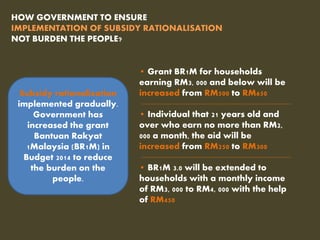

The document discusses Malaysia's subsidy policies and rationalizing subsidies. It notes that subsidies, particularly fuel subsidies, make up a large portion of government expenditures and contribute to budget deficits. The government wants to reduce subsidies by 20 cents per liter for fuel to make subsidies more targeted and use the savings to increase cash transfer programs for the poor. It outlines measures the government is taking to gradually implement subsidy rationalization and ensure it does not overly burden the people.