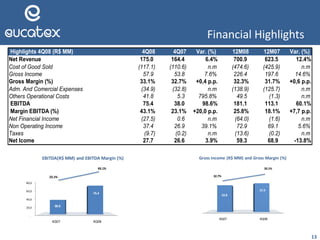

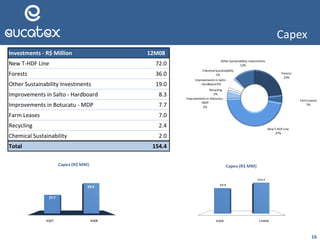

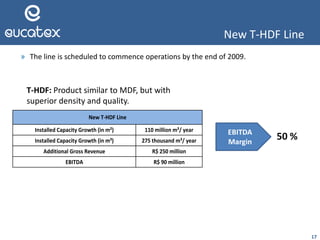

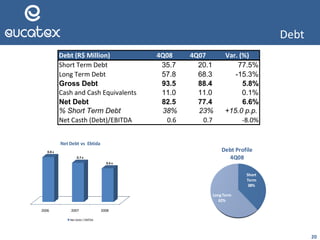

Eucatex reported financial results for 4Q08 and full year 2008. Key highlights included 6.8% revenue growth in 4Q08 and 13.1% growth for full year 2008. EBITDA was R$181.1 million for 2008, a 60.1% increase over 2007. The company is constructing a new T-HDF/MDF line that is expected to increase annual revenue by R$250 million and cash flow by R$90 million once operational in late 2009. Eucatex has 44,000 hectares of forested land and sources wood within 150km of its facilities on average, ensuring sustainable raw material supply.