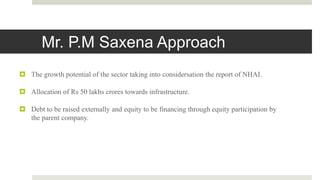

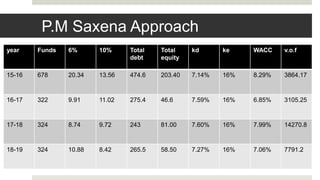

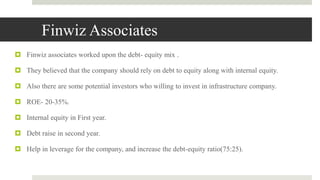

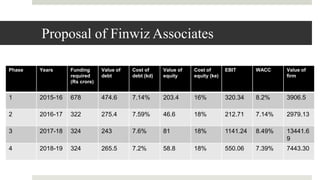

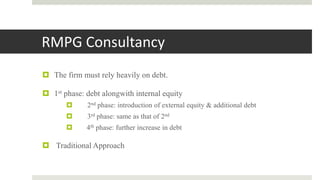

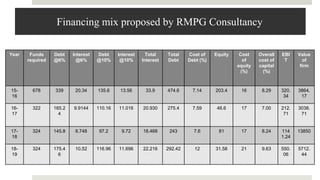

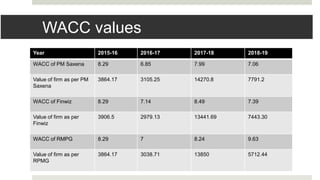

The document presents a financial management strategy for SRM Infrastructure Limited, highlighting its growth trajectory and major project acquisitions in India and abroad. It discusses debt-equity financing approaches proposed by consultants to optimize capital structure and minimize WACC, with various projected financial outcomes for the firm. The conclusion emphasizes the importance of capital structure decisions in influencing shareholder returns, advocating for a combination of debt and equity as the most effective financing strategy.