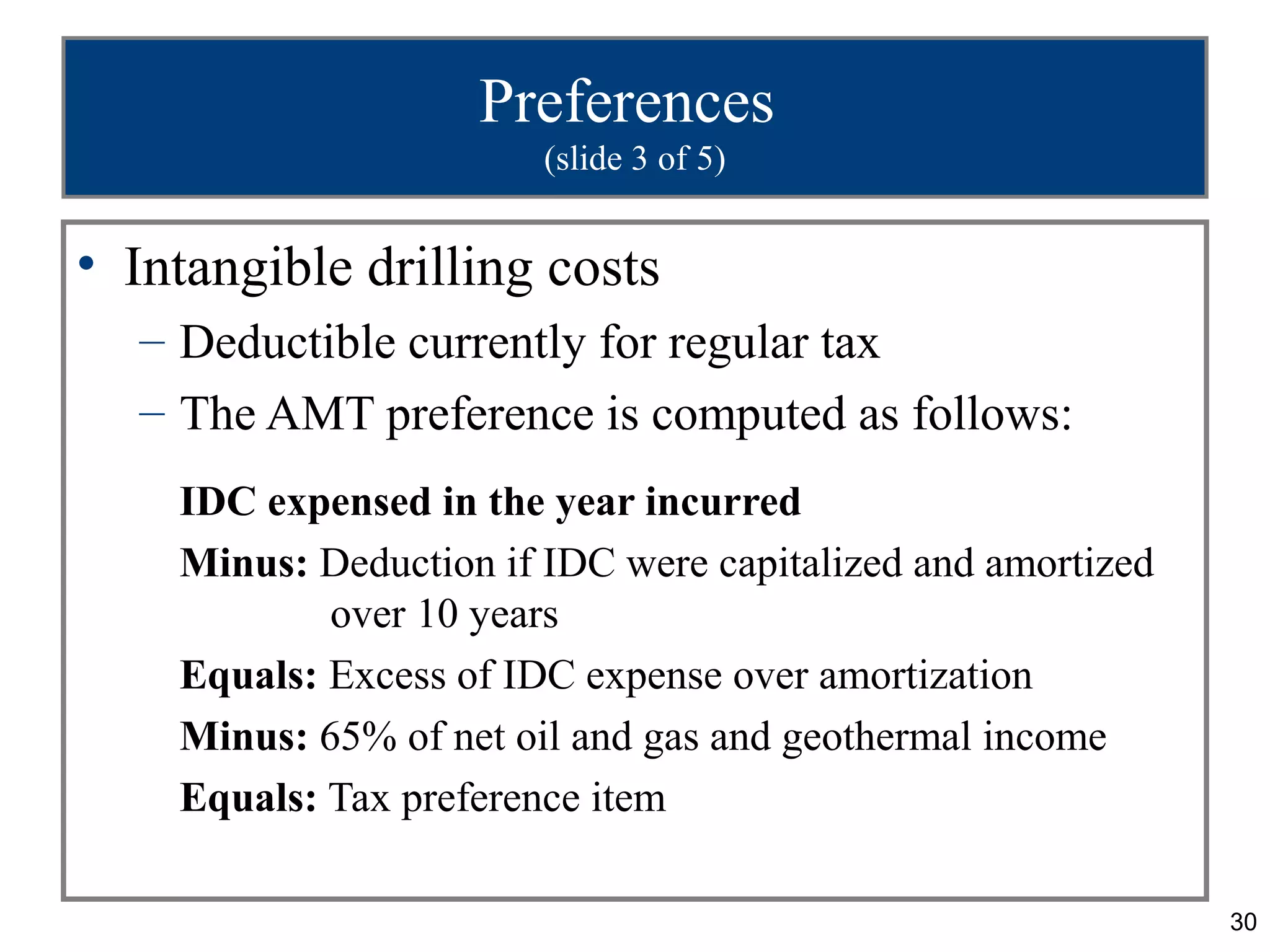

Bob and Carol paid different amounts of federal income tax even though they had identical incomes and deductions. Carol paid $15,000 more than Bob. Adam discovered that the difference was due to Carol's accountant incorrectly treating interest from private activity bonds issued in 2010 as an AMT preference. Since this interest is not a tax preference in 2010, Carol overpaid her taxes and is eligible for a refund.