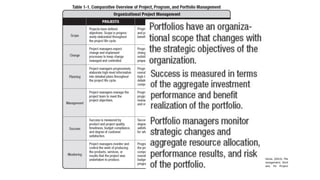

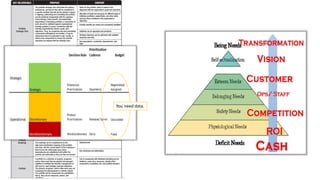

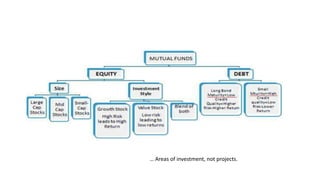

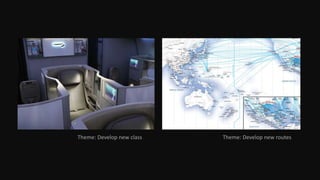

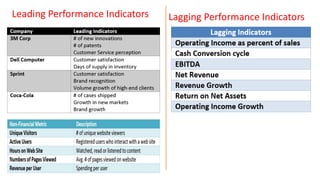

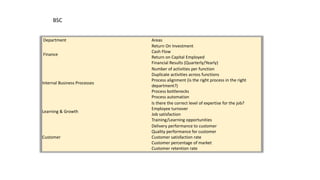

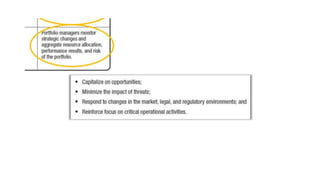

This document summarizes a presentation on project portfolio management. It discusses key aspects of PPM including strategy, governance, performance, risk management, and communication. It also references the Project Management Institute's standard for portfolio management as an important resource. The presentation aims to provide practical guidance on using data to make investment decisions and align projects, as well as optimizing performance through governance, risk management, and key performance indicators.