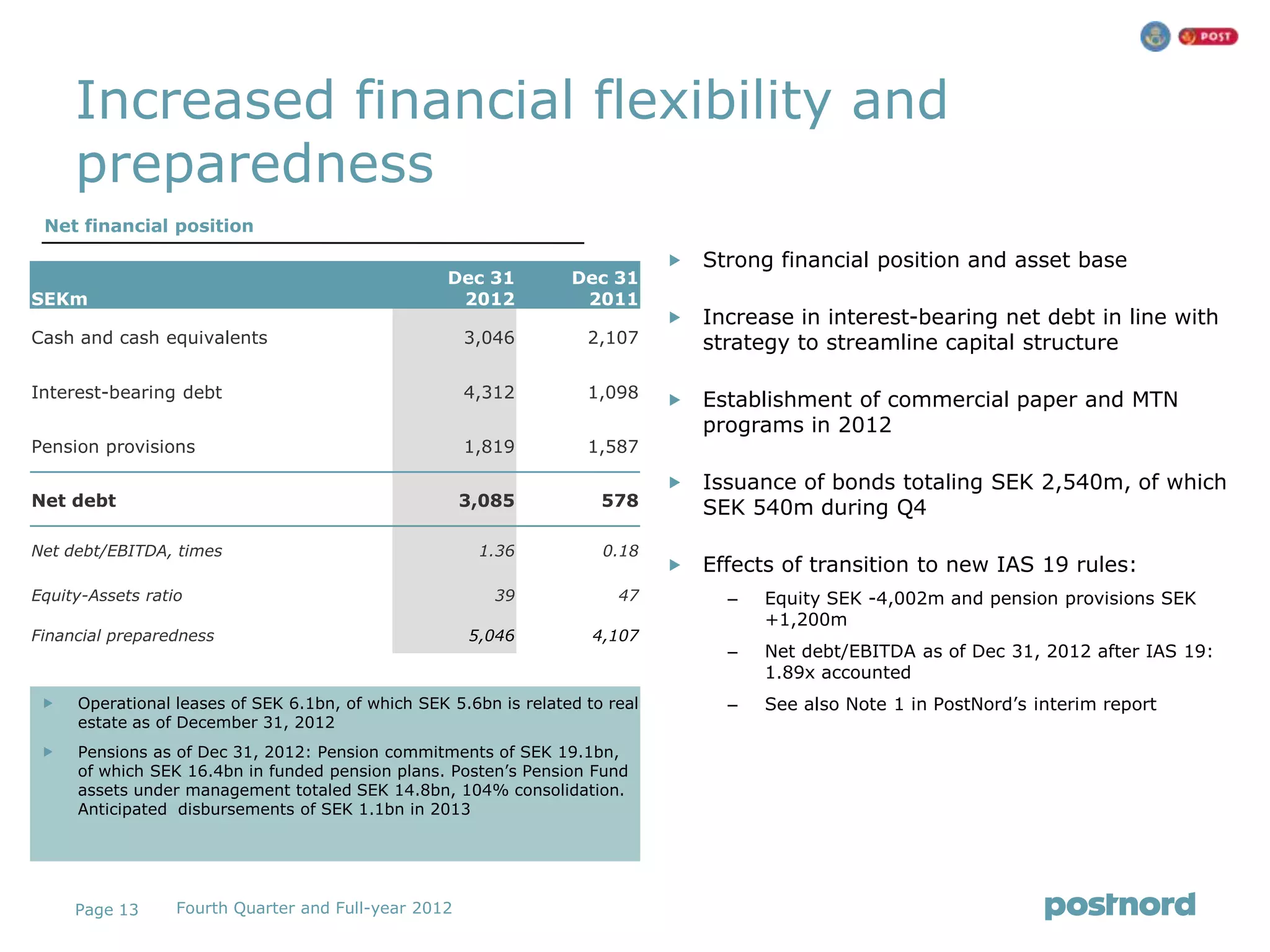

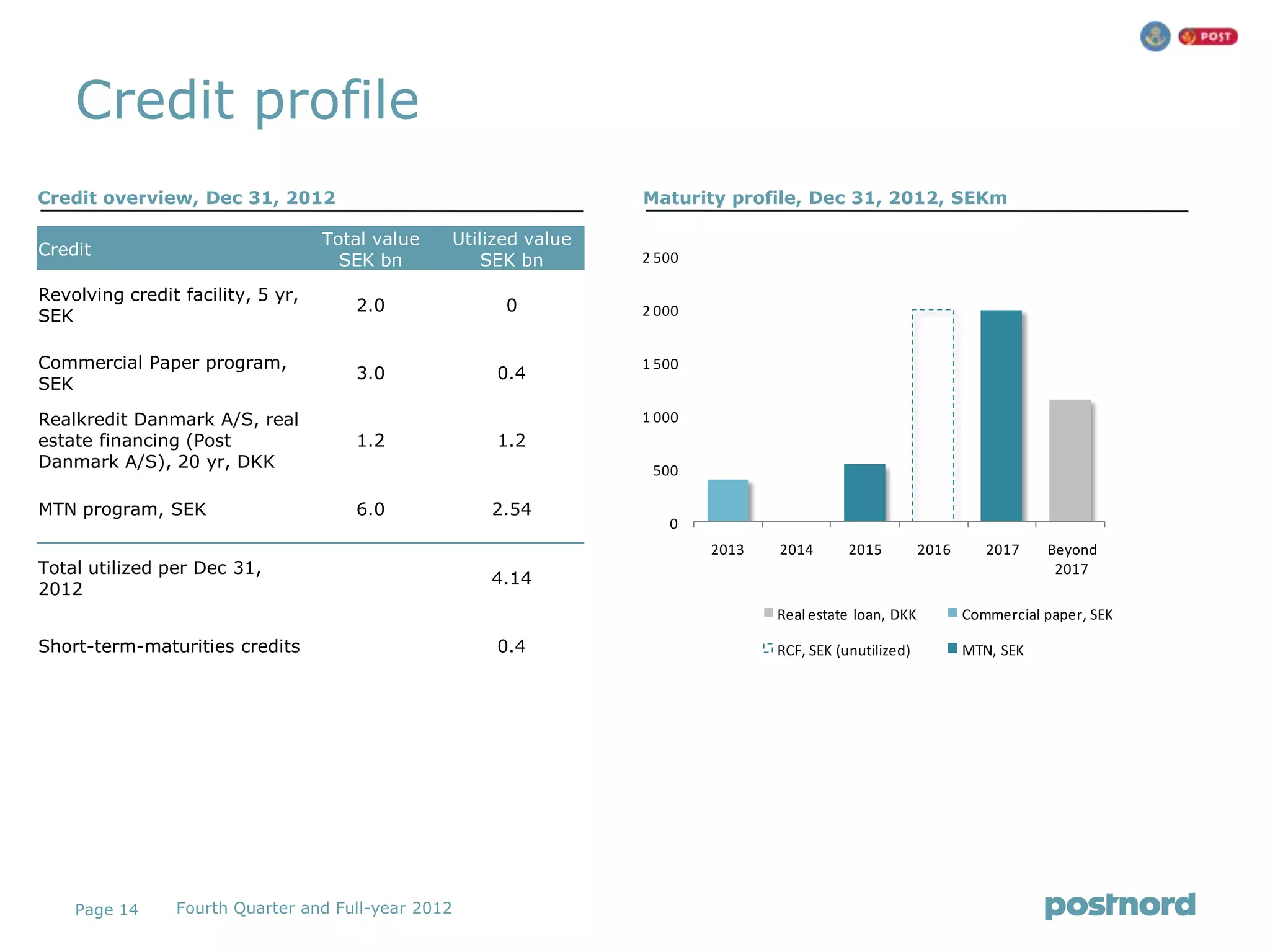

PostNord reported satisfactory annual results for 2012, maintaining efforts to convert operations amid declining letter volumes. Net sales were unchanged in Q4 2012 and fell 1% for the full year. Adjusted operating profit was SEK 549m in Q4 and SEK 1,550m for 2012. Results were impacted by SEK 600m in restructuring costs and write-downs in Q4 and SEK 1,400m for the full year. The Mail business stabilized its underlying margin despite a 7% volume decline for the year. Logistics grew sales 8% in Q4 and 1% for the year on increased e-commerce volumes, and also acquired complementary businesses. Strålfors achieved profitability following stream