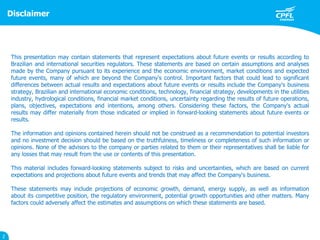

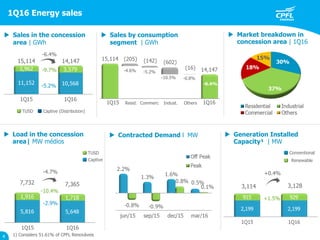

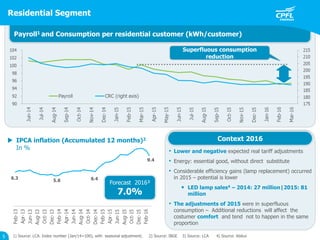

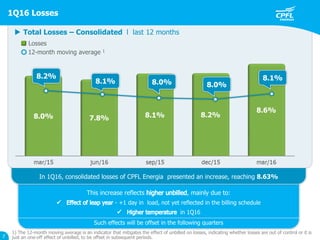

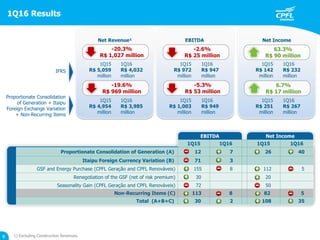

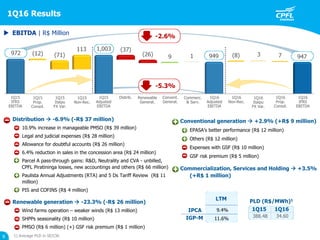

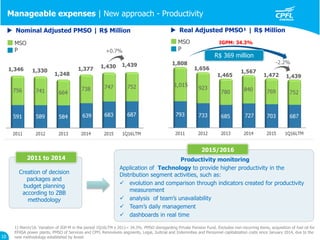

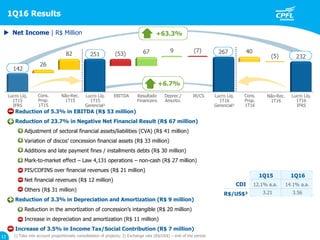

This document provides a summary of a company's 1Q16 results. It highlights that sales dropped 6.4% in the concession area, while contracted demand was stable. EBITDA decreased 5.3% to R$949 million due to lower sales and higher expenses, while net income fell 2.6% to R$267 million. Non-recurring items positively impacted results. Distribution segment EBITDA declined due to tariff adjustments and higher bad debt provisions, while renewable generation declined due to weaker winds and seasonality. Conventional generation increased due to better performance at EPASA.