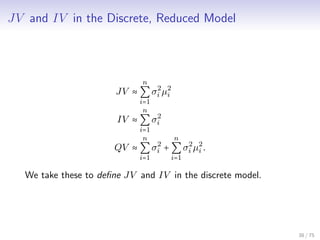

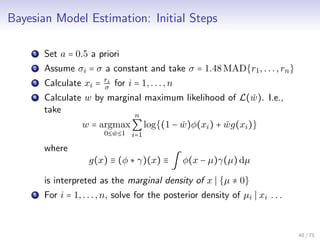

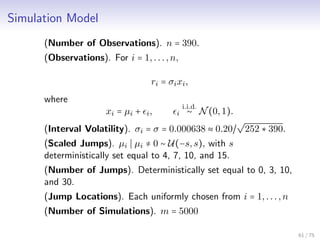

This document outlines a Bayesian model for estimating jump variation in high-frequency asset returns. It begins with background on high-frequency financial data and models jump variation as the sum of squared scaled interval jumps. The continuous jump-diffusion model is reduced to a discrete model where log-returns are modeled as scaled stochastic volatility plus scaled jumps. A Bayesian model is then developed where jumps are modeled with a mixture prior and posterior distributions are derived. Estimation involves calculating posterior jump probabilities and densities. Simulation results demonstrate the model can estimate jump variation.

![Simple Returns vs. Log Returns

If St is the spot price of an asset at minute t, then the simple

return over the interval [t − 1,t] is

Rt =

St − St−1

St−1

and the logarithmic return is

rt = log(St) − log(St−1)

= log(1 + Rt)

≈ Rt, for small Rt

We prefer the latter because of additivity and infinite support.

7 / 75](https://image.slidesharecdn.com/175917ed-c6a0-40b9-8f18-b34250e17a24-150117201747-conversion-gate02/85/pres06-main-7-320.jpg)

![Toward a Simple Jump-Diffusion Model for X

Under mild regularity conditions:

rt ≡ Xt − X0 = ∫

t

0

audu + ∫

t

0

σu dWu + Jt, 0 ≤ t < ∞

rt is the log-return over the trading time interval [0,t]

W ∈ BM

a,σ ∈ PRE are the spot drift and spot volatility of returns

Jt = ∑

Nt

i=1 Ci is the cumulative jump process

Nt is a simple counting process of the number of jumps in the

time interval [0,t]

Ci is the size of the ith jump.

9 / 75](https://image.slidesharecdn.com/175917ed-c6a0-40b9-8f18-b34250e17a24-150117201747-conversion-gate02/85/pres06-main-9-320.jpg)

![Revisiting the Motivating Question

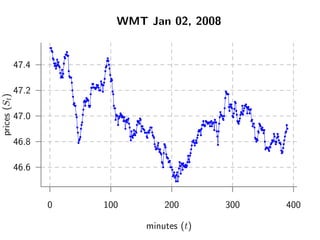

Q: What is the return variance for WMT on January 2nd, 2008?

Q:

Var{rt Ft} =?

where

Ft ≡ F{au,σu}u∈[0,t]

10 / 75](https://image.slidesharecdn.com/175917ed-c6a0-40b9-8f18-b34250e17a24-150117201747-conversion-gate02/85/pres06-main-10-320.jpg)

![Realized Variance: RV

For

an asset X

on a time interval [0,t]

with (n + 1)-element partition

Pn ≡ {τ0,τ1,...,τn}, 0 = τ0 ≤ τ1 ≤ ⋯ ≤ τn = t < ∞,

the realized variance

RV

(n)

t ≡

n

∑

i=1

r2

i , 0 ≤ t < ∞

where

ri ≡ Xτi − Xτi−1 , i = 1,...,n

is the i-th log-return on Pn.

12 / 75](https://image.slidesharecdn.com/175917ed-c6a0-40b9-8f18-b34250e17a24-150117201747-conversion-gate02/85/pres06-main-12-320.jpg)

![RV → IV

From Andersen et al. (2003); Barndorff-Nielsen and Shephard

(2002),

RV

(n)

t → IVt

convergence ucp on [0,t]

limit taken over all Pn with limn→∞ Pn = 0.

13 / 75](https://image.slidesharecdn.com/175917ed-c6a0-40b9-8f18-b34250e17a24-150117201747-conversion-gate02/85/pres06-main-13-320.jpg)

![Realized Bipower Variation: RBPV

For

an asset X

on a time interval [0,t]

with (n + 1)-element partition Pn,

the realized bipower variation

RBPV

(n)

t ≡

n

∑

i=2

ri ri−1 , 0 ≤ t < ∞.

19 / 75](https://image.slidesharecdn.com/175917ed-c6a0-40b9-8f18-b34250e17a24-150117201747-conversion-gate02/85/pres06-main-19-320.jpg)

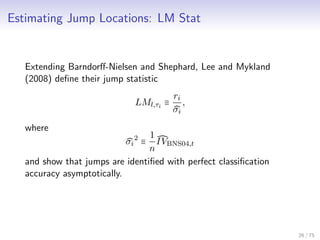

![Na¨ıve Shrinkage Estimators: JVNS,IVNS

In previous work, I extended Lee and Mykland (2008) and defined

na¨ıve shrinkage estimators of JV, IV

JV

(n)

NS,t ≡

n

∑

i=1

[Fξ(LMg,τi )ri]

2

IV

(n)

NS,t ≡ RV

(n)

t − JVNS,t.

and showed their consistency.

27 / 75](https://image.slidesharecdn.com/175917ed-c6a0-40b9-8f18-b34250e17a24-150117201747-conversion-gate02/85/pres06-main-27-320.jpg)

![Continuous → Discrete: Assumptions and Definitions

Assume,

(i) (Zero Drift). au = 0, ∀u ∈ [0,t],

(ii) (Homogenous Sampling). An (n + 1)-element homogenous

sampling of Xu over the time interval [0,t],

{X0,Xδ,X2δ,...,X(n−1)δ,Xt}, where δ = t/n is the width of

the sampling interval,

and define for i = 1,...,n,

(i) (Interval Volatility). σi ≡ σ[δ(i−1), δi].

(ii) (Scaled Interval Jump). µi ≡ 1

σi

(Jδi − Jδ(i−1)).

(iii) (Log-Returns). ri ≡ Xδi − Xδ(i−1).

(iv) (Scaled Log-Returns). xi ≡ 1

σi

ri.

37 / 75](https://image.slidesharecdn.com/175917ed-c6a0-40b9-8f18-b34250e17a24-150117201747-conversion-gate02/85/pres06-main-37-320.jpg)

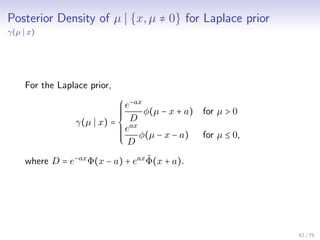

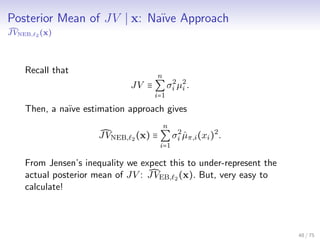

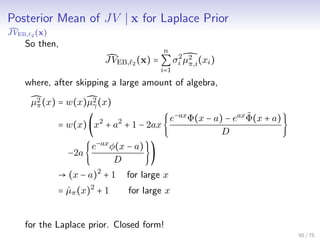

![Posterior Mean of JV x: Na¨ıve Relation

JVEB, 2 (x)

JVEB, 2 (x) ≡ E[JV x]

= E[

n

∑

i=1

σ2

i µ2

i x]

=

n

∑

i=1

σ2

i E[µ2

i xi]

=

n

∑

i=1

σ2

i ˆµπ,i(xi)2

+ σ2

i Var[µi xi]

= JVNEB, 2 (x) +

n

∑

i=1

σ2

i Var[µi xi].

49 / 75](https://image.slidesharecdn.com/175917ed-c6a0-40b9-8f18-b34250e17a24-150117201747-conversion-gate02/85/pres06-main-49-320.jpg)

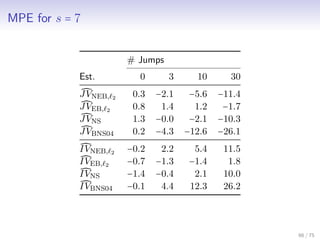

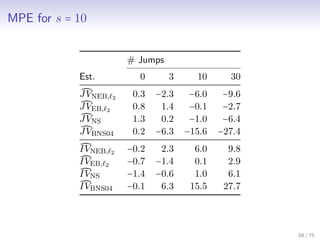

![Estimator Evaluation Criteria: MPE, MAPE

We define the mean percentage error and mean absolute

percentage error for an estimator JV of JV as

MPE(JV ) = 100 ∗ E[

JV − JV

QV

]

MAPE(JV ) = 100 ∗ E[

JV − JV

QV

]

and similarly for an estimator IV of IV

MPE(IV ) = 100 ∗ E[

IV − IV

QV

]

MAPE(IV ) = 100 ∗ E[

IV − IV

QV

]

62 / 75](https://image.slidesharecdn.com/175917ed-c6a0-40b9-8f18-b34250e17a24-150117201747-conversion-gate02/85/pres06-main-62-320.jpg)