The document provides information about The Walt Disney Company, including:

- It was founded in 1923 by Walt Disney and is headquartered in California.

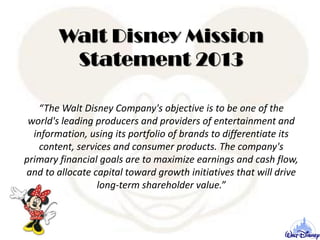

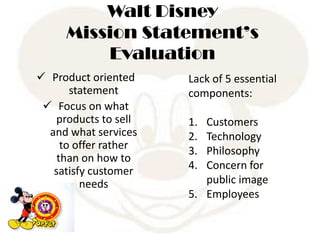

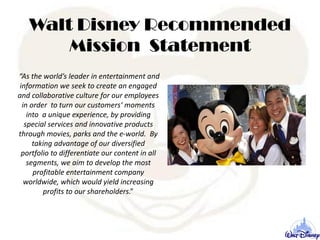

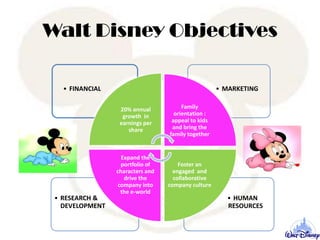

- Its vision is "To make people happy" and its mission is to be a leading producer of entertainment and information.

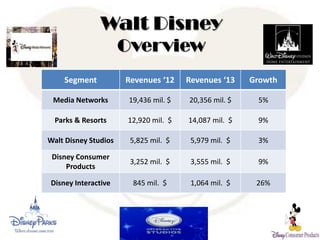

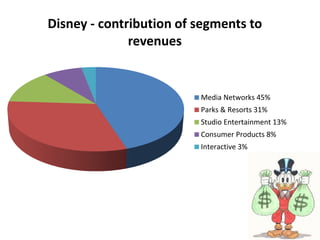

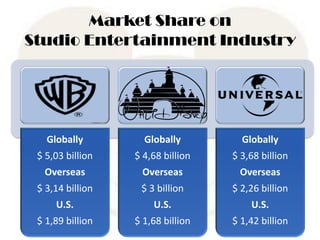

- Its largest segments are Media Networks, Parks & Resorts, and Studio Entertainment.

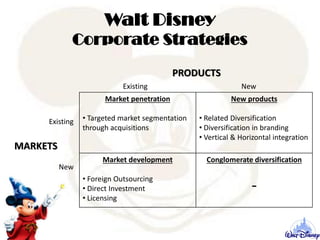

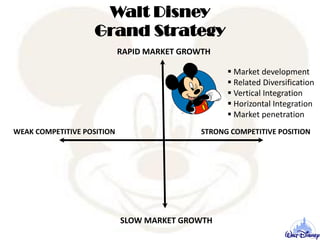

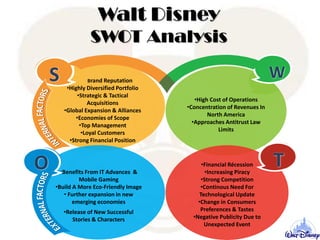

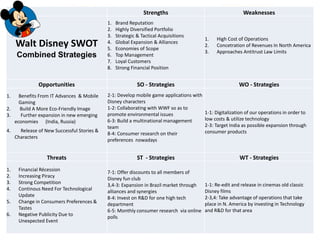

- It has a diversified portfolio and pursues strategies like acquisitions, global expansion, and diversification.