Embed presentation

Download to read offline

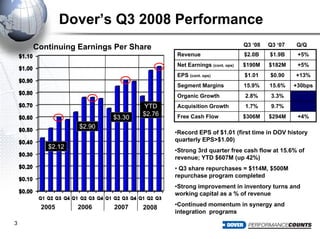

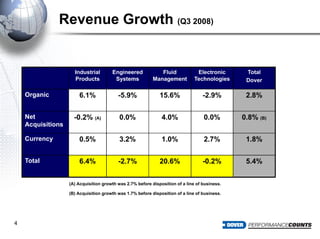

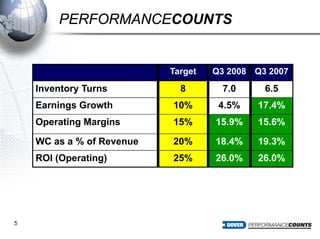

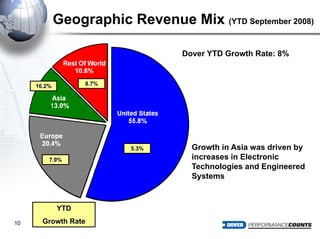

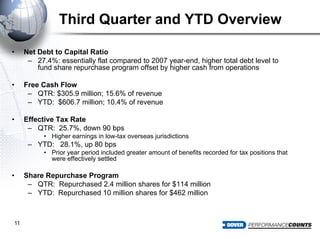

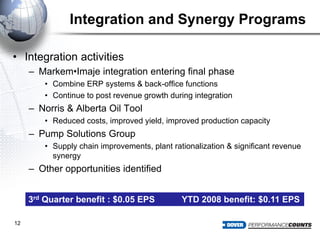

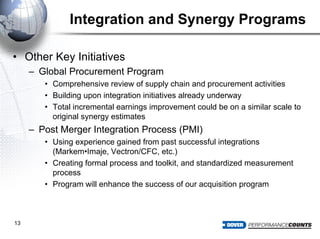

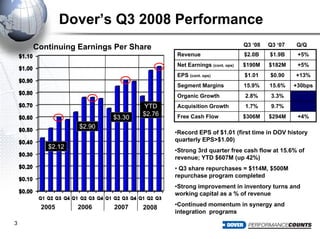

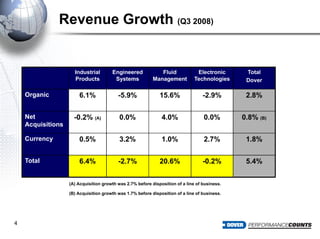

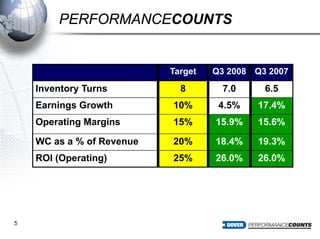

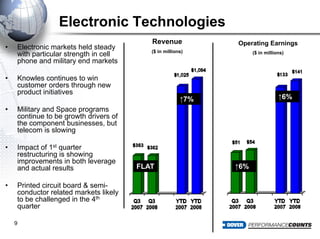

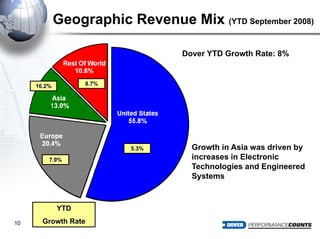

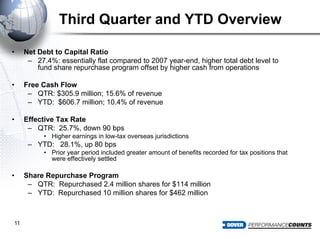

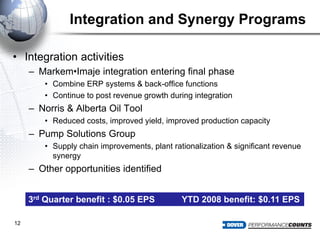

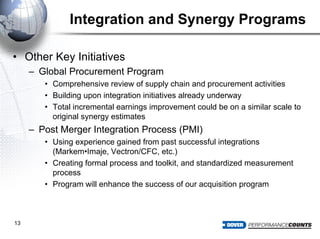

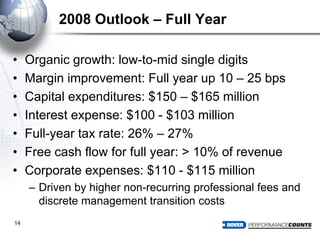

Dover Corporation reported third quarter 2008 results with revenue increasing 5% year-over-year to $2 billion and earnings per share increasing 13% to $1.01. Free cash flow was up 4% to $306 million for the quarter. Segment margins increased slightly to 15.9% while organic growth was 2.8% and acquisition growth was 1.7%. The company completed its $500 million share repurchase program for the quarter, repurchasing $114 million in shares. Integration and synergy programs contributed $0.05 per share for the quarter and $0.11 per share year-to-date.