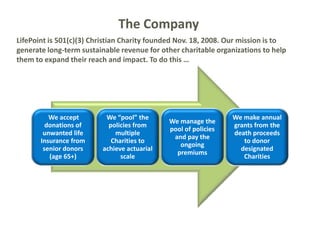

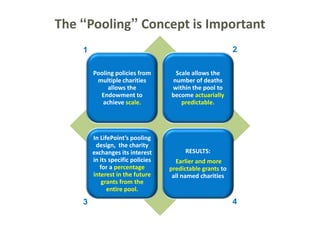

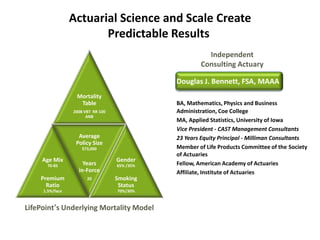

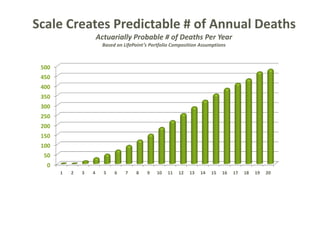

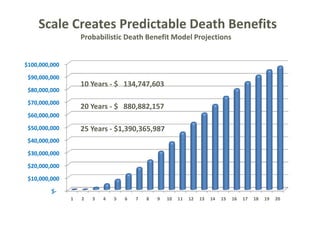

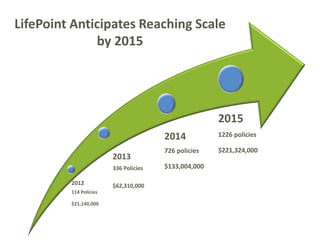

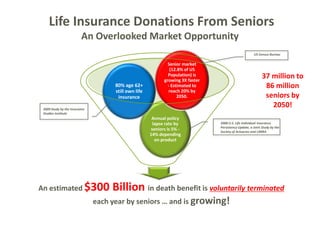

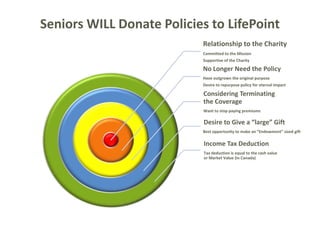

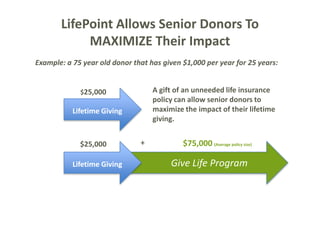

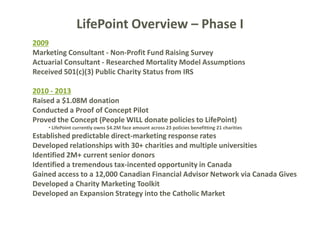

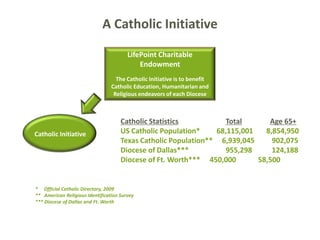

The document discusses LifePoint Catholic Charitable Endowment, a 501(c)(3) organization that accepts donations of unwanted life insurance policies from senior donors aged 65 and older. LifePoint pools these policies from multiple charities to achieve actuarial scale, allowing the number of deaths to become predictable. This predictability enables LifePoint to make annual grants from death proceeds to donor-designated charities. The document provides statistics on the Catholic population in the U.S., Texas, and the Dioceses of Dallas and Fort Worth to demonstrate the potential scope of LifePoint's Catholic Initiative.