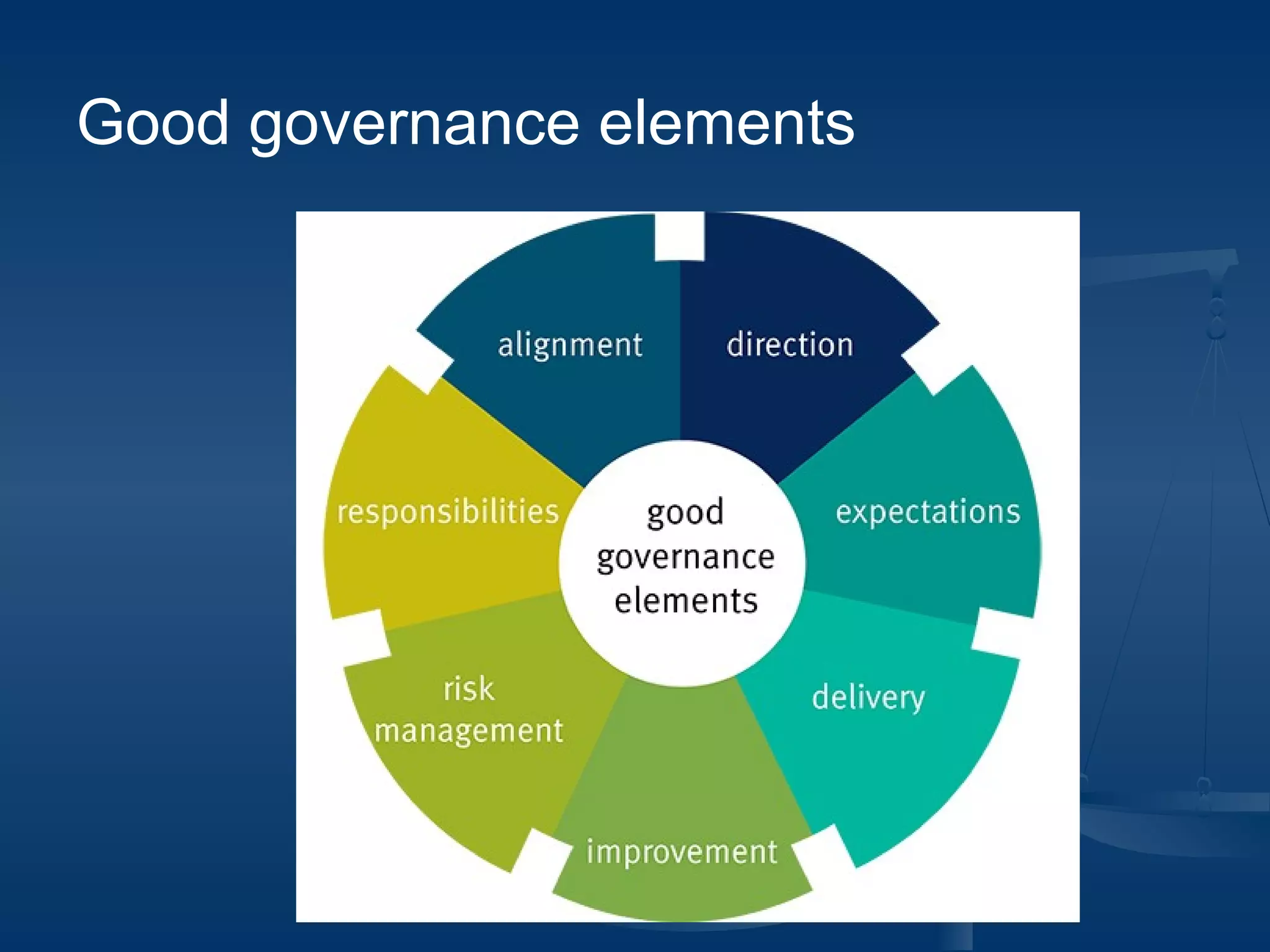

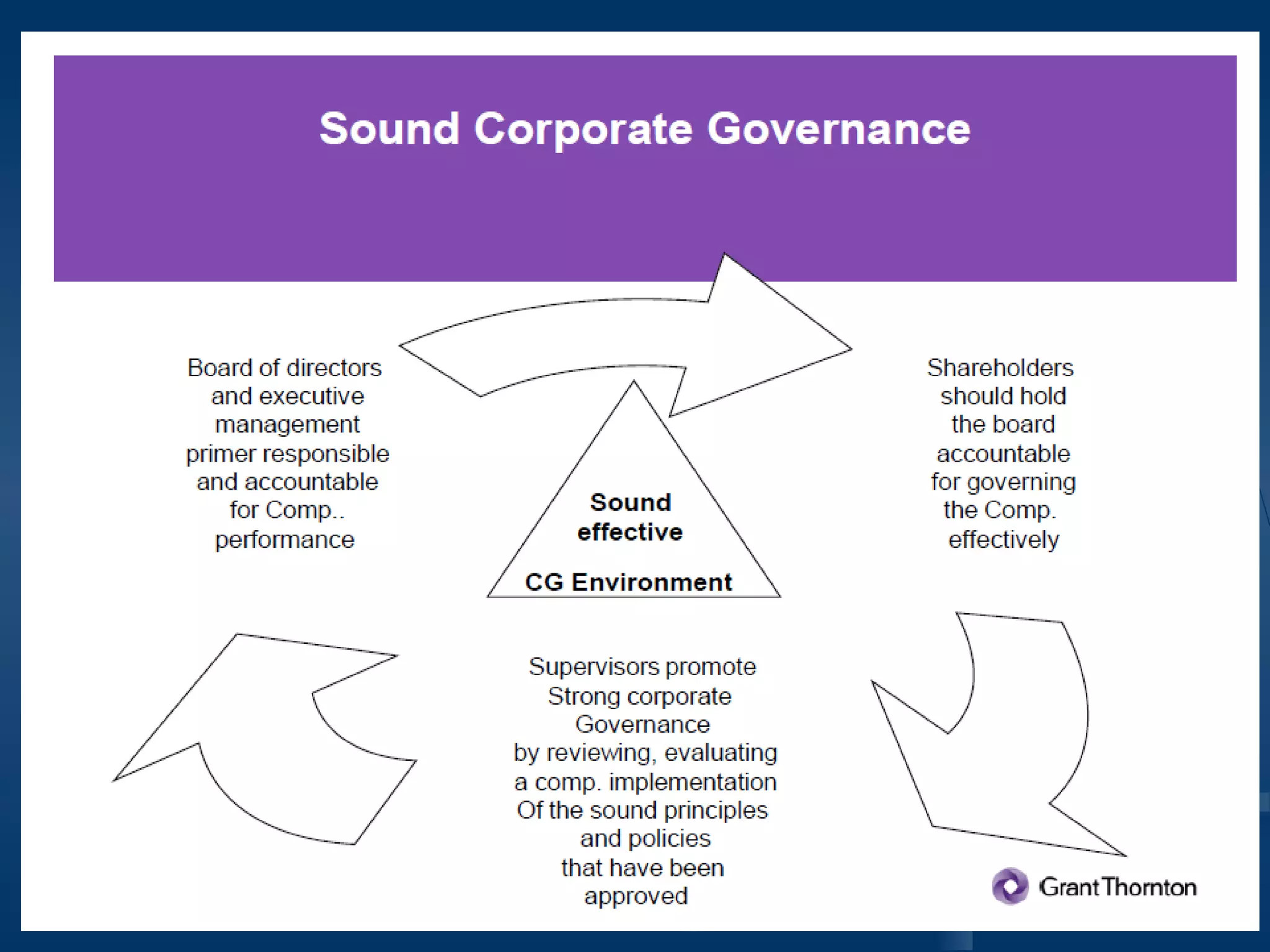

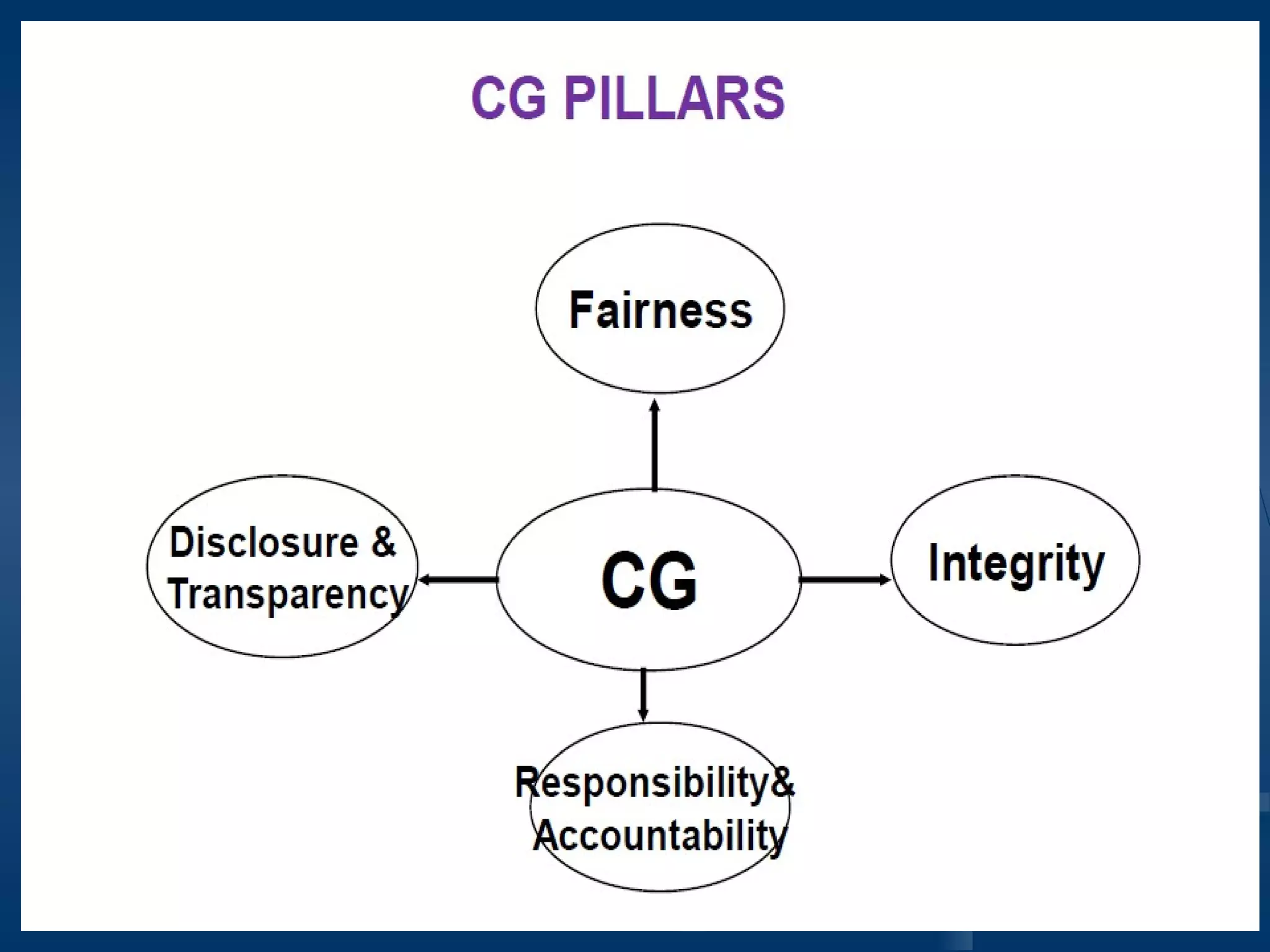

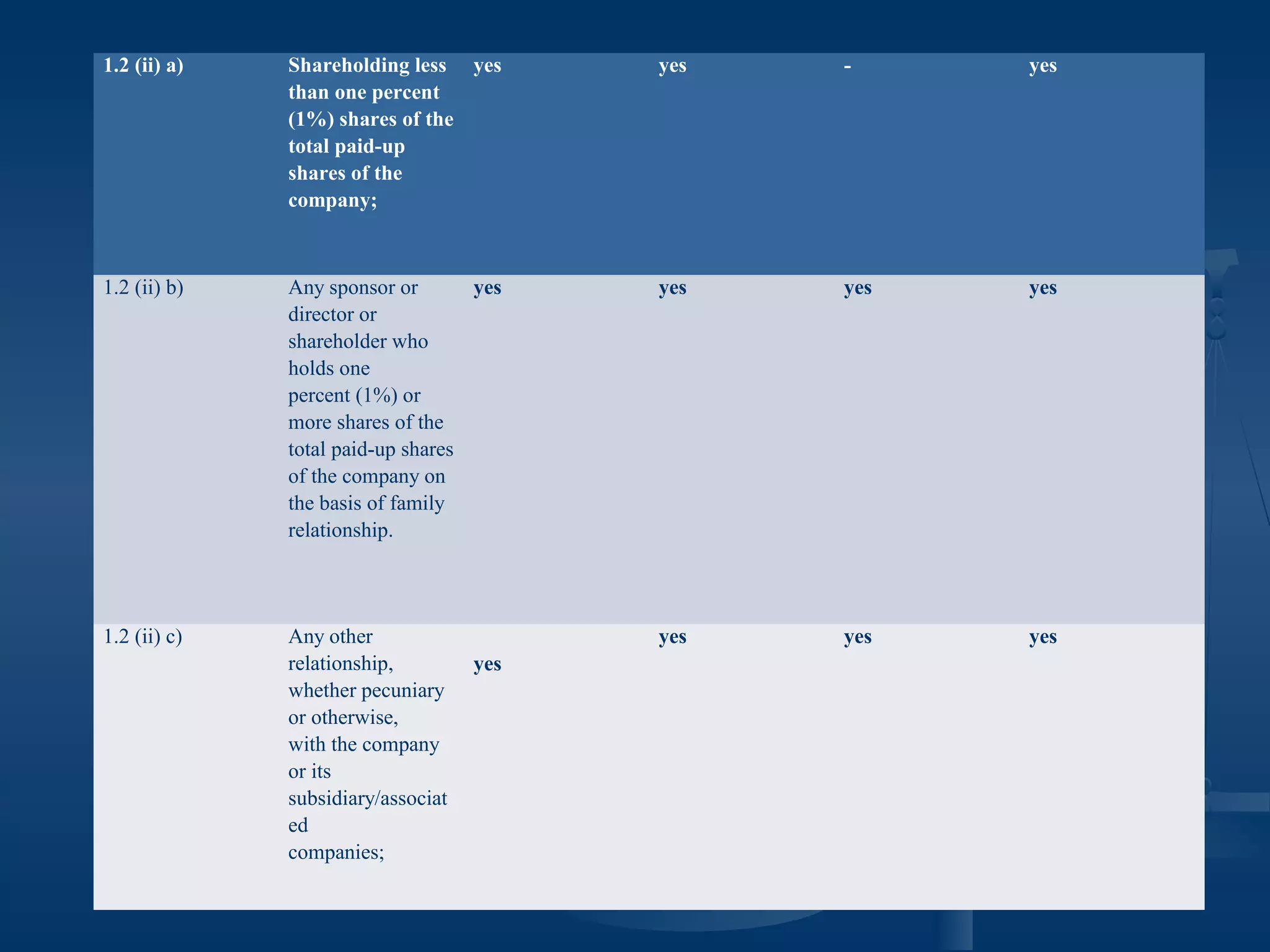

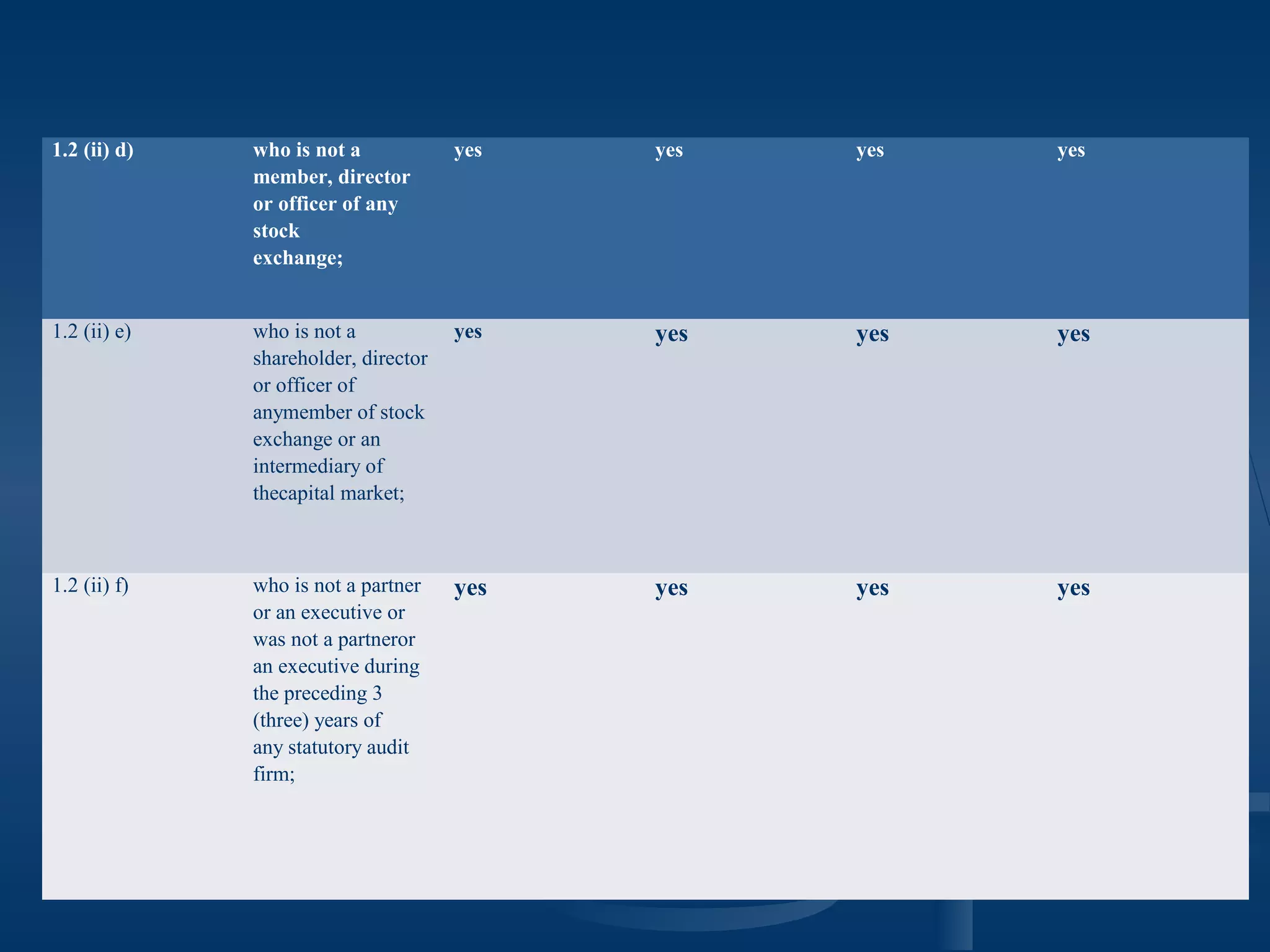

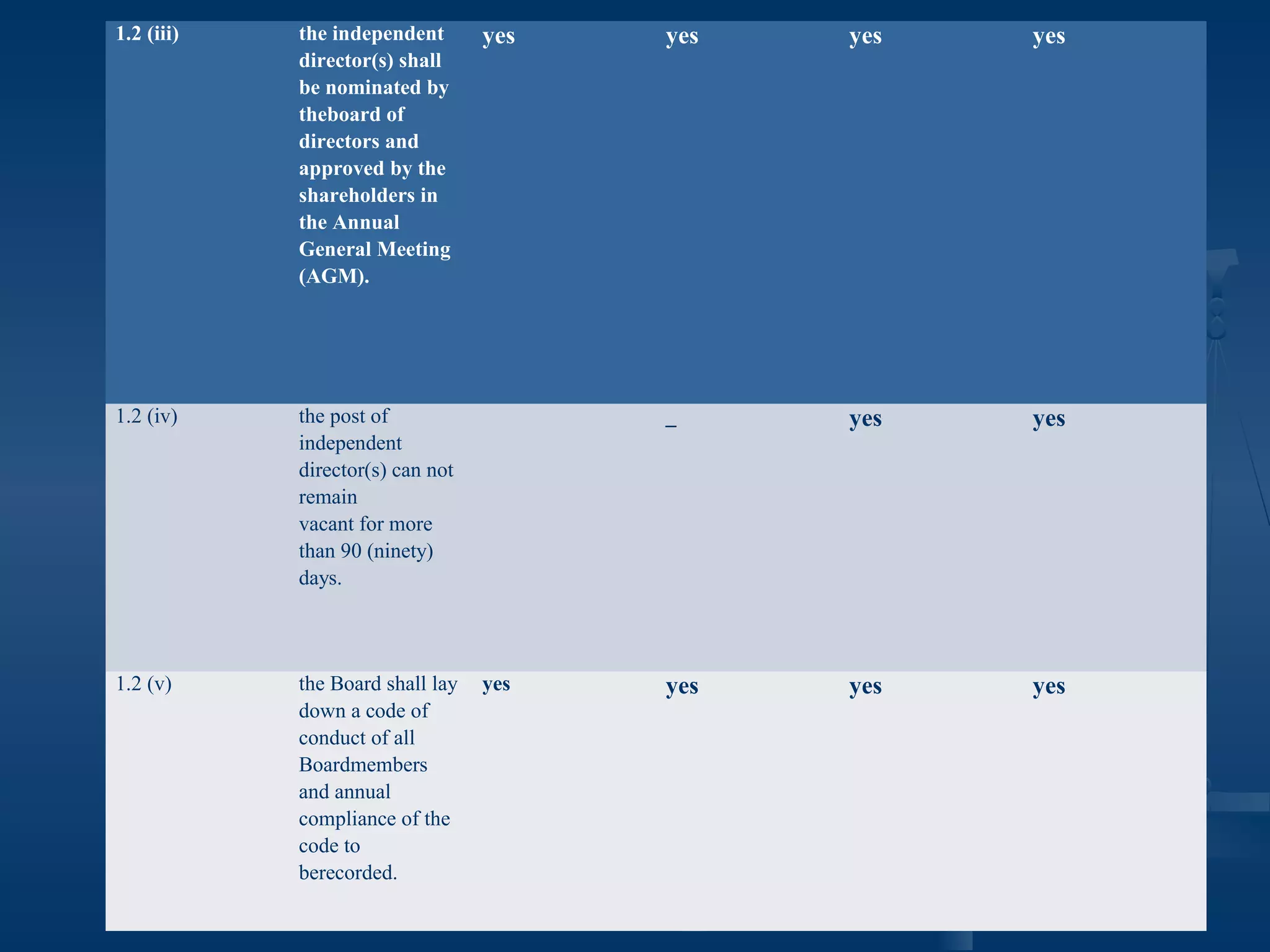

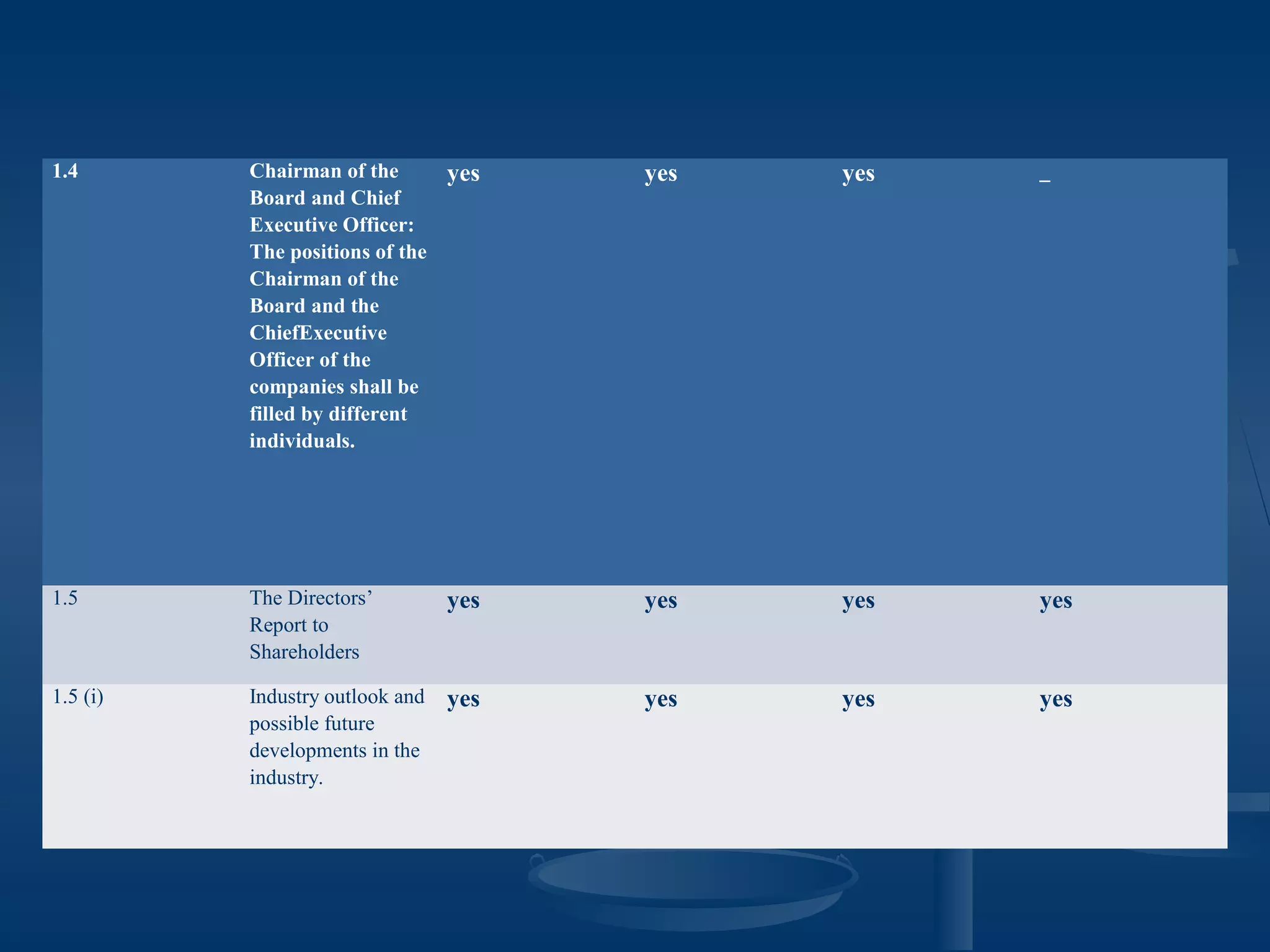

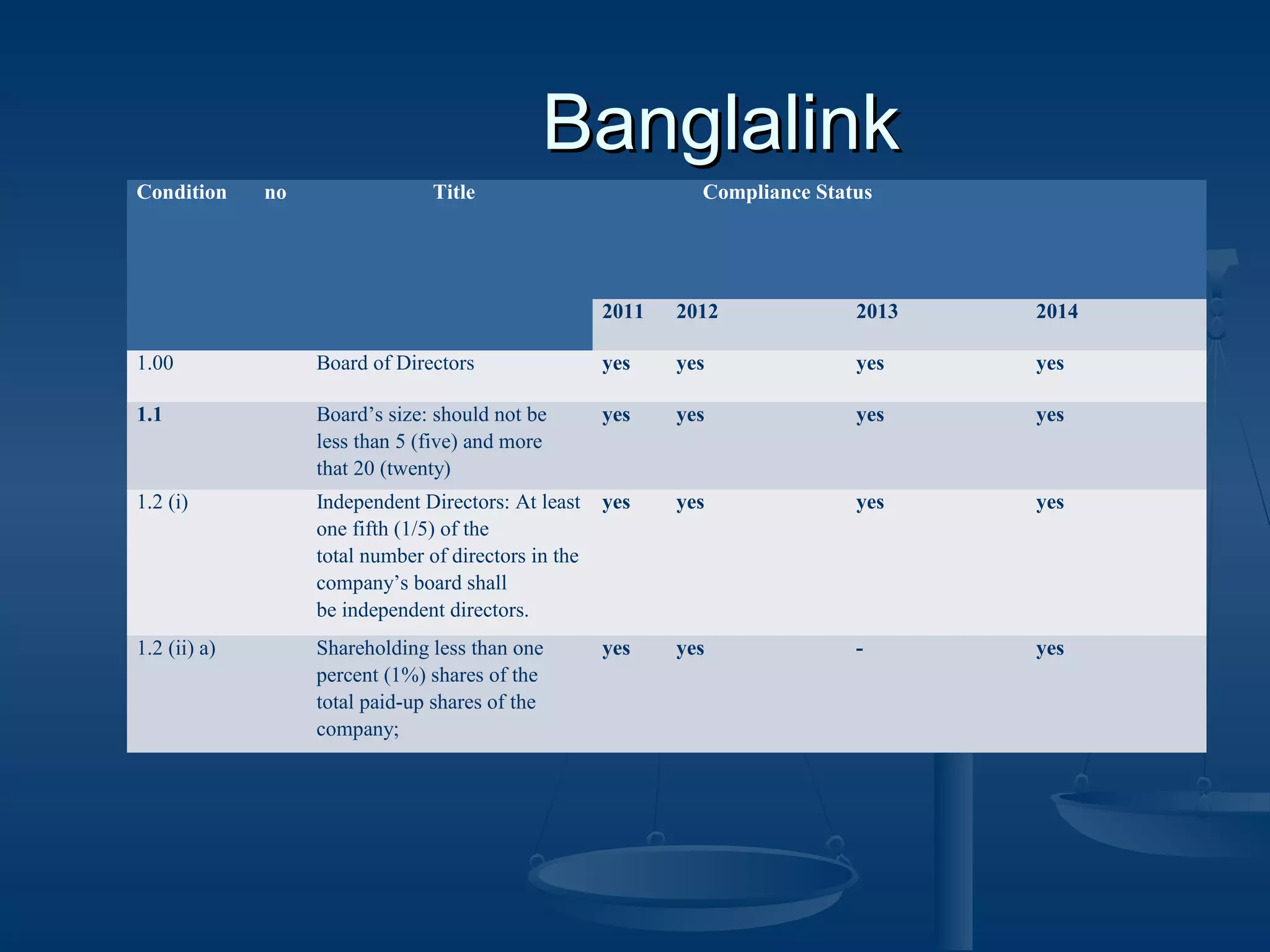

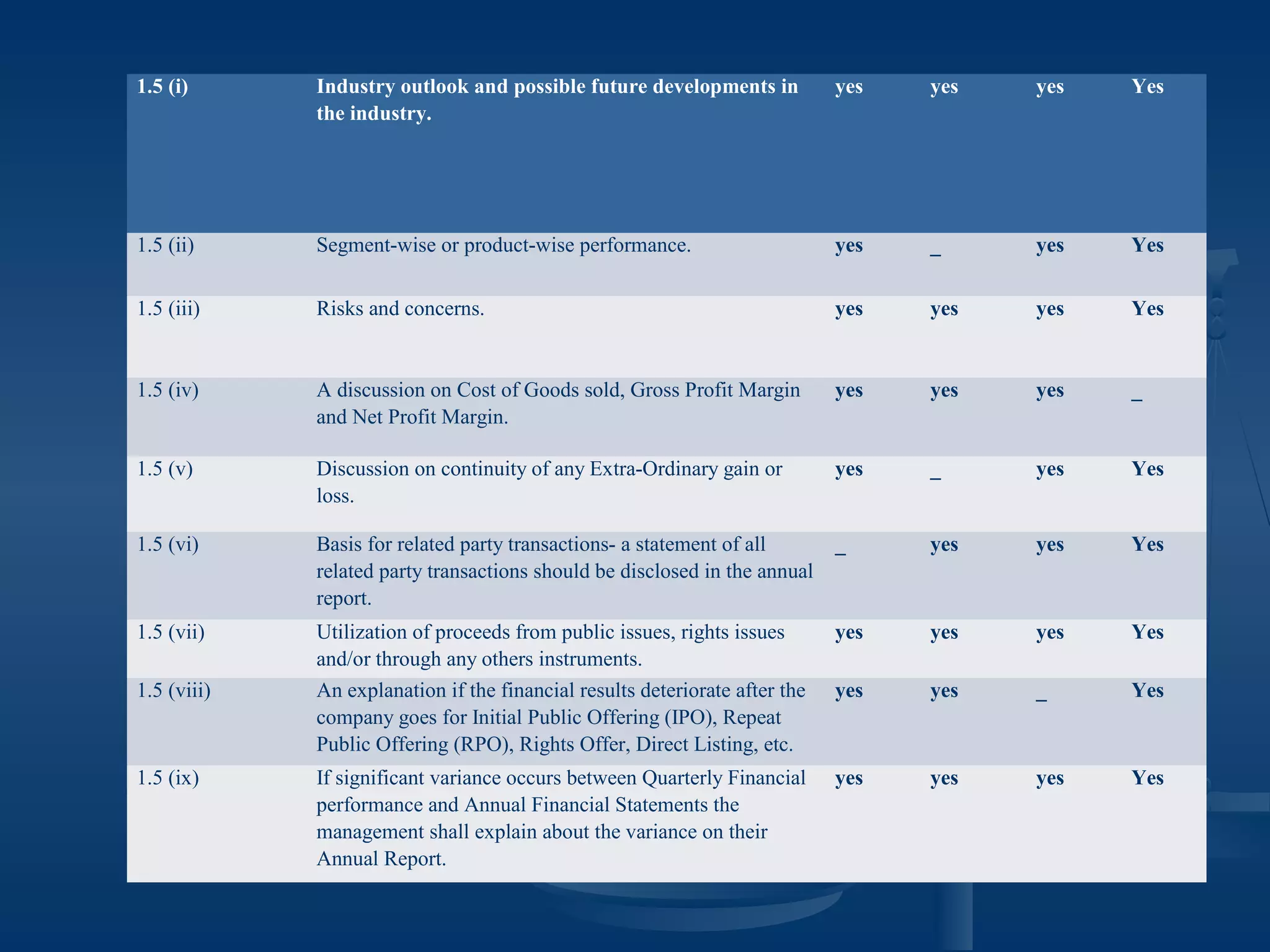

This document provides a presentation on corporate governance in the telecommunication sector of Bangladesh. It introduces the group members giving the presentation and defines governance and corporate governance. It then discusses key elements of good corporate governance like fairness, transparency and accountability. The presentation focuses on corporate governance policies and practices in the telecom industry in Bangladesh, highlighting the importance of compliance, defined business structures and adherence to regulatory guidelines. It also summarizes various board structures and committees in telecom companies like the Board of Directors, Executive Committee and Audit Committee. Finally, it provides examples of corporate governance compliance of two major telecom companies in Bangladesh.