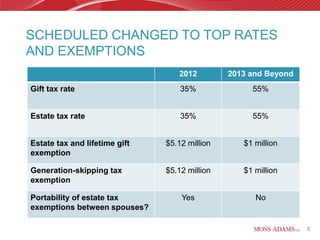

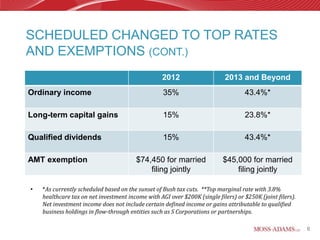

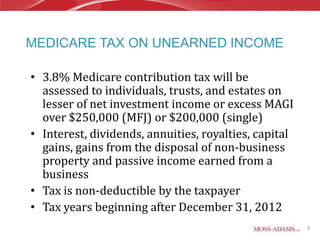

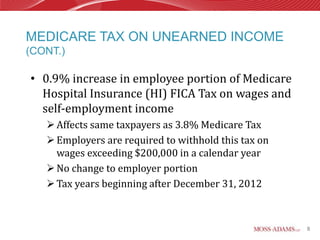

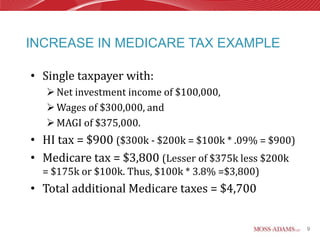

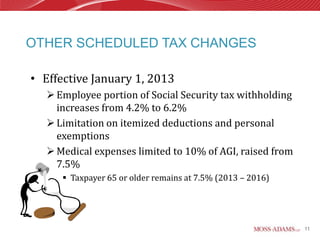

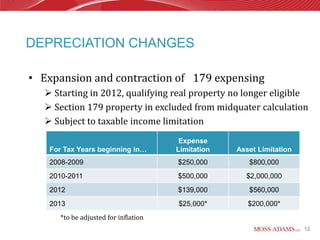

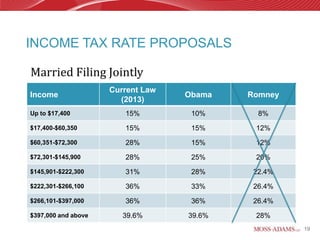

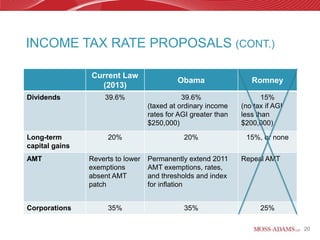

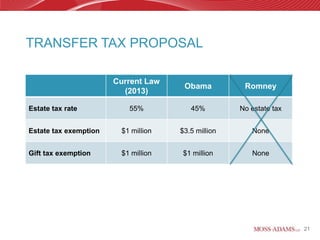

This document provides an overview of scheduled tax changes for 2012 and 2013, including increases to income, capital gains, and Medicare tax rates. It discusses opportunities for tax planning for individuals and businesses before year-end, and notes some decisions that may be best to wait until after the election due to ongoing presidential tax proposals.