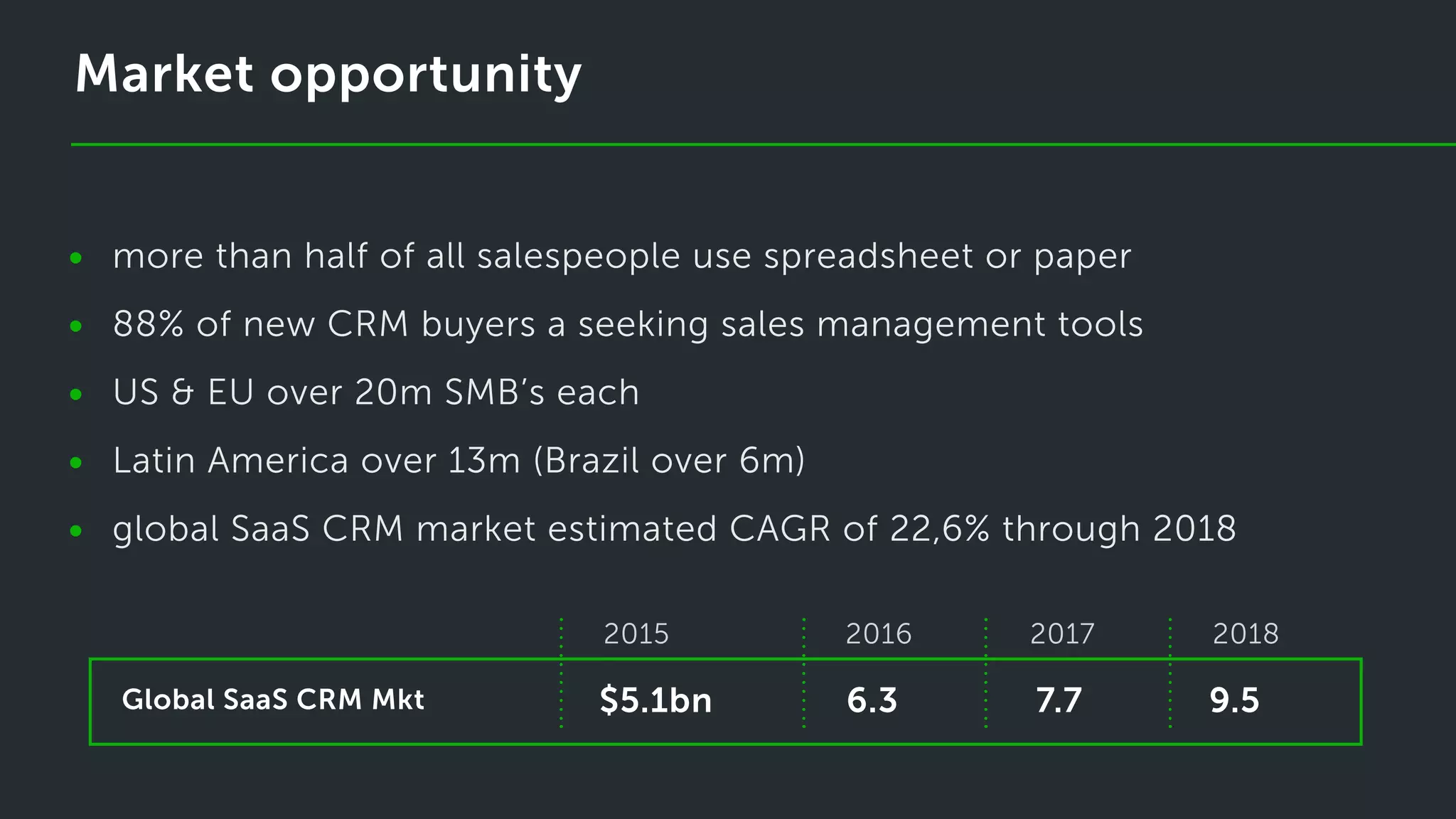

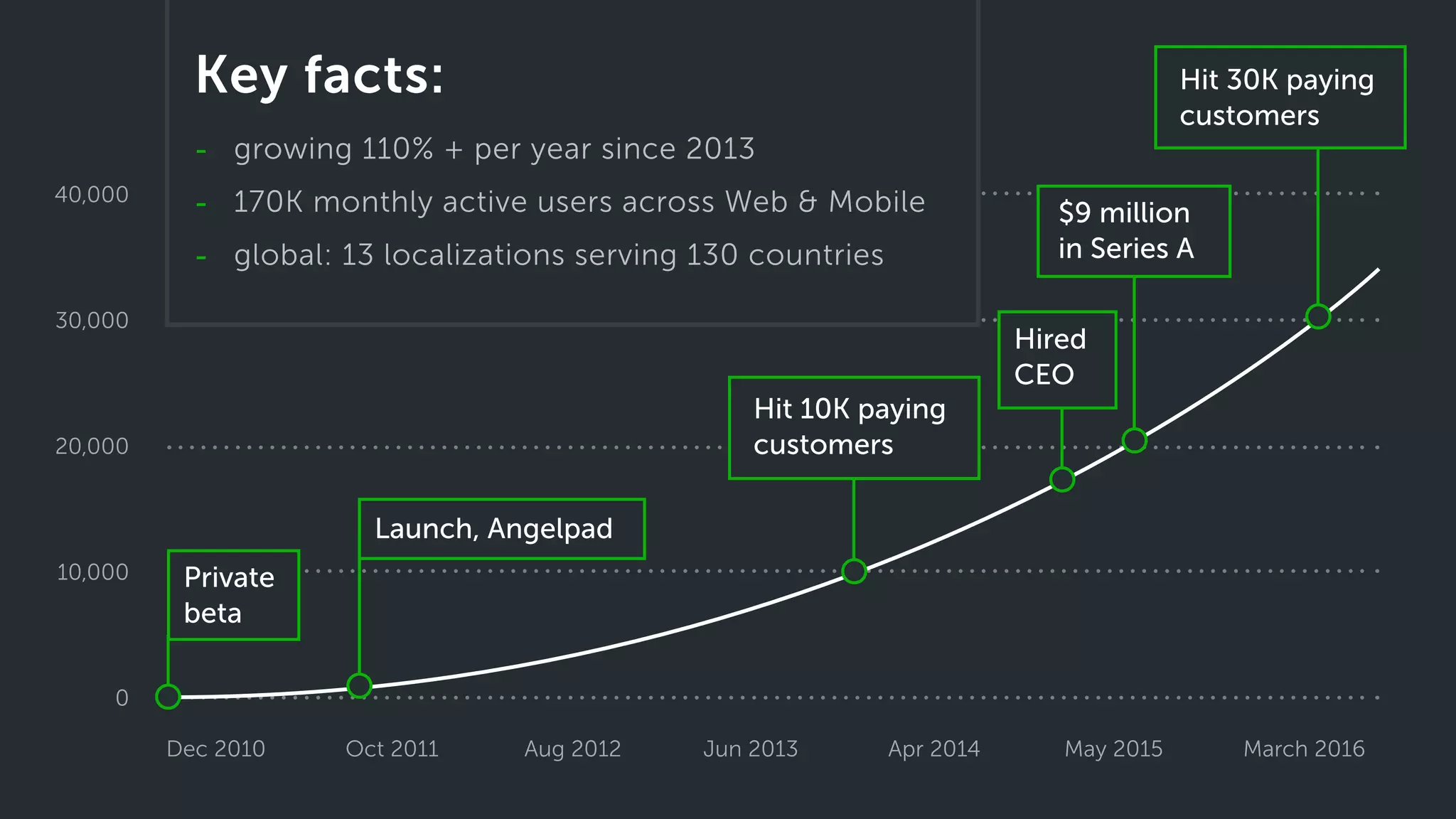

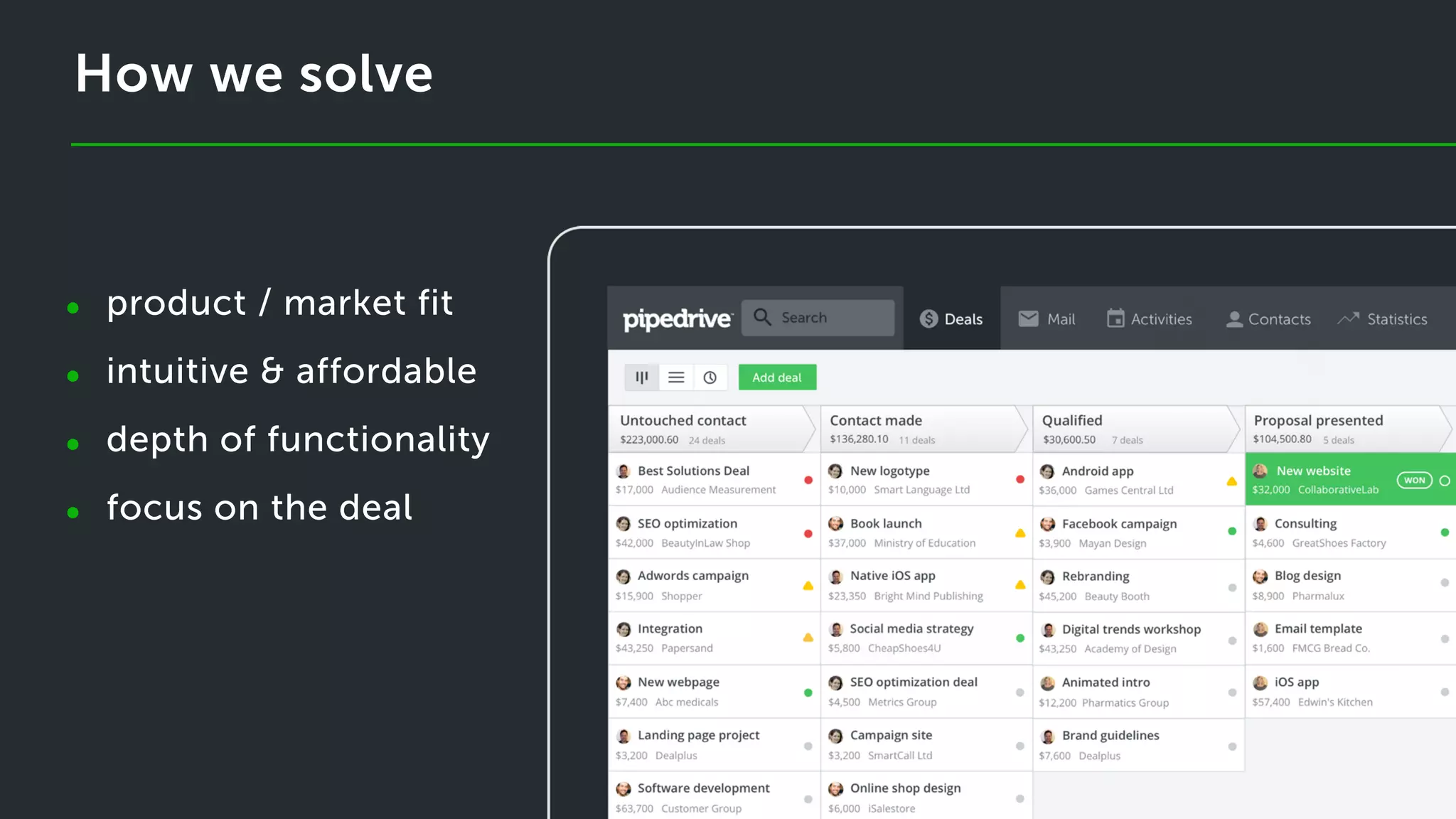

The document discusses the market opportunity for sales CRM solutions targeting small to medium-sized businesses (SMBs), highlighting that over half of salespeople currently use spreadsheets. It emphasizes the advantages of an intuitive, user-friendly CRM system that addresses common challenges faced by SMBs and encourages active sales practices. Additionally, it outlines the expertise and accomplishments of Noah Advisors in facilitating financial transactions within the internet sector.