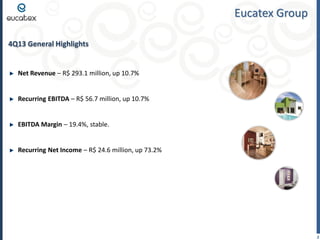

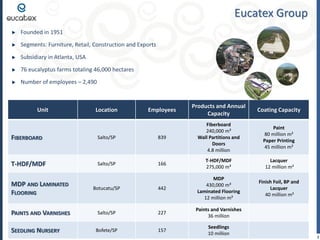

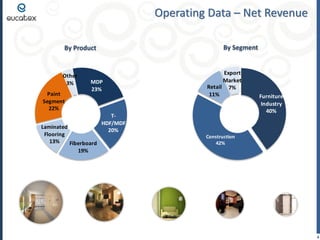

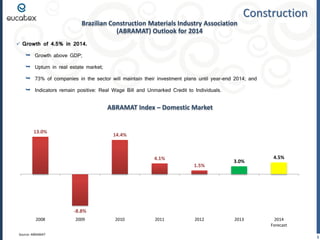

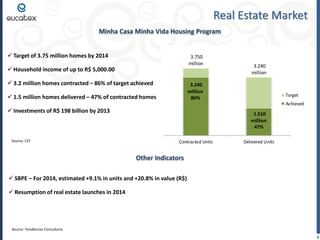

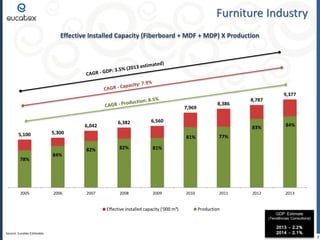

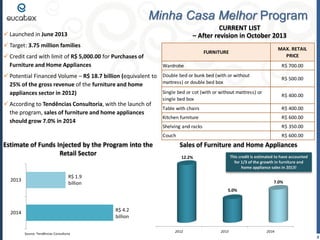

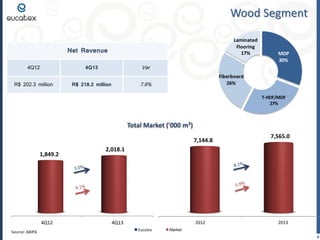

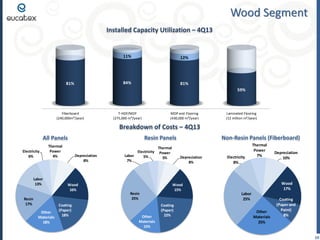

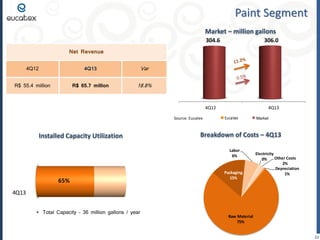

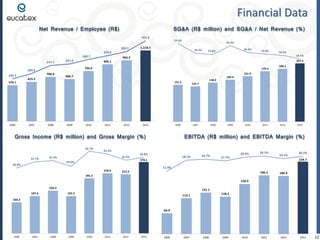

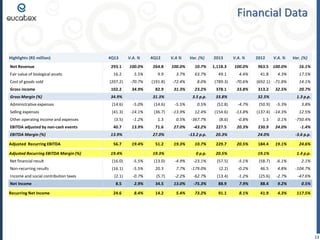

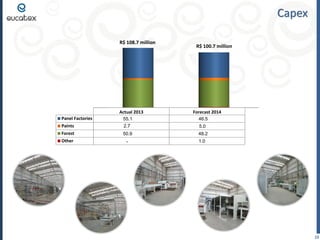

Eucatex reported strong financial results for 4Q13, with net revenue up 10.7% and recurring EBITDA up 10.7%. Segment revenues grew across furniture, construction, and paints. The construction industry is expected to grow 4.5% in 2014, supported by housing programs. Eucatex maintained a stable EBITDA margin of 19.4% and increased recurring net income 73.2% for the quarter. Capex plans of R$108.7 million for 2014 will focus on panel factories and forests.