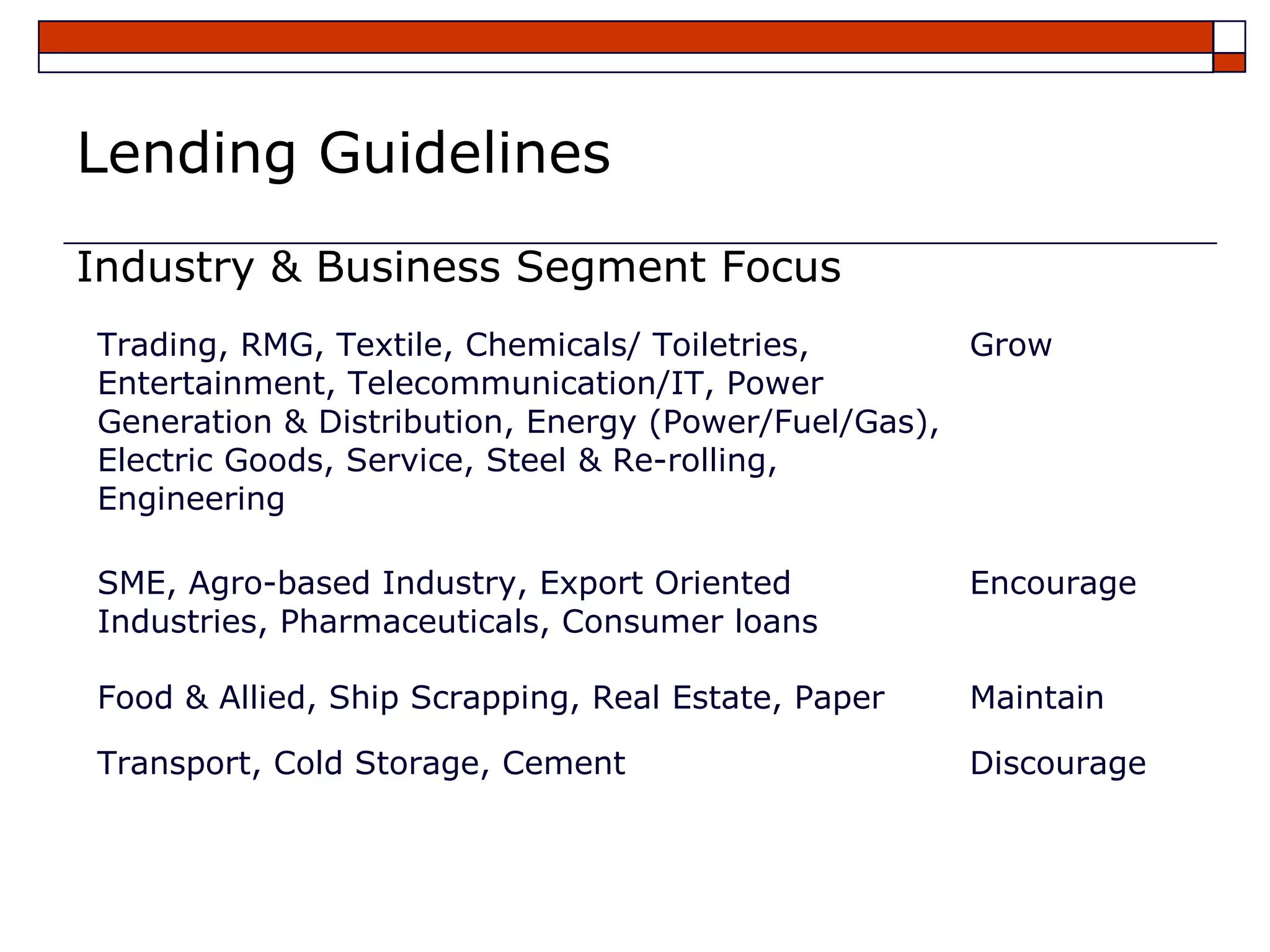

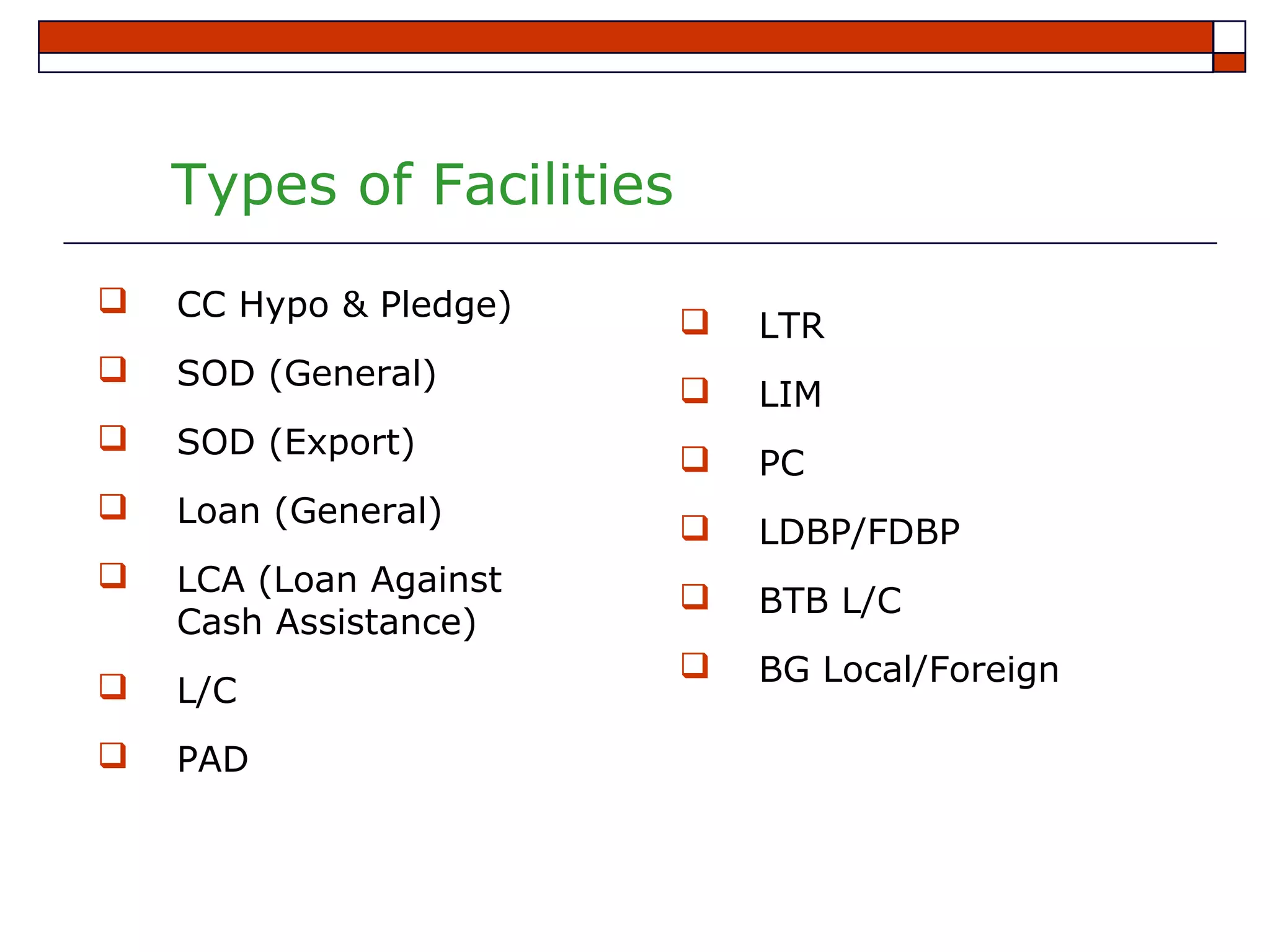

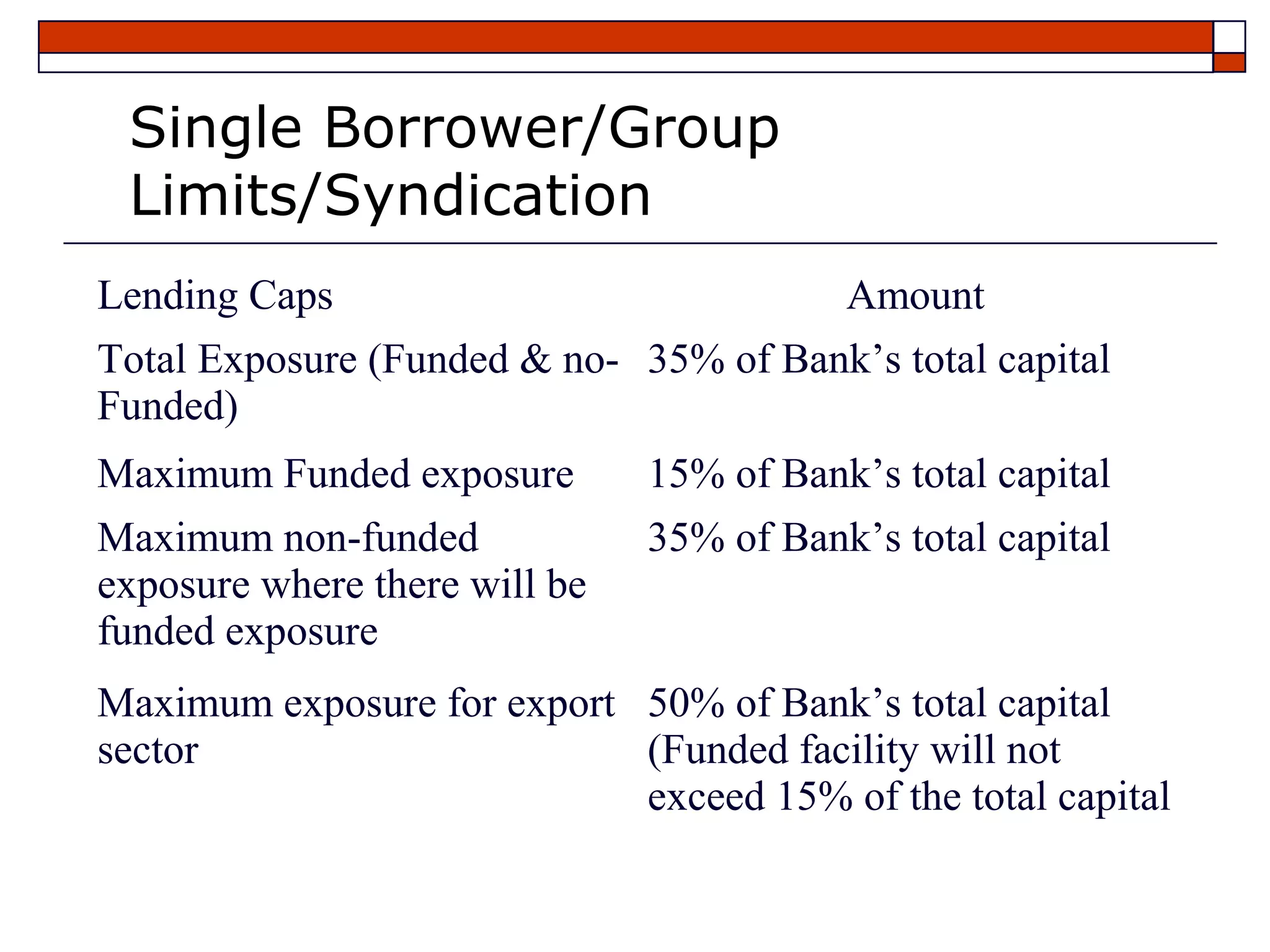

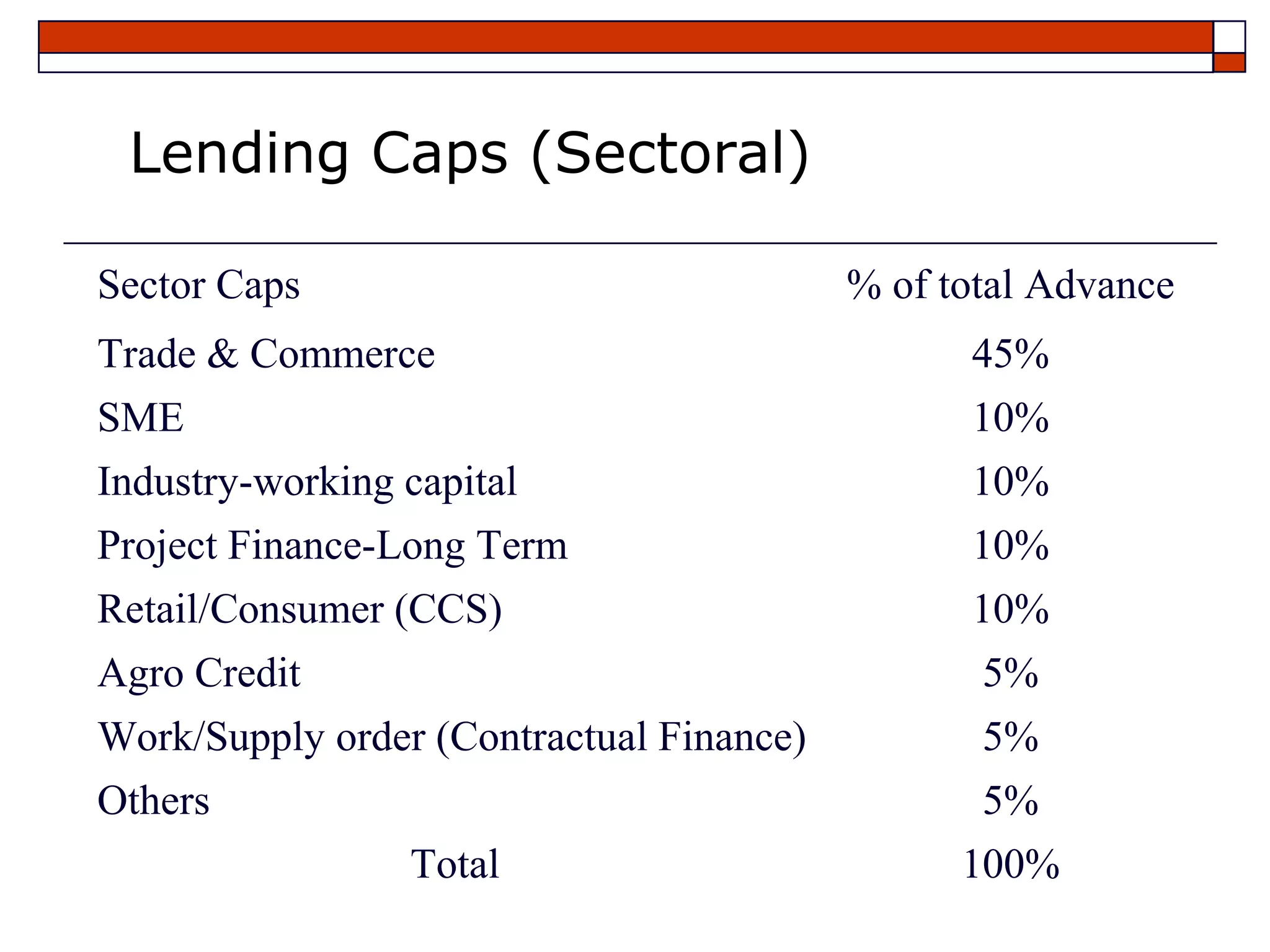

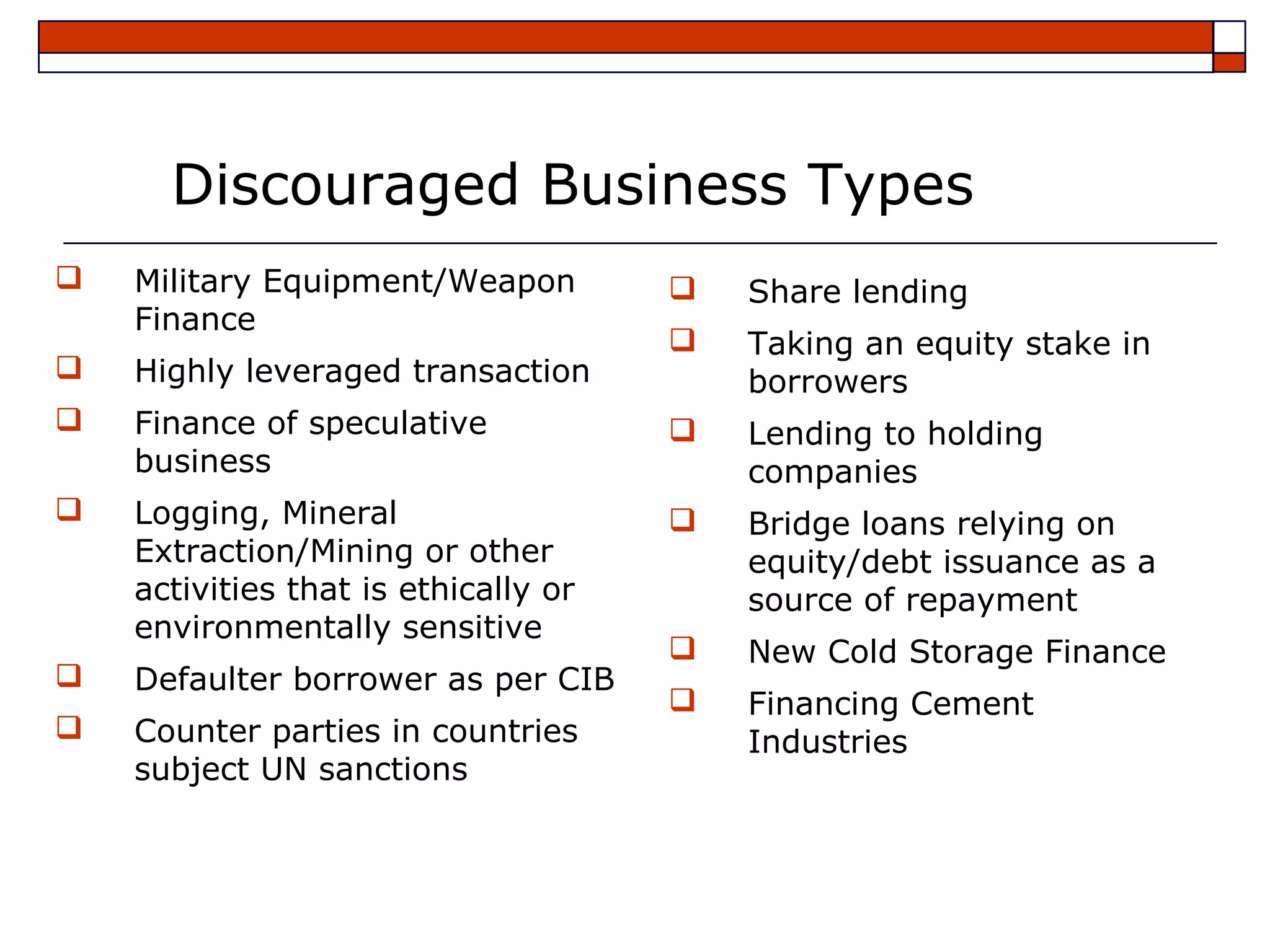

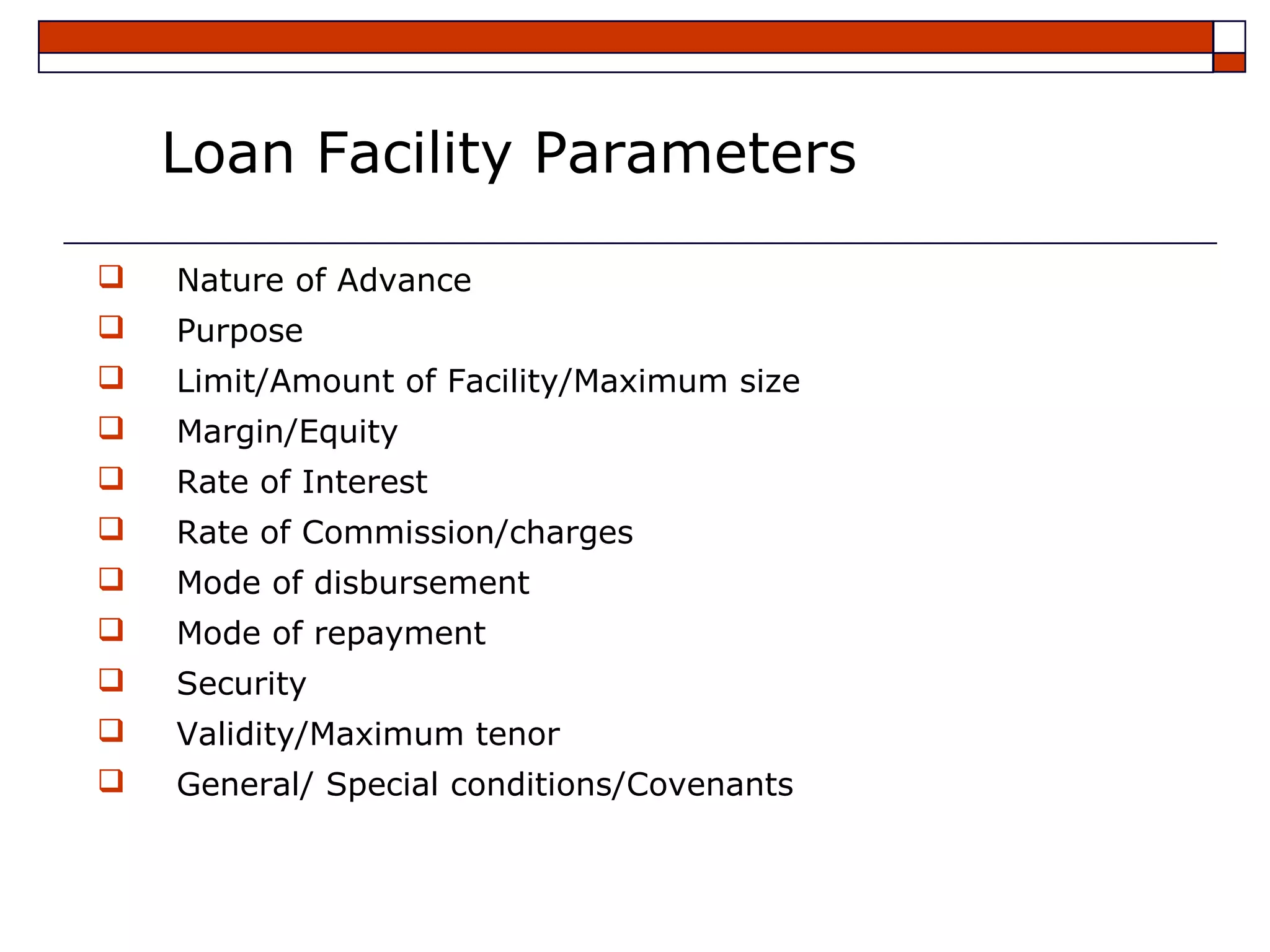

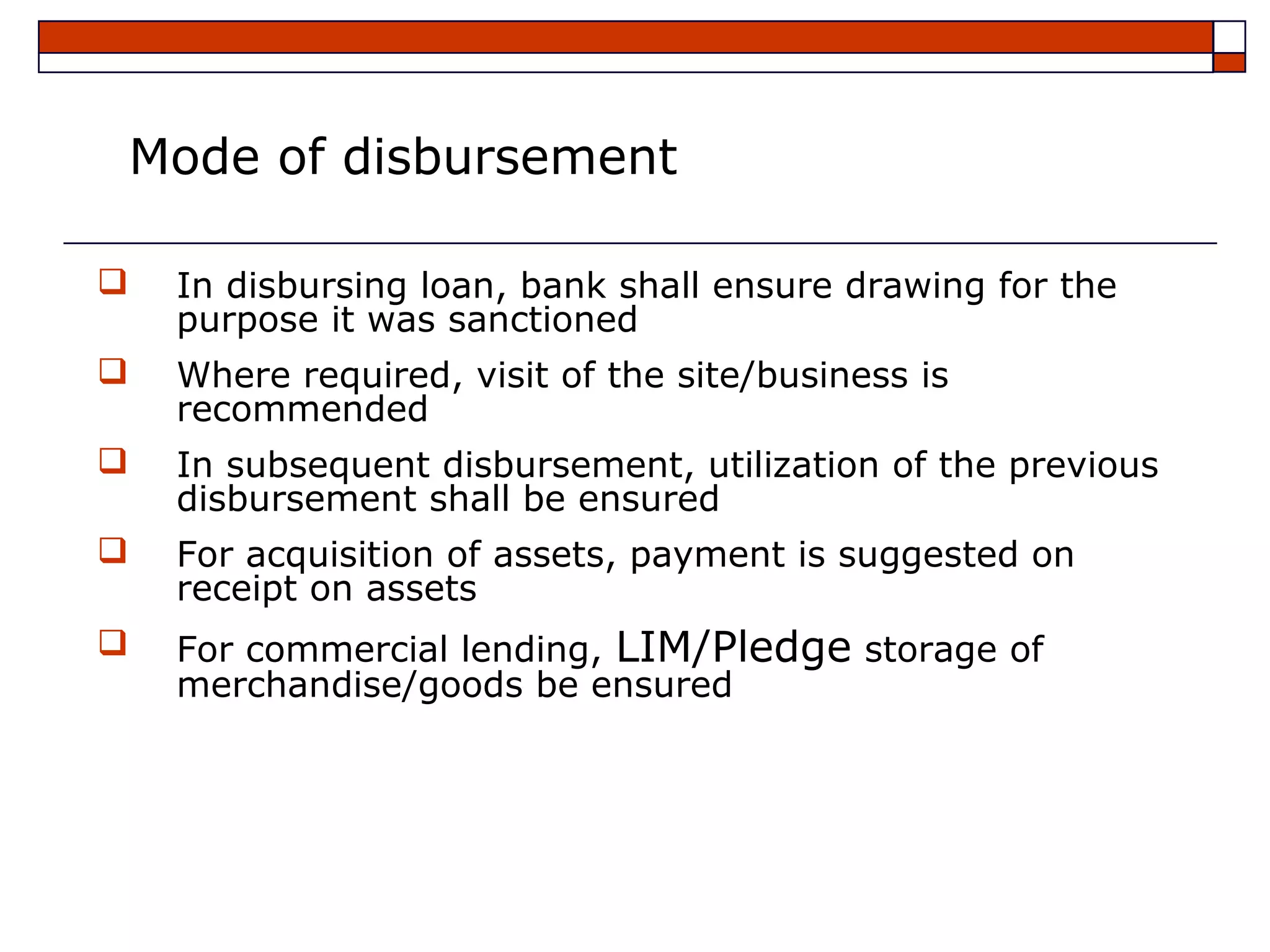

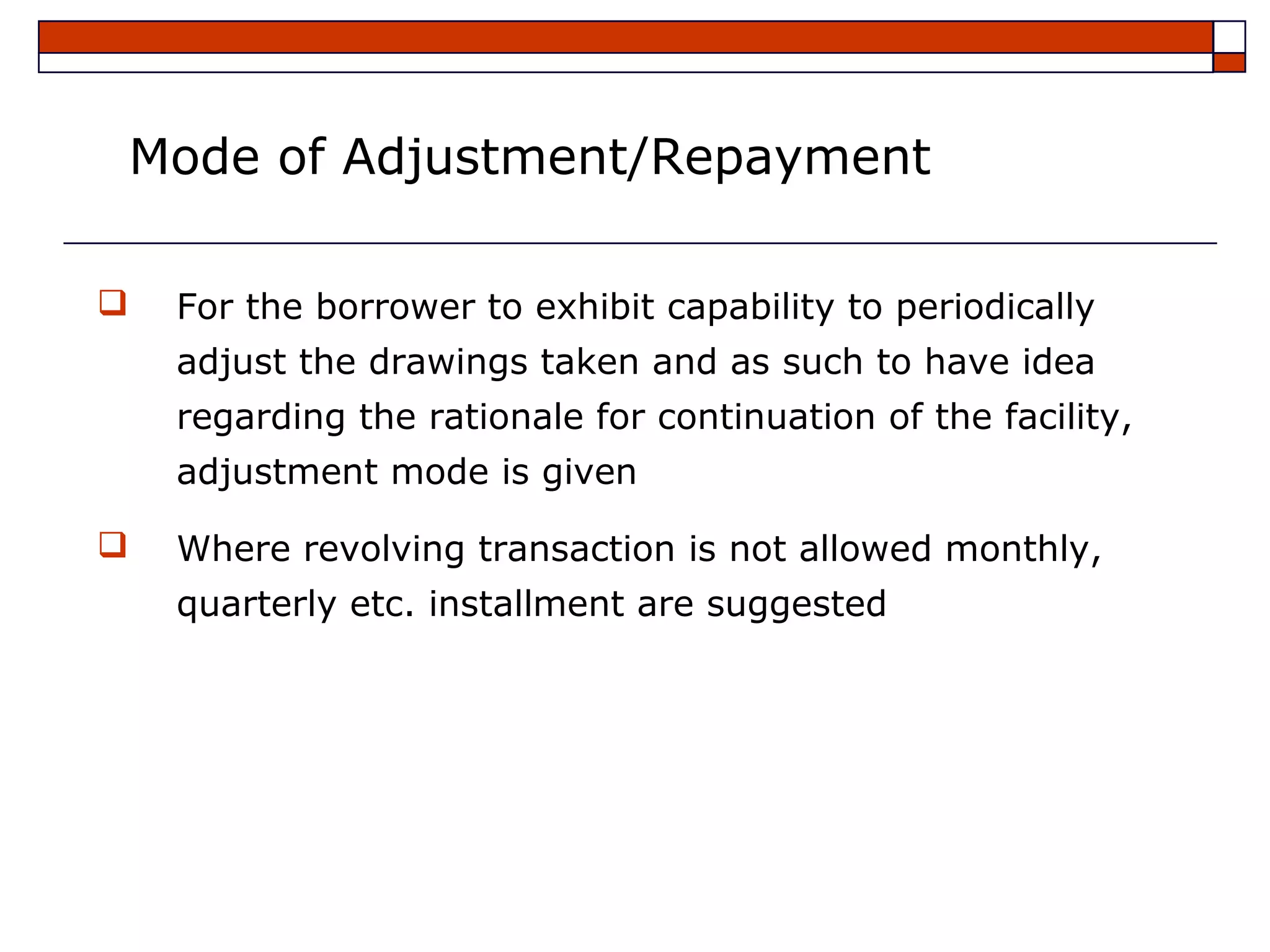

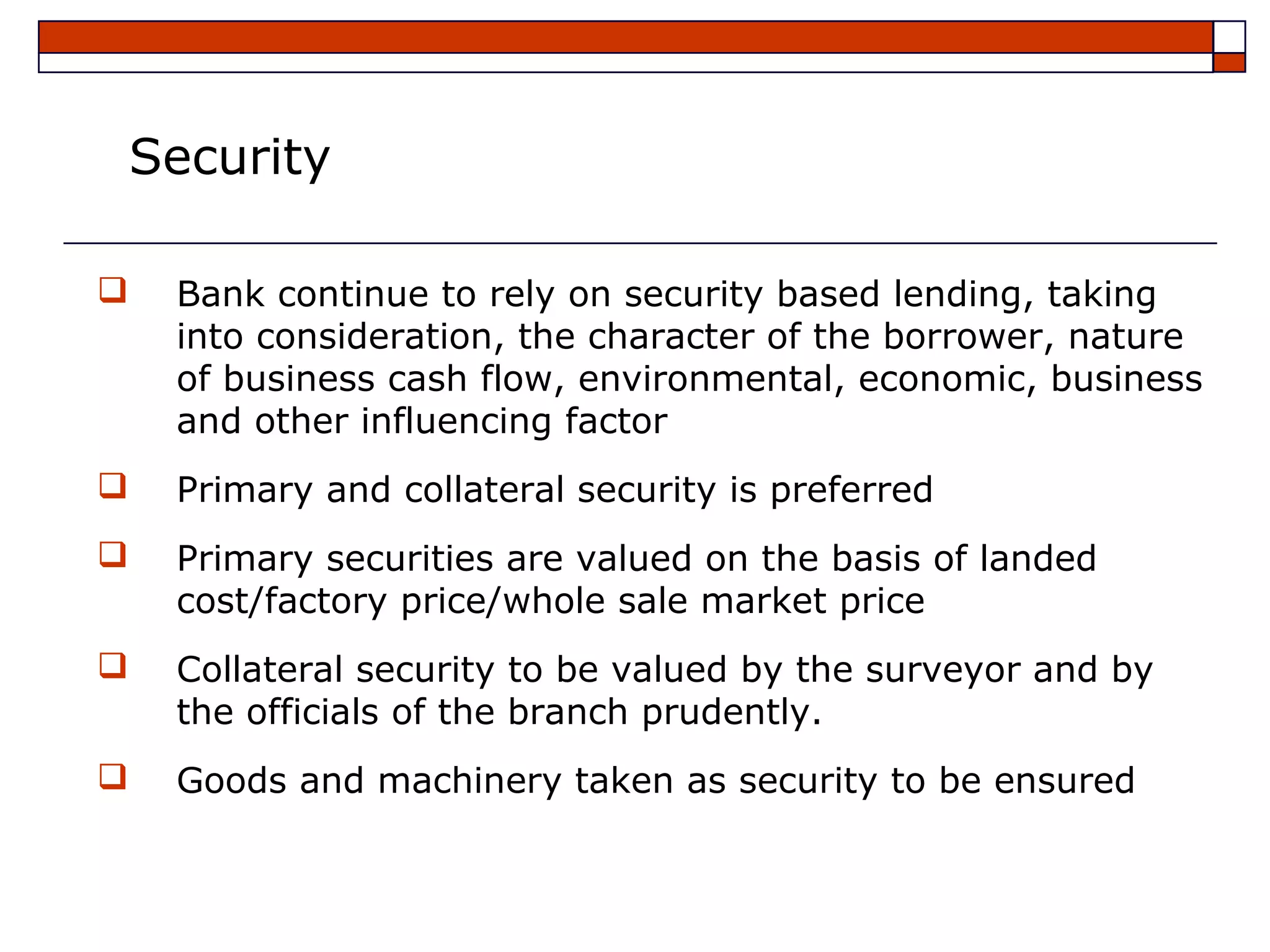

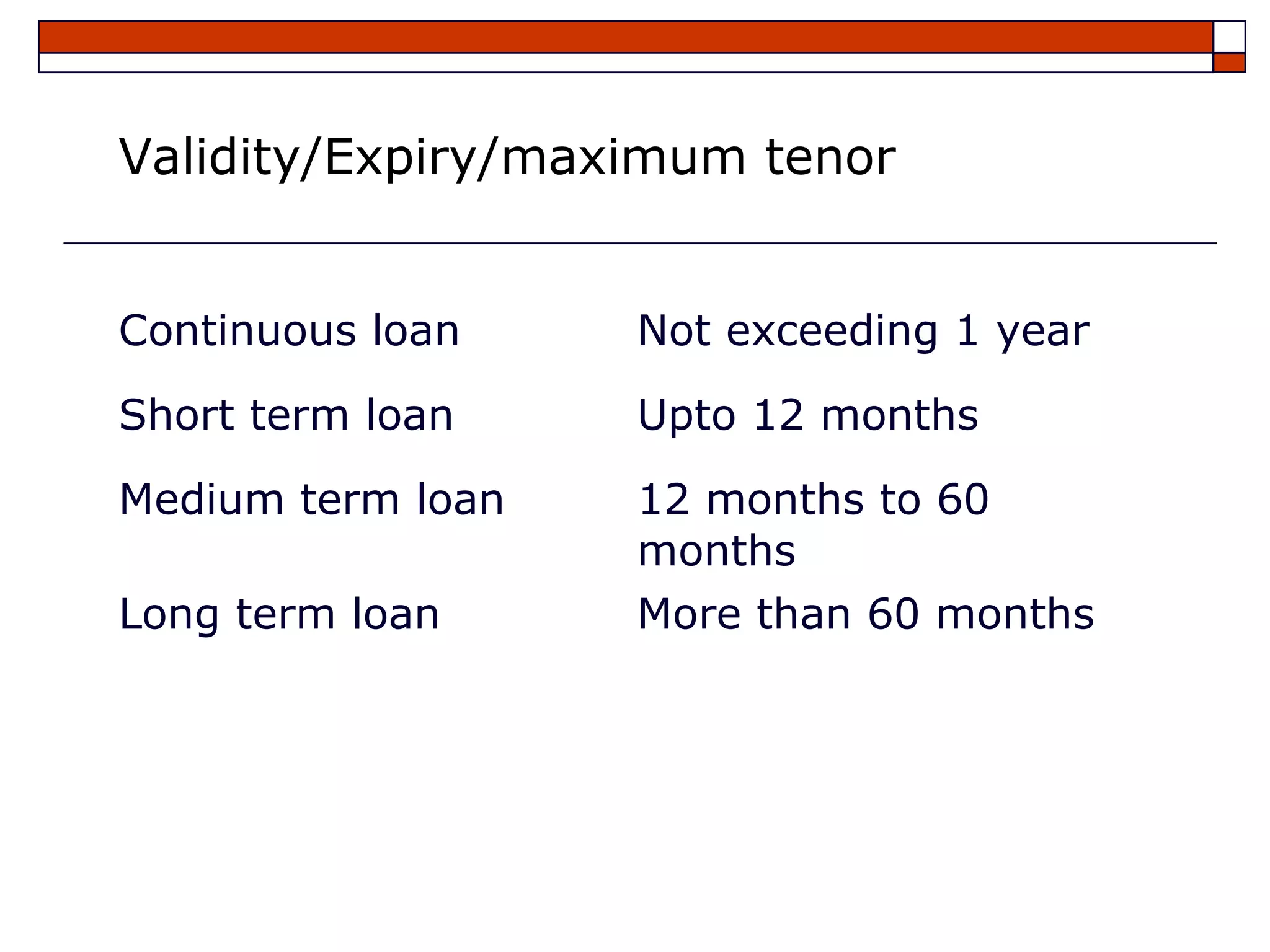

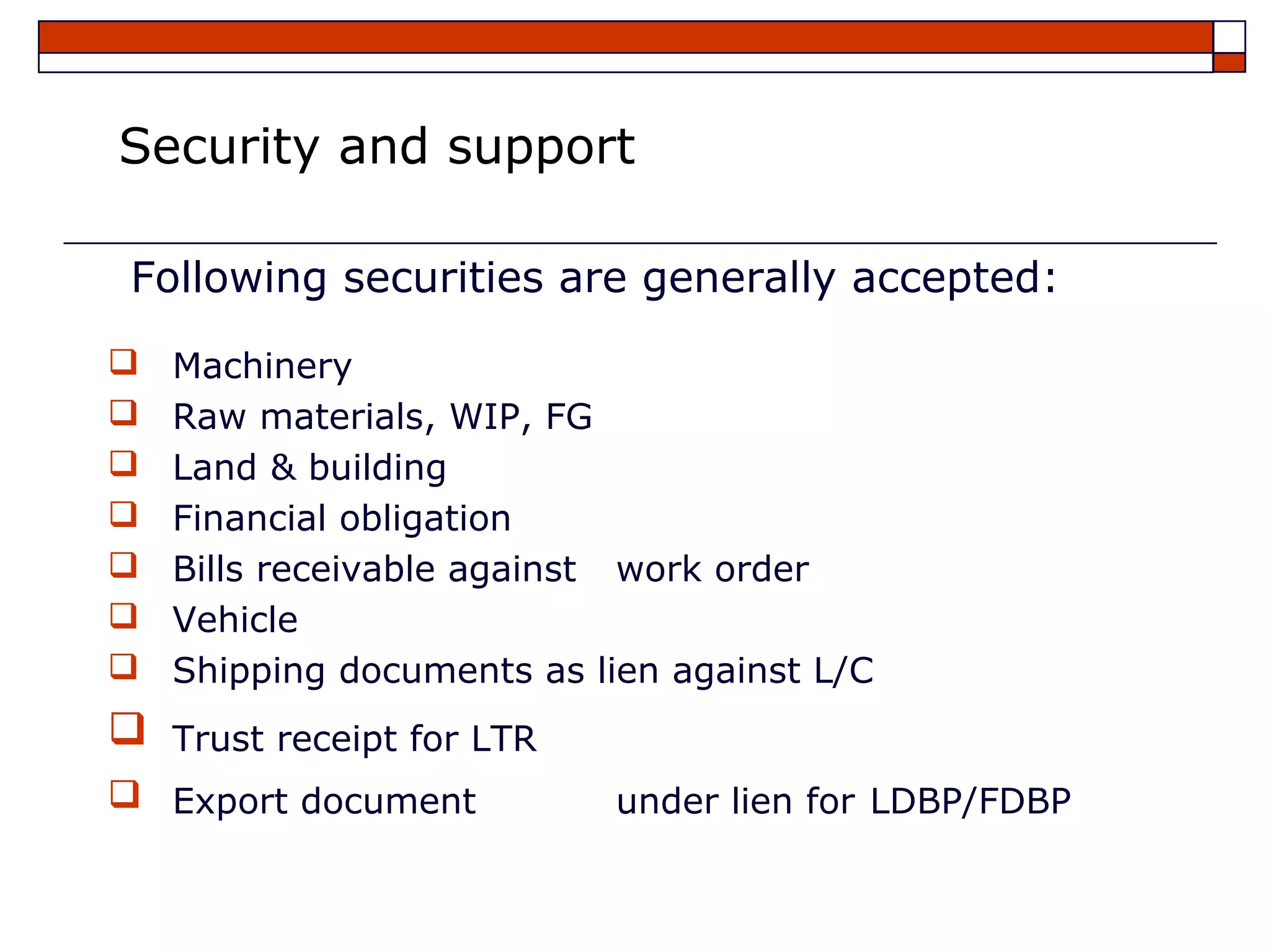

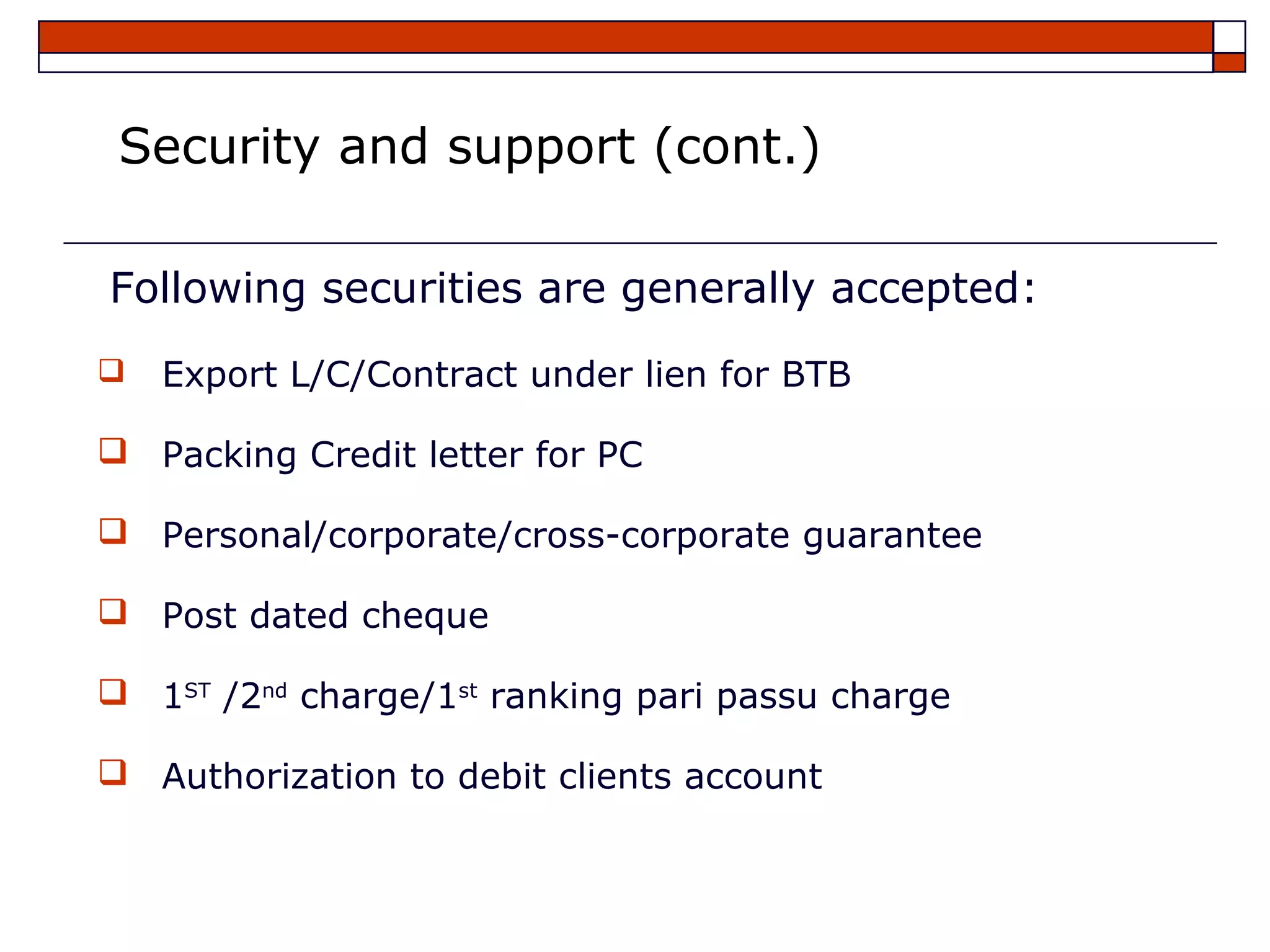

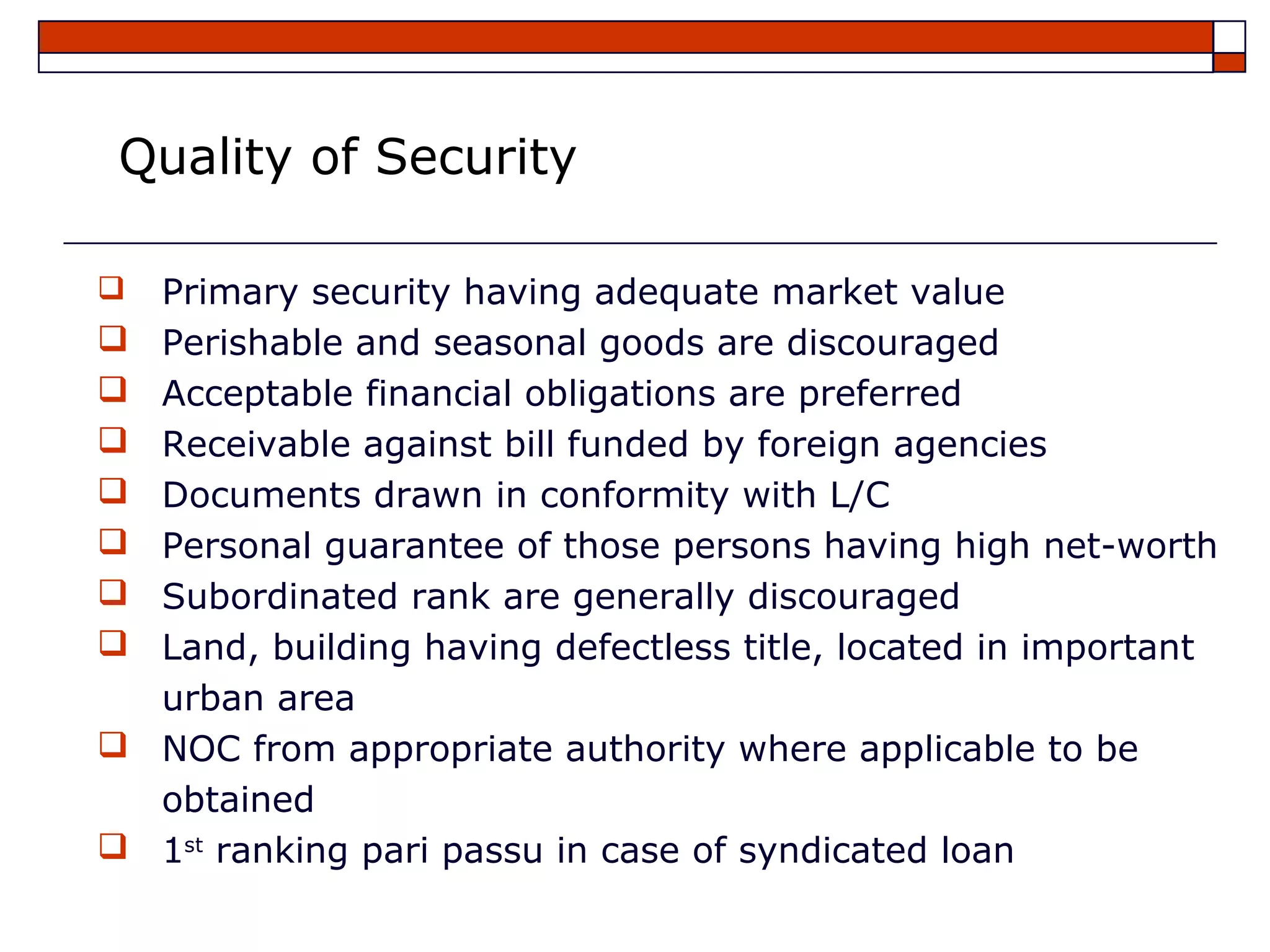

This document outlines policy and procedural guidelines for credit risk management at a bank. It discusses guidelines for lending focus, types of facilities, single borrower limits, sectoral lending caps, discouraged business types, loan parameters, nature of advances, purposes of lending, security requirements, and other procedural details. The key points are encouraging lending to SMEs, export industries, maintaining lending to some sectors, and discouraging others. It provides amounts and percentages for exposure limits and sectoral caps.