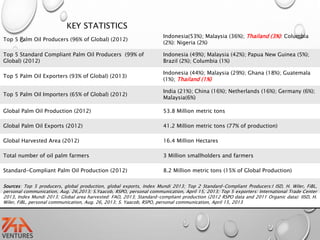

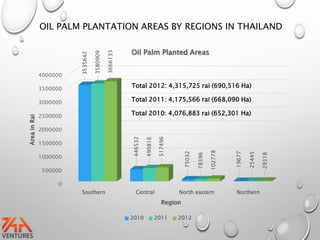

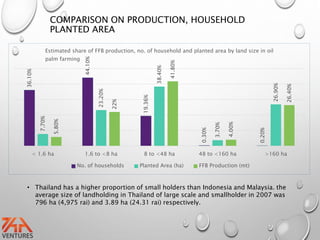

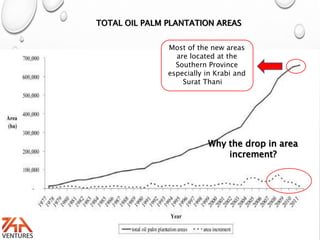

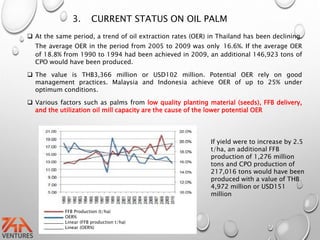

- Thailand has over 4 million rai (approximately 690,000 hectares) of oil palm plantation area, with most growers being smallholders. Yield and oil extraction rates remain low on average.

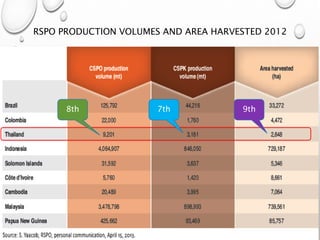

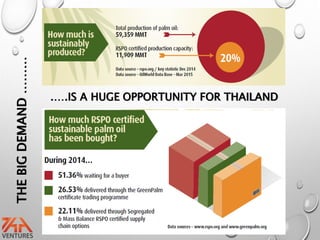

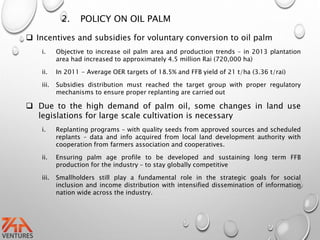

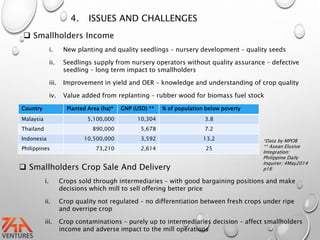

- Key challenges include low incomes for smallholders, issues with crop sales and delivery, and lack of knowledge in good agricultural practices. The industry aims to increase yields, extraction rates, and compliance with sustainability standards.

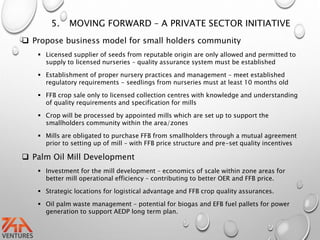

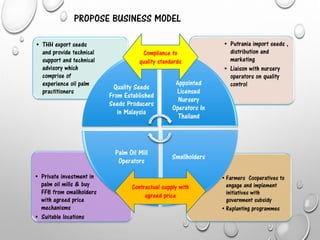

- A private sector initiative proposes a business model to address these challenges by establishing a licensed seed and nursery system, mills to purchase from smallholders, and providing training to improve cultivation knowledge and incomes. The goal is a more productive and sustainable Thai oil palm industry.