1. The document outlines the sales process for selling an IUL (indexed universal life) policy, which includes a client presentation, financial needs analysis, illustrations/application, and policy delivery.

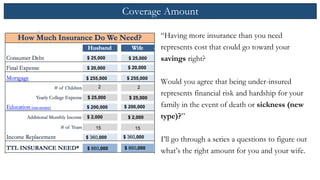

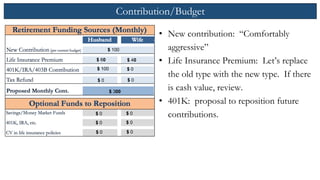

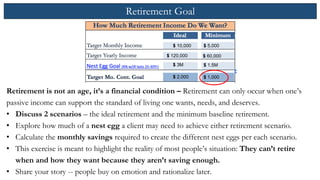

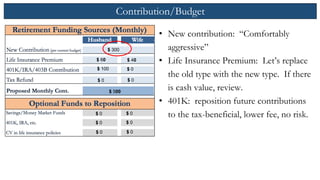

2. The financial needs analysis involves determining the appropriate coverage amount through a series of questions, reviewing retirement goals by discussing ideal vs minimum retirement scenarios, and analyzing a client's contribution budget.

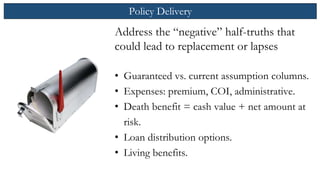

3. Illustrations would be used to demonstrate policy details like death benefits, cash value, expenses, and living benefits, while addressing potential objections around guarantees vs assumptions.