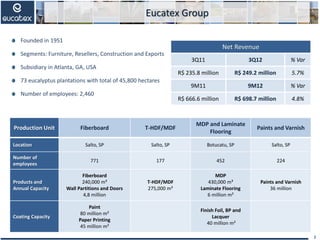

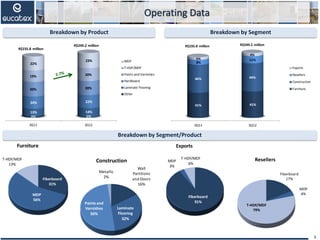

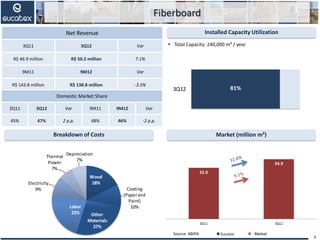

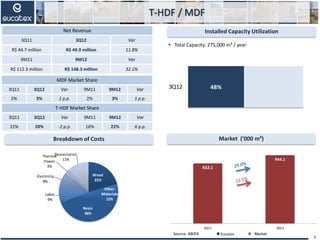

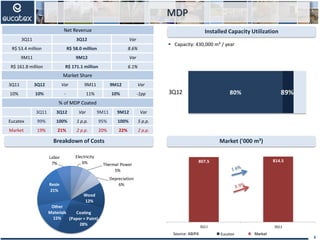

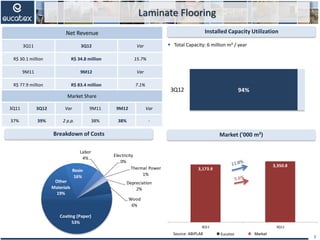

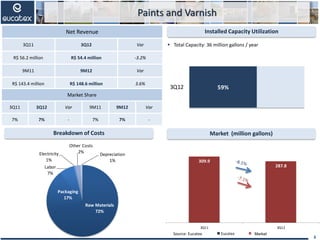

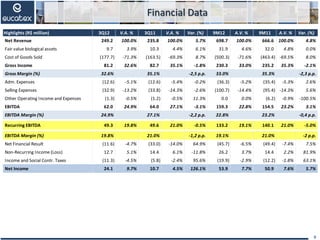

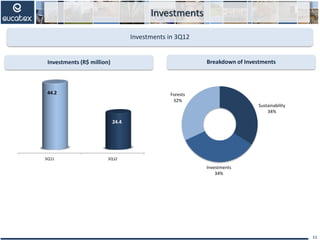

Eucatex Group reported a 5.7% increase in net revenue for 3Q12 compared to 3Q11. The main segments contributing to revenue were MDP, T-HDF/MDF, and paints and varnishes. Capacity utilization increased across segments, with MDP at 94% and fiberboard at 80%. Investments in 3Q12 totaled R$24.4 million, with 34% going to sustainability initiatives and 32% to forest plantations. Eucatex remains focused on increasing productivity through new harvesting systems and recycling programs.