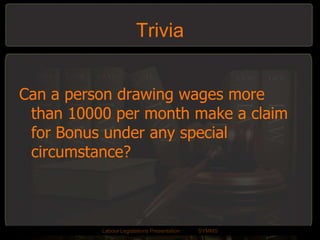

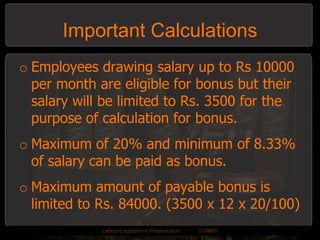

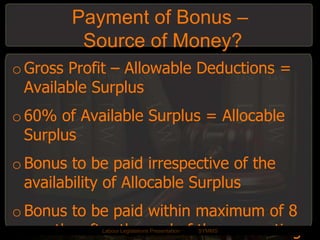

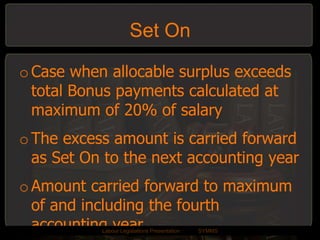

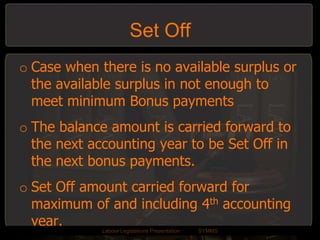

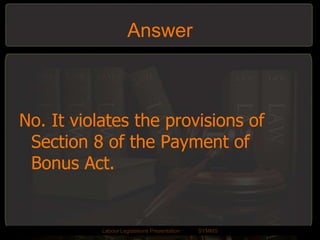

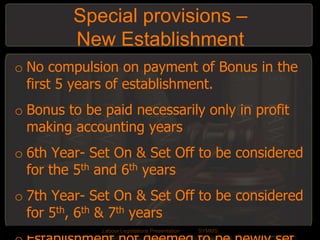

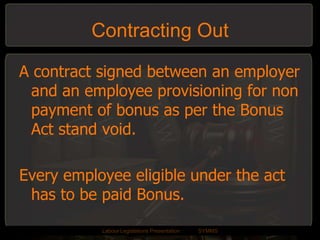

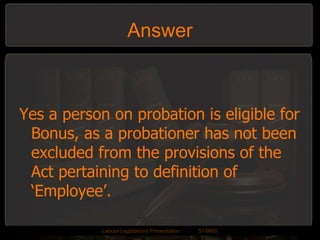

The Payment of Bonus Act, 1965 provides for the payment of bonus to employees in establishments with 20 or more employees based on profits. It applies to factories and other establishments and covers employees earning up to Rs. 10,000 per month who have worked for at least 30 days. The act specifies minimum and maximum bonus amounts as a percentage of salaries and carries forward surplus amounts across years for set-on or set-off.