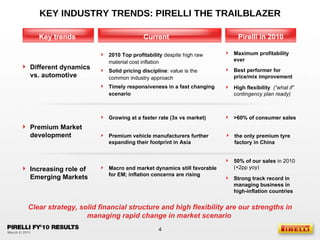

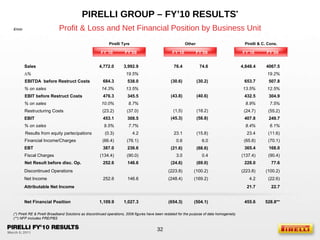

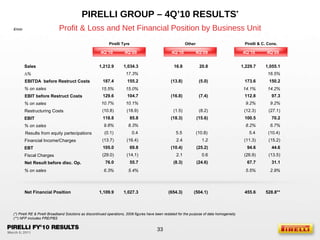

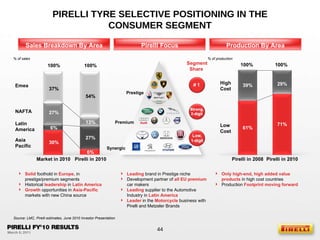

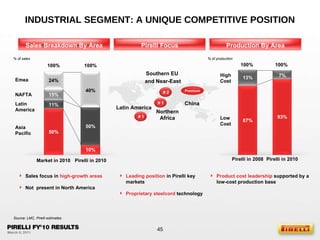

Pirelli & C. SpA's financial presentation summarizes the company's 2010 results and 2011 outlook. Key highlights include:

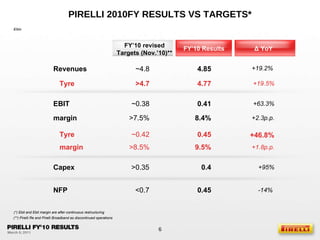

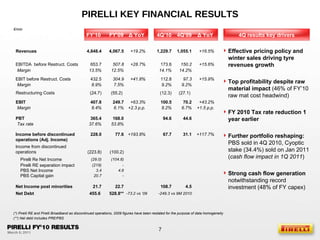

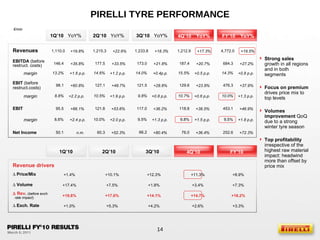

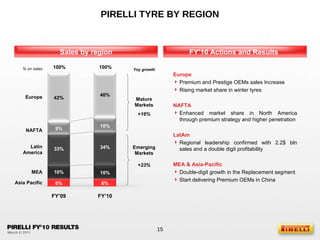

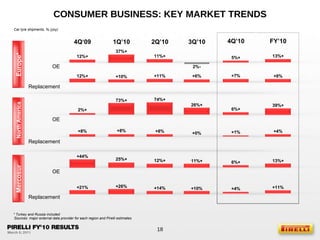

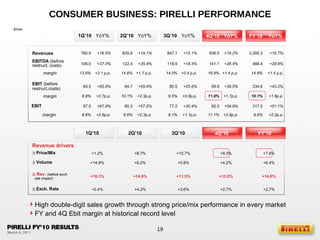

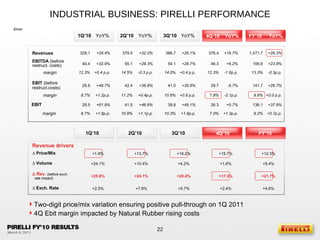

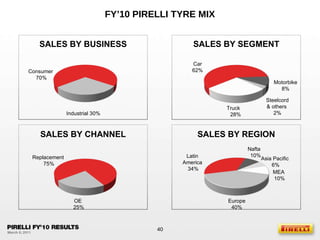

- 2010 revenues of €4.85 billion, up 19.2% over 2009, driven by strong pricing discipline and focus on premium products.

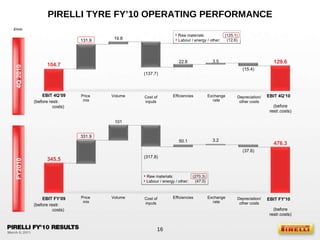

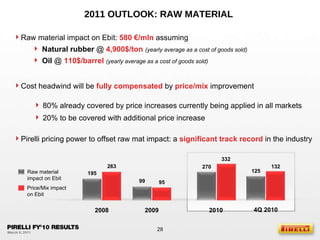

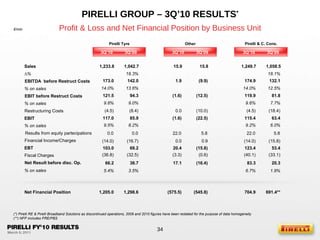

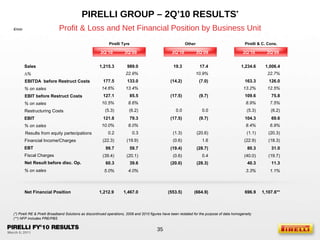

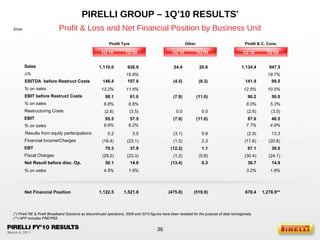

- EBIT of €407.8 million in 2010, up 63.3% over 2009, despite high raw material costs, due to price/mix improvements and efficiencies.

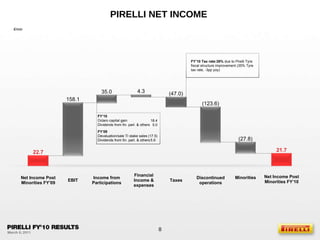

- Net income of €249.7 million in 2010, up 72.3% over 2009.

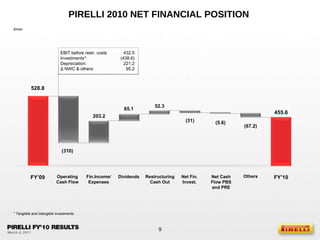

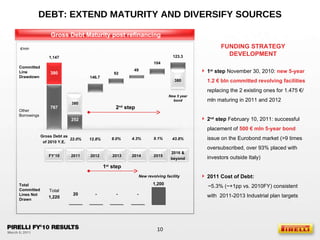

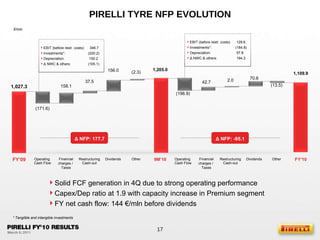

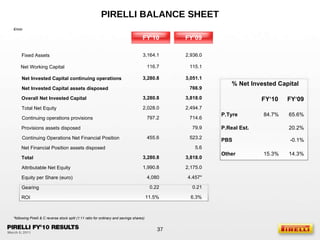

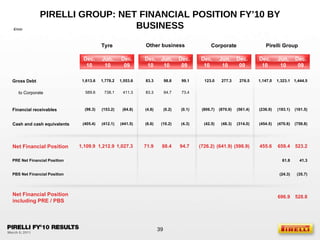

- Net financial debt of €455.6 million at year-end 2010, an improvement from €1,109.9 million in