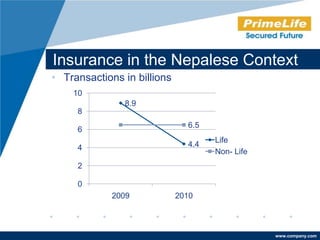

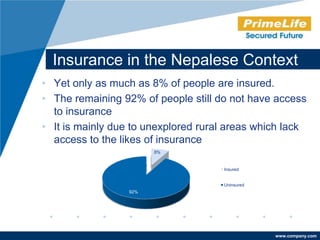

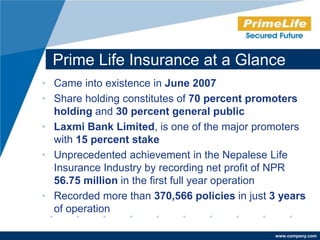

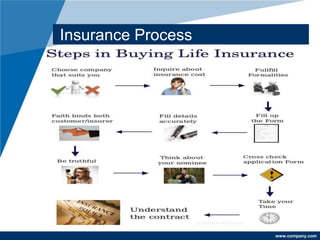

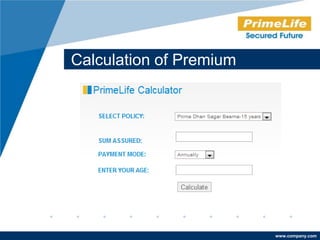

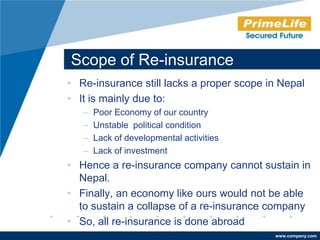

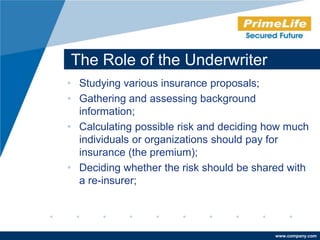

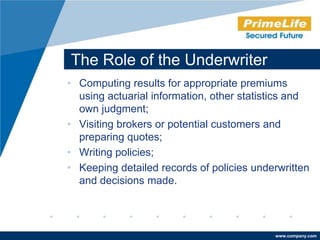

This document discusses insurance in Nepal and Prime Life Insurance. It provides an overview of the insurance industry and Prime Life Insurance, including key statistics on transactions. It also summarizes Prime Life Insurance's products and marketing strategies. The document then discusses concepts like the insurance process, imperfections, claim settlement, premium calculation, reinsurance and the role of underwriters.