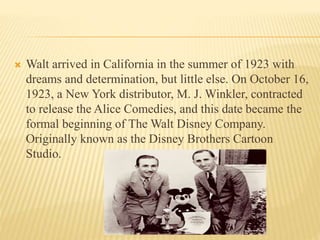

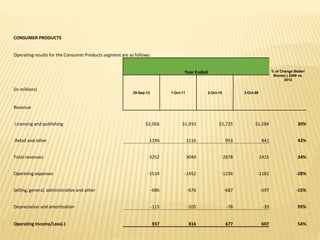

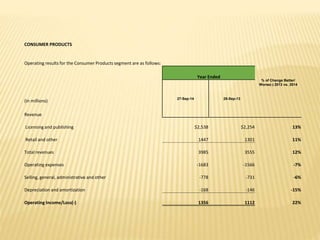

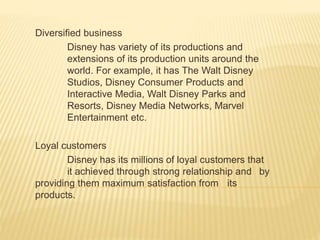

The Walt Disney Company was founded in 1923 in Los Angeles by brothers Walt and Roy Disney. Walt Disney was the voice of Mickey Mouse for two decades and won a total of 32 Oscars during his 43-year career. Disney is now the largest media and entertainment company in the world, with its headquarters in Burbank, California. The company operates theme parks, resorts, cruise lines, film studios, television networks, and consumer products divisions around the world.