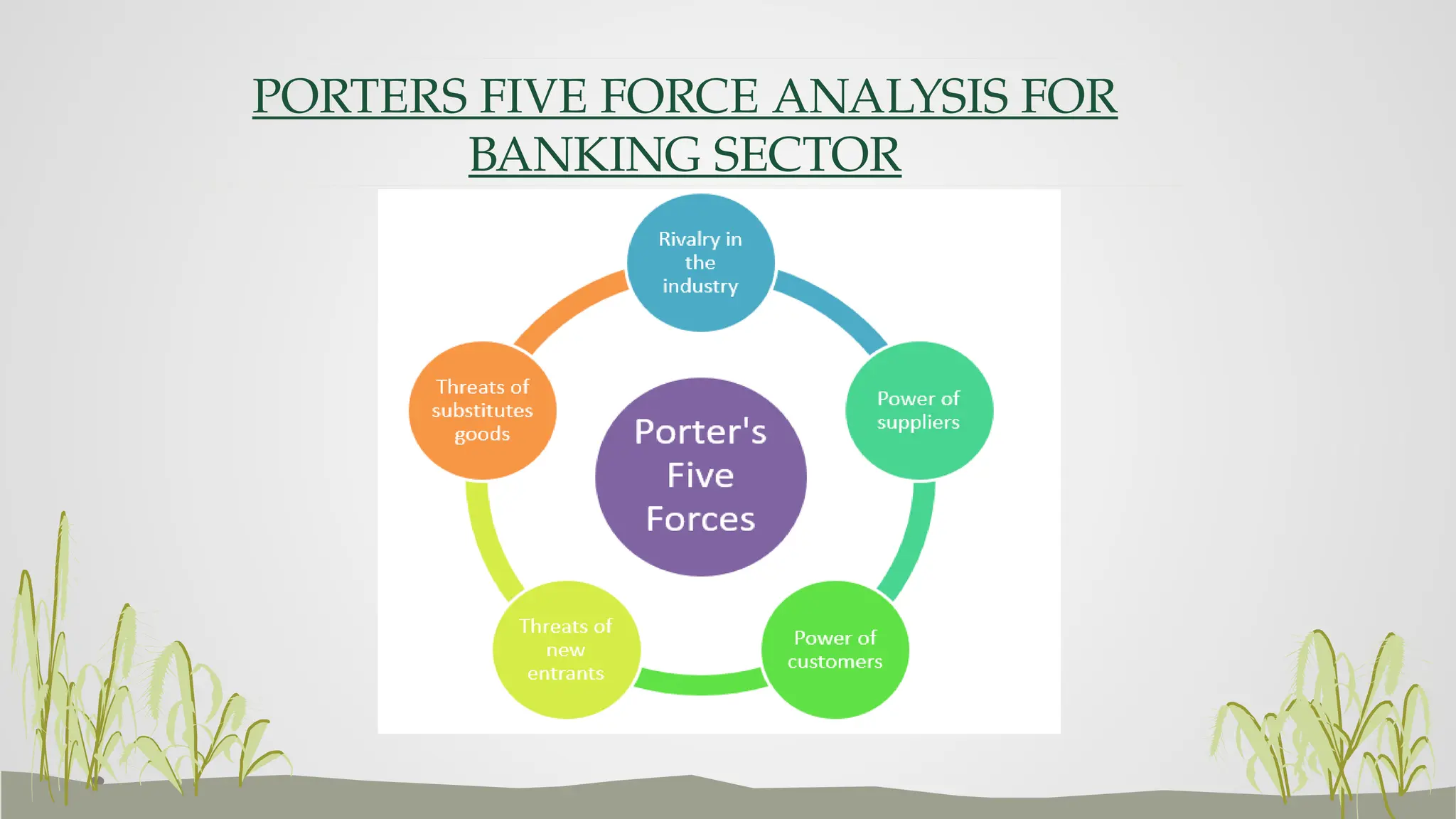

Porter's Five Forces analysis examines the competitiveness of the banking sector, highlighting high threats from fintech and digital banks and the significant bargaining power of buyers. It identifies direct and indirect substitutes that challenge traditional banking, such as digital wallets and cryptocurrencies. The analysis indicates a highly competitive environment where banks must innovate and adapt to maintain market share.