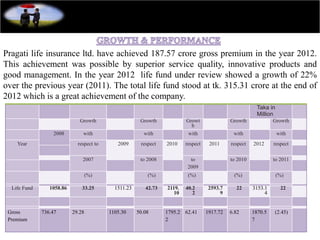

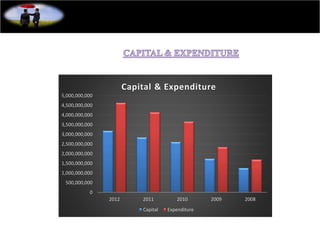

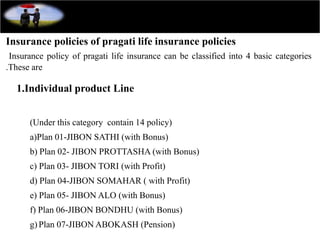

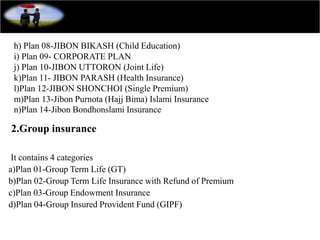

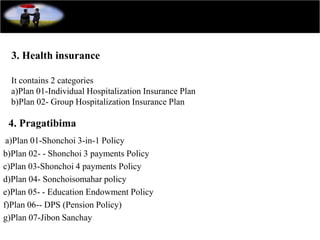

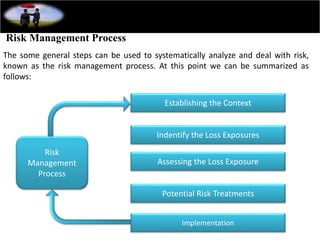

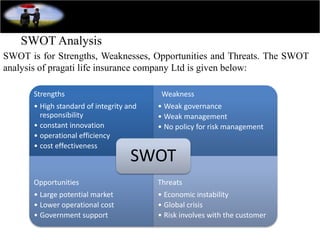

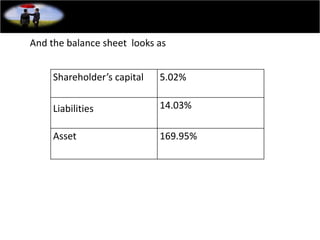

Pragati Life Insurance Limited was established in 2000 with the motto "TRUST US for LIFE". It started with paid up capital of 30 million BDT and is owned by some renowned Bangladeshi business entrepreneurs. The company has grown significantly over the years, achieving a gross premium of 187.57 crore BDT in 2012. Pragati Life Insurance provides various individual and group insurance policies and has clear visions, missions, goals and objectives focused on customer satisfaction, ethical practices and benefitting stakeholders. It employs various risk management strategies and has experienced consistent growth in life fund and gross premium in recent years.