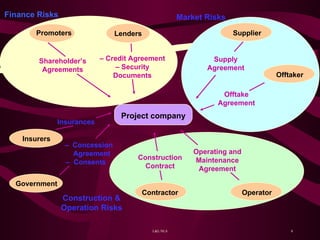

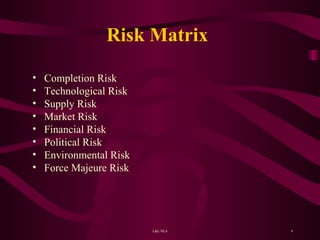

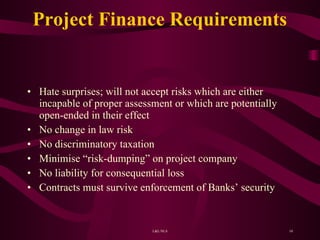

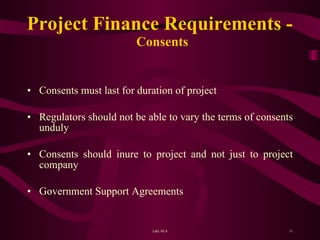

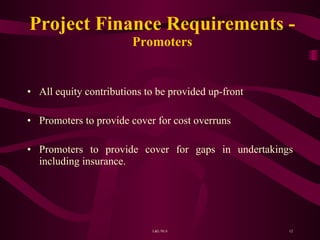

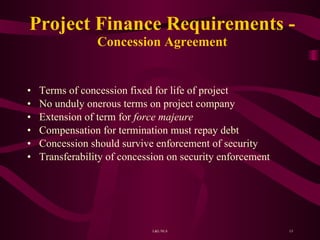

The document discusses project financing and the role of a project finance counsel. It defines project financing as financing development or exploitation of an asset using revenues from the project rather than share capital. The key roles of a project finance counsel are to allocate and mitigate risks through documentation, balance interests of participants, and ensure fulfillment of financing requirements. Requirements include fixed contracts, government support, promoter contributions, and security over key assets and contracts to protect lenders.