The document outlines various aspects of financial ratios and portfolio management, including liquidity, leverage, profitability, and selection of securities. It discusses market participants, investment objectives, and strategies for assessing performance and risk in managing portfolios. Additionally, it highlights the importance of adhering to accounting principles and evaluating industry performance to derive key financial metrics.

![7/16/2015 1

FINANCIAL RATIOS & PORTFOLIO MANAGEMENT

Asset Management

(Activity or Efficiency)

Liquidity

Leverage

Profitability (Margin)

PORTFOLIO SELECTION & MANAGEMENT

Attributes & Data

EVALUATION

• Company level

• Industry level

I – Market index return, Ri – Security return, Rp – Portfolio return

Attributes

•Tax favoring

•Marketability of securities

•Convenience

•Risk & Return

•Liquidity of portfolio

Data

Portfolio of securities

• Stocks

• Bonds

• Real estate, Previous stones, Art etc

• Convertibles, Warrants

Risk

&

Return

Portfolio Class

• Cyclical

• Defensive

• Growth

• Cyclical growth

Parameters & Conditions

P/E – Price - Earnings

D/E – Debt - Equity

P/S - Price – Sales

BV/MV - Book value / Market value

P/BV - Price /Book value

ROCE – Return on Capital Employed

ROE – Return of Equity

Dividend payout (Dividend Per Share]

Earnings Per Share (EPS)

Mathematical measures

• Average,

• Standard deviation,

• Variance

• Co-variance

• Regression coefficient

• Co-relation coefficient

RATIOS

•Measurement of earning

•Forecasting of earnings

Return

%Expected Return

Std deviation

Portfolio Std deviation

Coefficient of correlation

$Beta coefficient

Covariance

Total Portfolio return

MARKET VALUE RATIOS

Price - Sales & Price - Earnings Performance;

SELECTION

1 Dependent on

i

ii

iii

iv

1. Correctness

2. Completeness

3. Consistency

4. Comparability

Conditions

3. Refers to the agreement with

the “Accounting Principles Board (APB or FASB or Others)” i.e. In accordance with US GAAP or similar Accounting standards

NXXXX ....321

Portfolio

of Securities

Nxxxx ....321

Neeee xxxx ....321

N ....321

ji

ji

xx

ji

x

xxCov

r

),(

,

N

i

iiip IXR

1

)(

I

Ri

i

),( ji xxCov

$Measures the risk & its diversification

on the portfolio of securities

% Expected or the Average return](https://image.slidesharecdn.com/portfoliomanagement-150511082300-lva1-app6892/85/Portfolio-management-1-320.jpg)

![7/16/2015 4

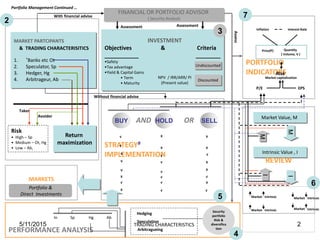

LEGEND

Portfolio Selection & Management

_____________________________________________________________

•Review – Considers the market & Intrinsic value conditions for marketable securities.

•Strategy Implementation – Buy & Hold, Sell, Long & Short Buy or Sell

•Market Participants - Investor, Hedger, Arbitrageur & Speculator

•Portfolio Indicators – Market price Volume, Net Present Value or Rate of Return

_____________________________________________________________

# - indicates the strategy implementation

is a complex combination of BUY, HOLD or SELL situations which

can be taken by the investor or client. The investment decisions are however

dependent upon both the financial or portfolio advisor and the client or

the investor for the prevailing market conditions. The combinations shown

in the slide are for indicative purposes ONLY. In reality there are much more possibilities

than that are shown in the block.

It does not bear any resemblance with actual market behavior as the real market is

dependent upon the several other factors & increasingly complex. The “x” & “V” marks

In the block represent the individual situation taken by the investor or client during the

process of portfolio management whilst trading the portfolio of securities.

‘ *Others include Commercial Banks, Central & Non bank dealers, Financial institutions

Treasuries, Foreign exchange brokers .Refers to the derivatives market or

other financial markets like Equity , Capital markets etc.

With increasing portfolio risk, the dilution of P/E or EPS occurs, therefore in most situations

Market participants resort to hedging , arbitragueing or speculating.

LEGEND

Financial Ratios & Valuations

They Indicates the relative valuation of the company

in terms of the security values trading the market

[ Regular financial statements

& Common size statements.]

The true earnings of the company in an

Industry are largely dependent upon the

extent or the rate of interest, tax prevailing.

Evaluation

Industry scenario

Historic & Current performance of industry segments

Company scenario

Earnings & forecasting Performance of company. The

Company performance is derived using key variables

As Sales volume, Dividend payout (DPS/EPS)

Ratios

Effect of foreign exposures related to the

accounting system, transaction & allied operations

on the ratios needs careful consideration. The overall

Financial performance depends however on the size

Of the company & nature of business](https://image.slidesharecdn.com/portfoliomanagement-150511082300-lva1-app6892/85/Portfolio-management-4-320.jpg)