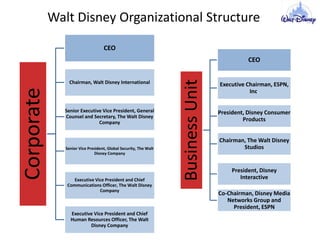

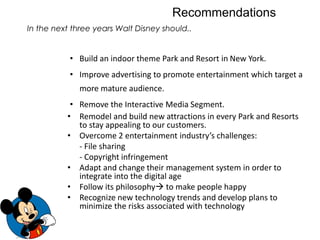

This document provides an overview of The Walt Disney Company. It was established in 1923 by Walt Disney and is currently headquartered in California. Disney has a highly diversified portfolio including media networks, parks and resorts, studio entertainment, consumer products, and interactive. The document discusses Disney's organizational structure, mission and vision statements, divisions, strategies, SWOT analysis, and competitive profile. It also provides financial information showing the impact of the economic downturn in 2009, with recommendations for Disney to improve its performance in the next three years through strategic investments and addressing challenges in the entertainment industry.