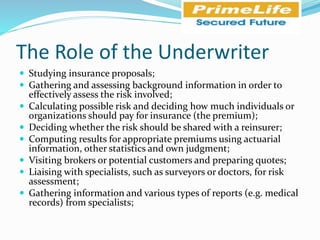

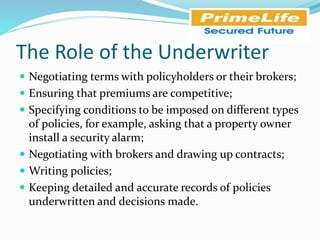

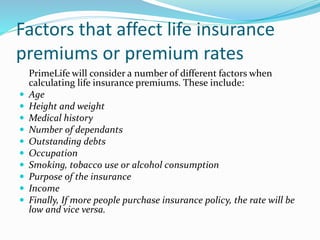

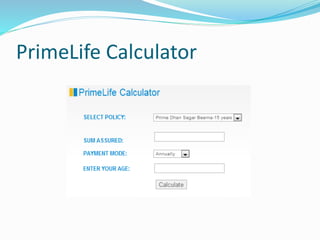

The document is a project report detailing the operations and offerings of Prime Life Insurance Company Limited in Nepal, acknowledging the support of its teacher and relevant stakeholders. It outlines Prime Life's corporate governance, values, insurance products, claim settlement processes, and marketing strategies, highlighting its rapid growth since its establishment in 2007. Additionally, it discusses factors affecting life insurance premiums and the company's commitment to high standards of service and ethical conduct.