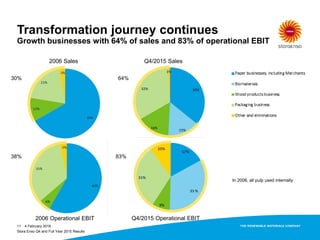

Stora Enso reported financial results for Q4 and full year 2015. Key highlights included:

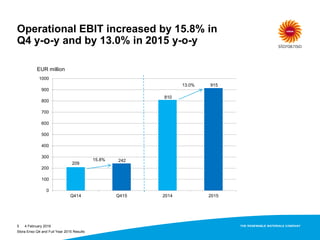

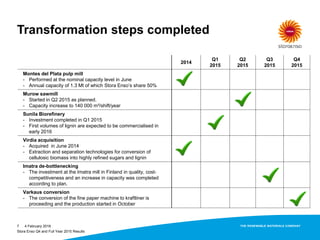

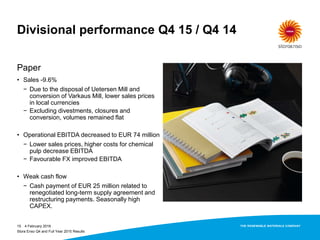

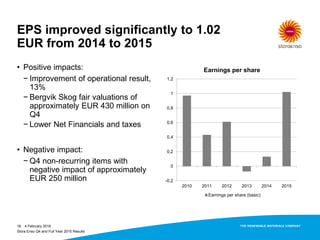

- Operational EBIT improved 15.8% in Q4 and 13% for the full year due to higher pulp volumes from Montes del Plata and favorable foreign exchange rates.

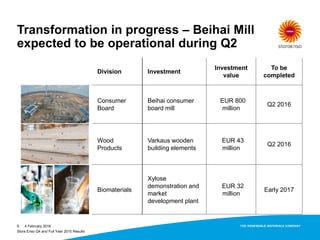

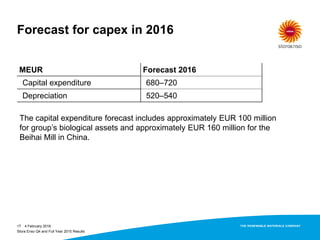

- Cash flow remained strong at EUR 412 million before investments and EUR 75 million after investments despite peak capital expenditures in 2015.

- Net debt to operational EBITDA was reduced to 2.4 from 2.6 the prior year.

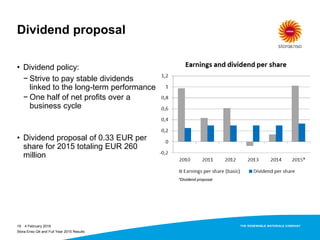

- Annual EPS increased substantially to EUR 1.02 from EUR 0.13 in 2014, supported by a forest valuation gain.

- The company proposed increasing