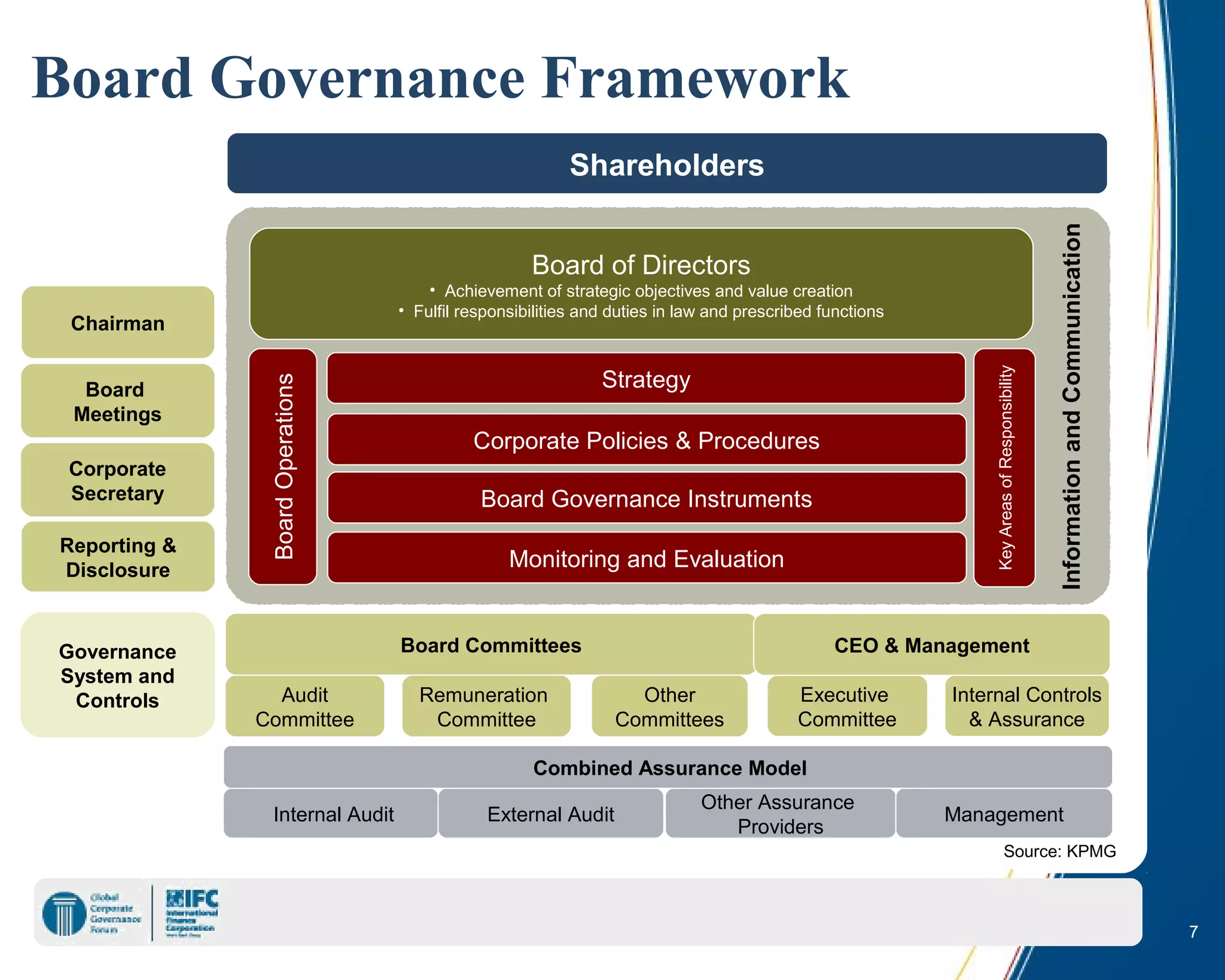

This document discusses the role of boards of directors in corporate governance. It defines corporate governance and outlines how boards can build effective governance through defining roles, putting in place governance arrangements, and ensuring proper oversight. It describes the key roles of the board chairman and CEO and discusses how board committees and instruments like charters can enhance effectiveness. The document also addresses boards' responsibilities in areas like financial oversight, risk management, and upholding legal principles of directorship.

![3

What is Corporate Governance?

Corporate Governance is a mechanism through which boards andboards and

directorsdirectors are able to direct, monitor and supervise the conduct and

operation of the corporation and its management in a manner that ensures

appropriate levels of authority, accountability, stewardship, leadershipleadership,

direction and control.

““The importance ofThe importance of

corporate governancecorporate governance

lies in its contributionlies in its contribution

both to businessboth to business

prosperity and toprosperity and to

accountability.”accountability.”

Paragraph 1.1, Committee on

Corporate Governance:

Final Report Hampel Committee

““Corporate governance is concerned withCorporate governance is concerned with

holding the balance between economic andholding the balance between economic and

social goals and between individual andsocial goals and between individual and

communal goals…… The aim is to align ascommunal goals…… The aim is to align as

nearly as possible the interests ofnearly as possible the interests of

individuals, corporations and society.”individuals, corporations and society.”

Sir Adrian Cadbury

Corporate Governance Overview, 1999

[World Bank Report]](https://image.slidesharecdn.com/sample1-140625040404-phpapp01/75/Board-of-Directors-Presentation-3-2048.jpg)