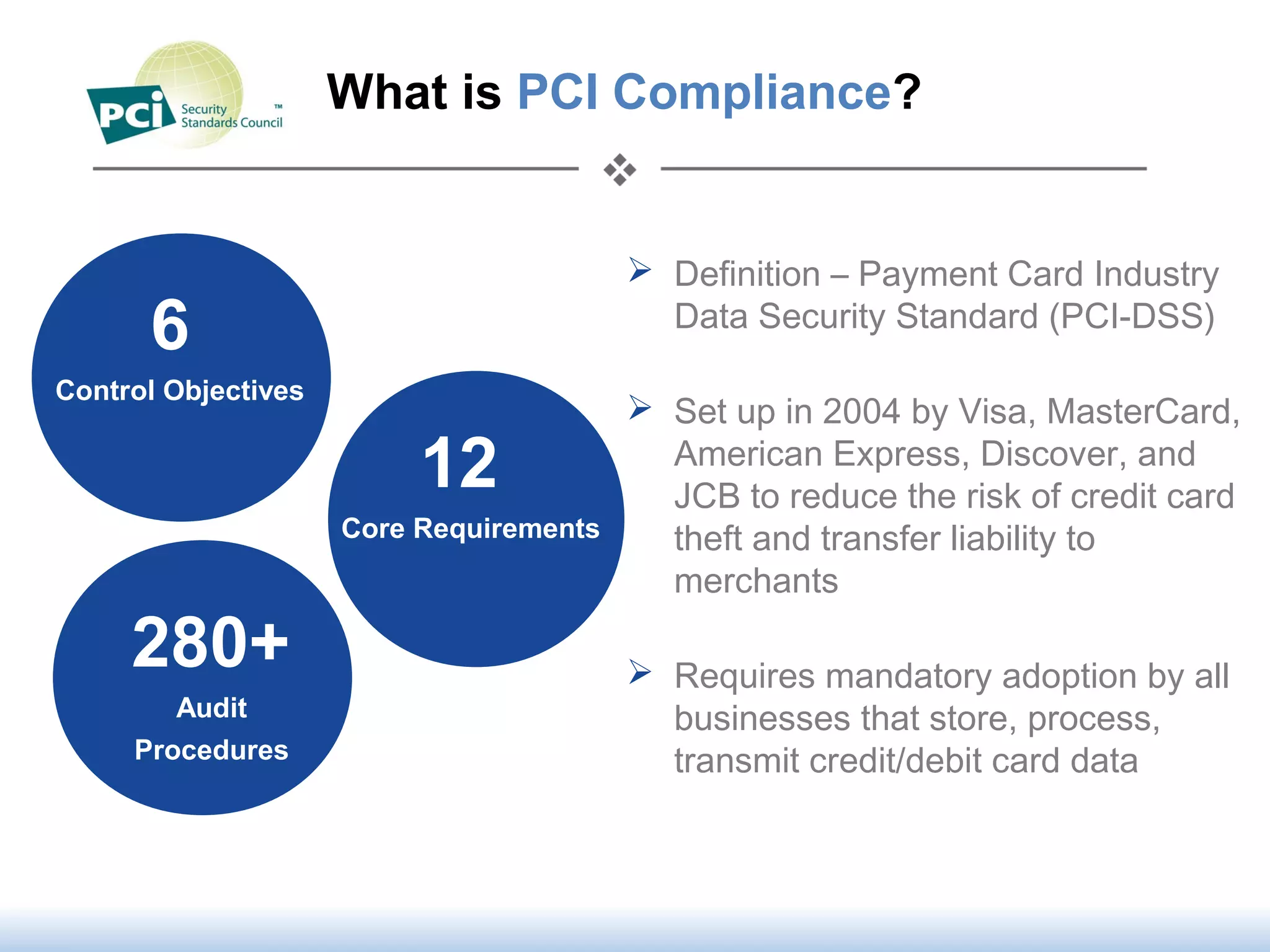

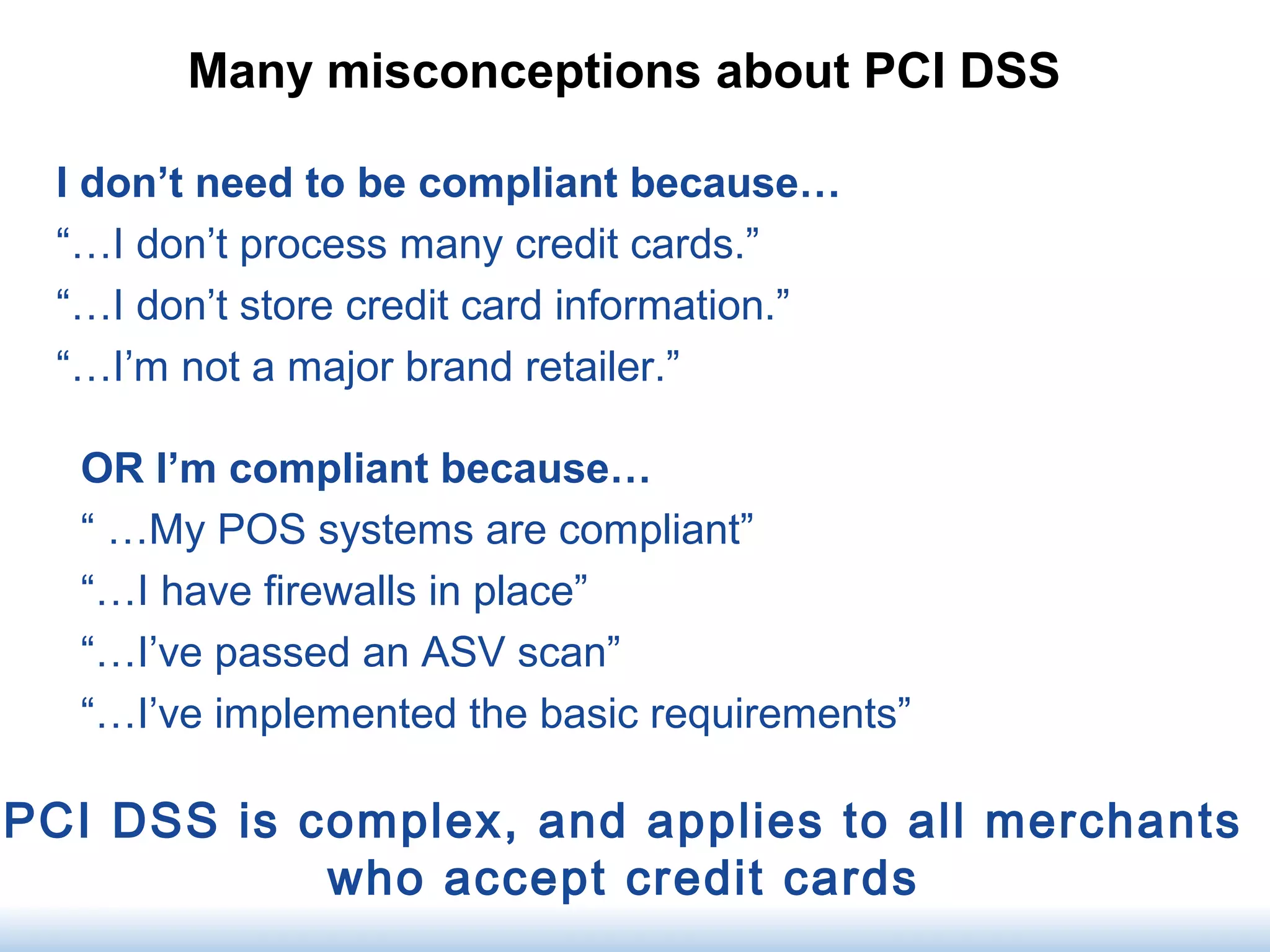

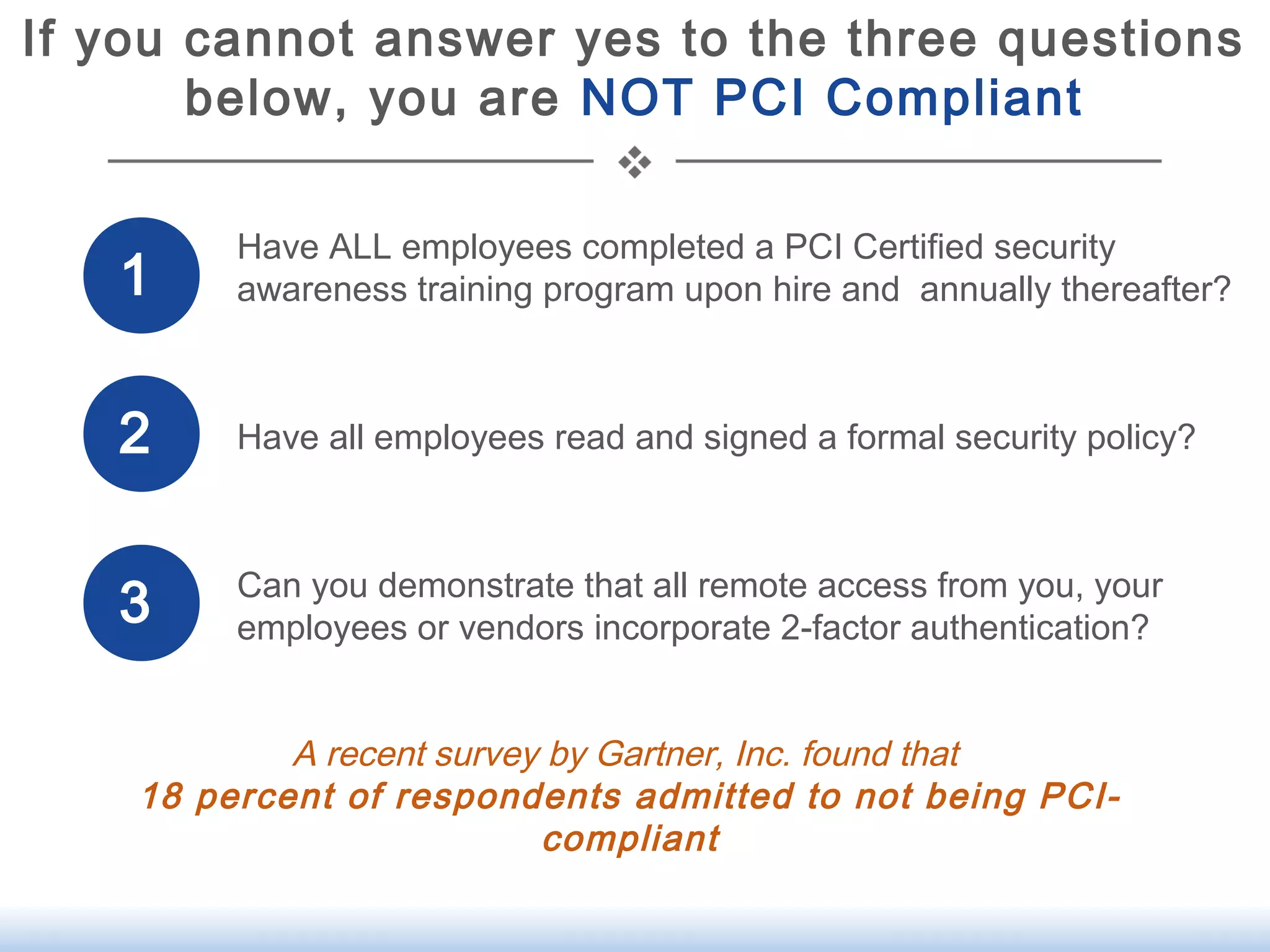

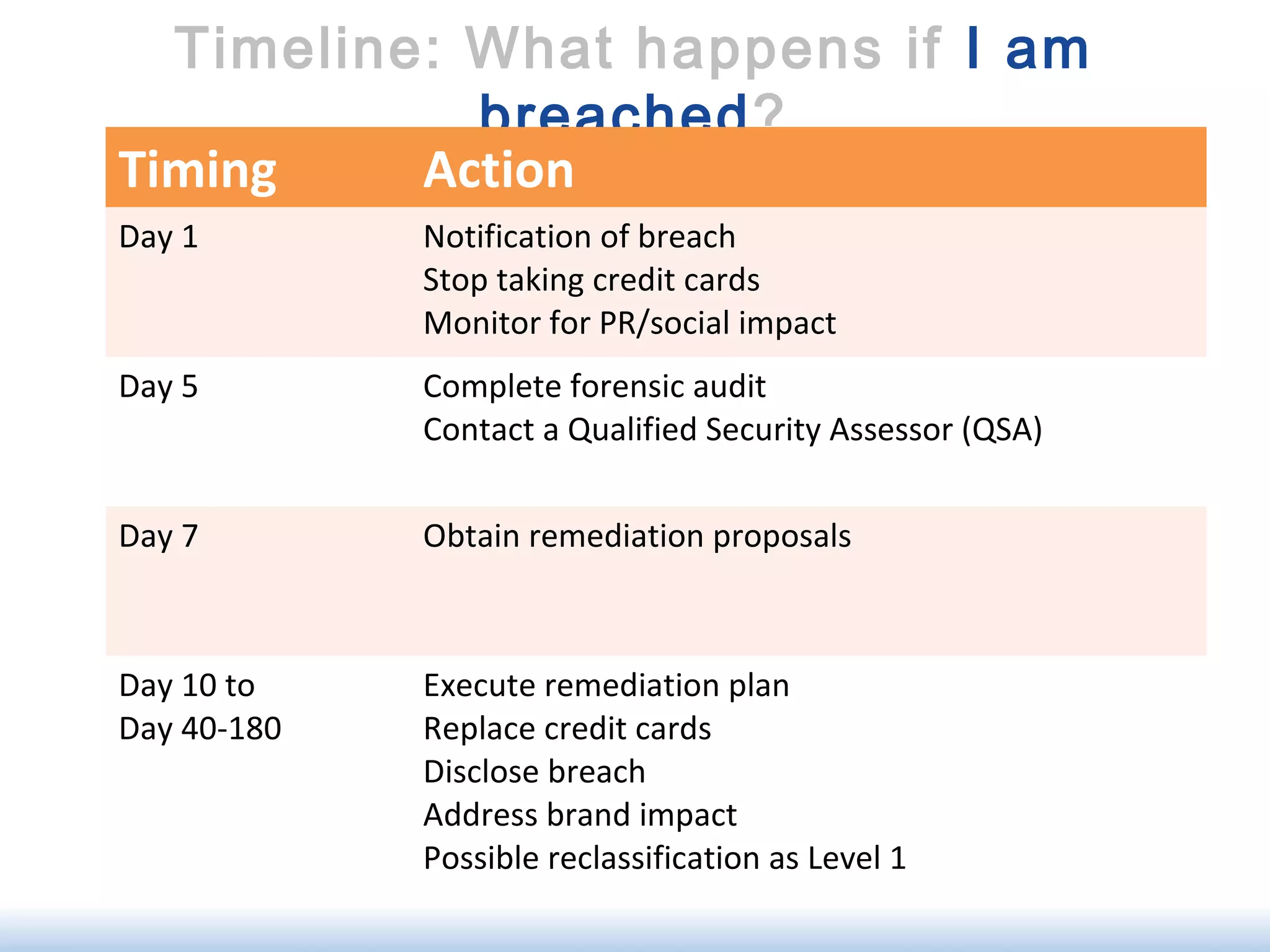

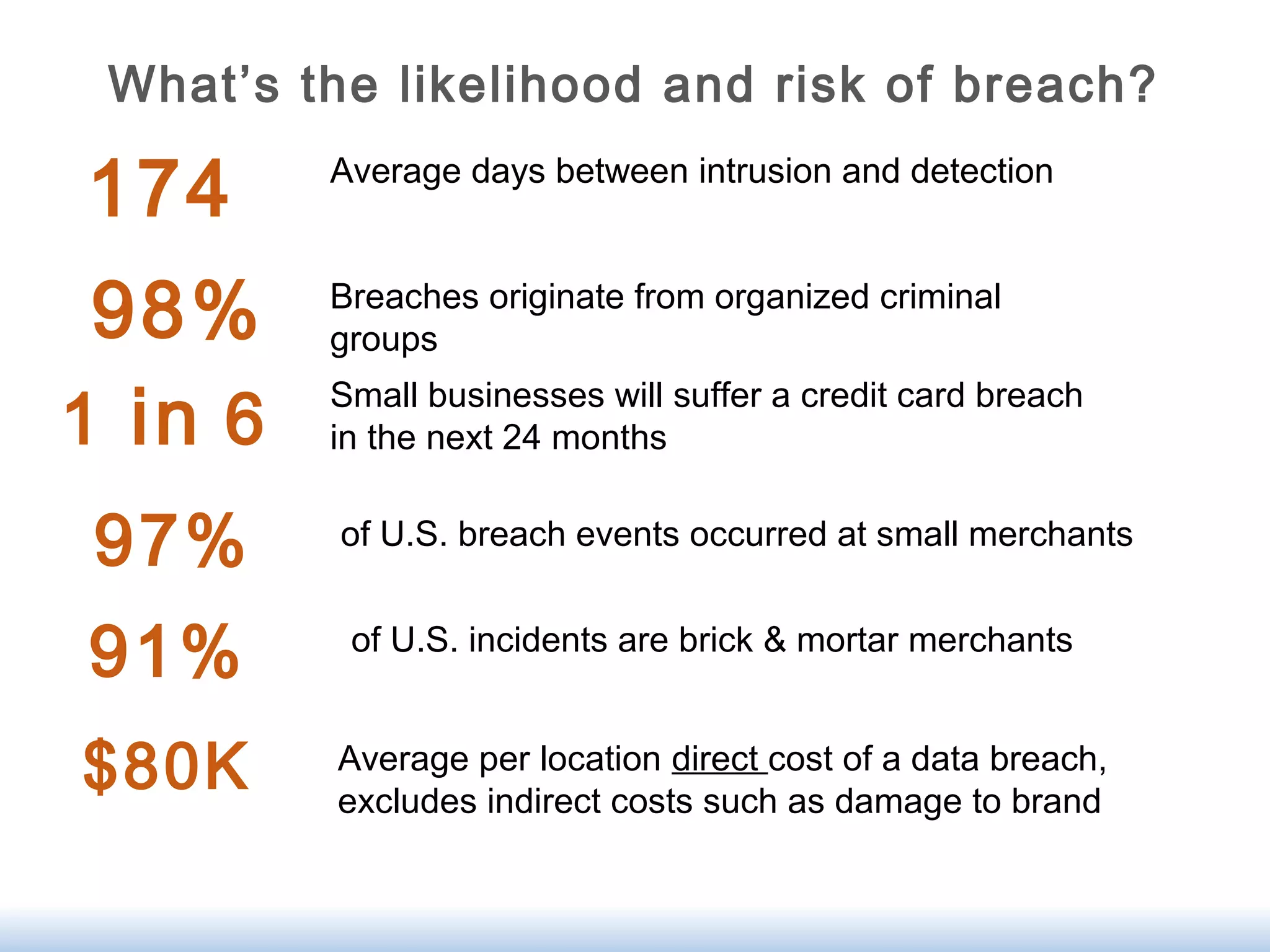

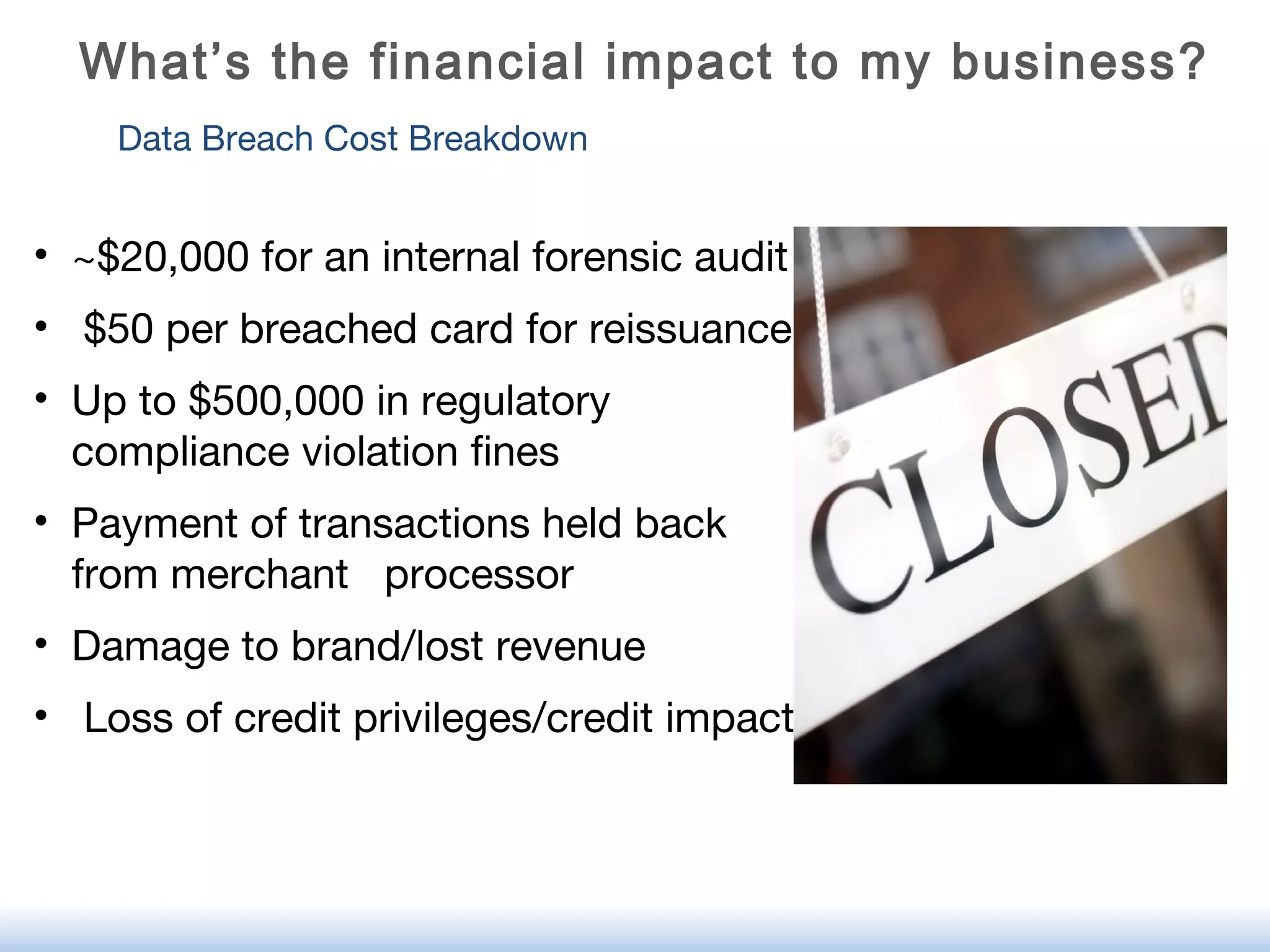

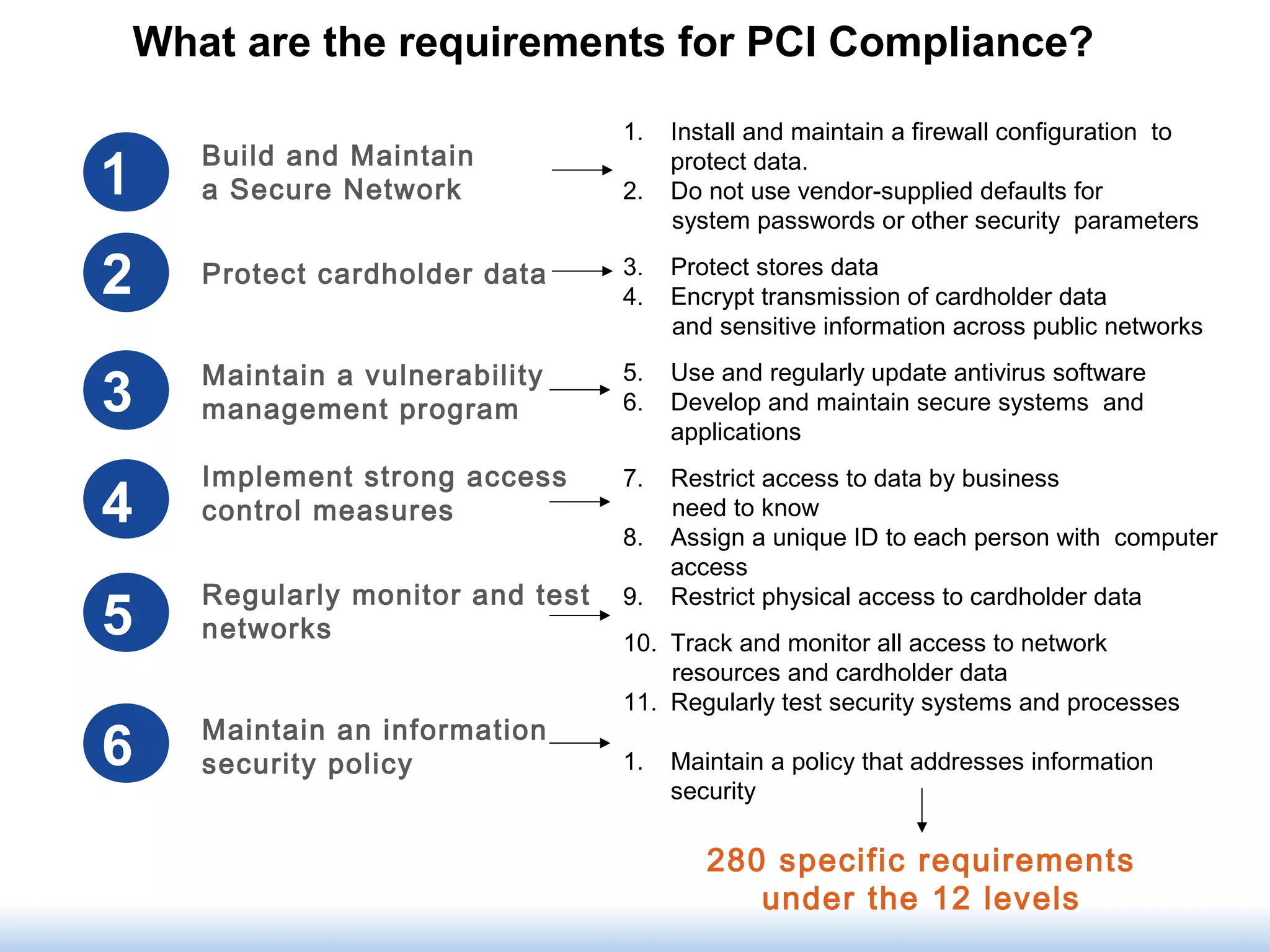

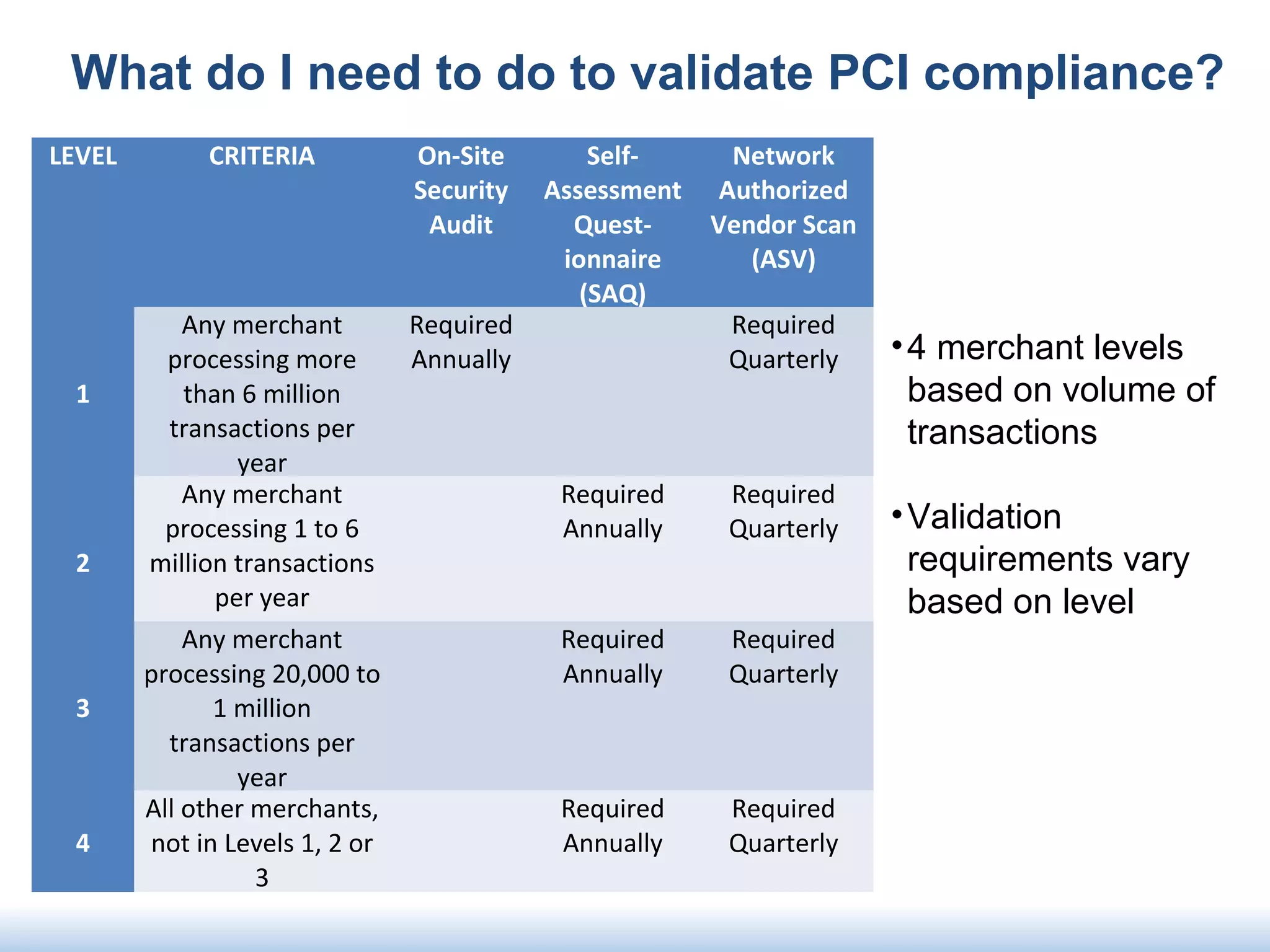

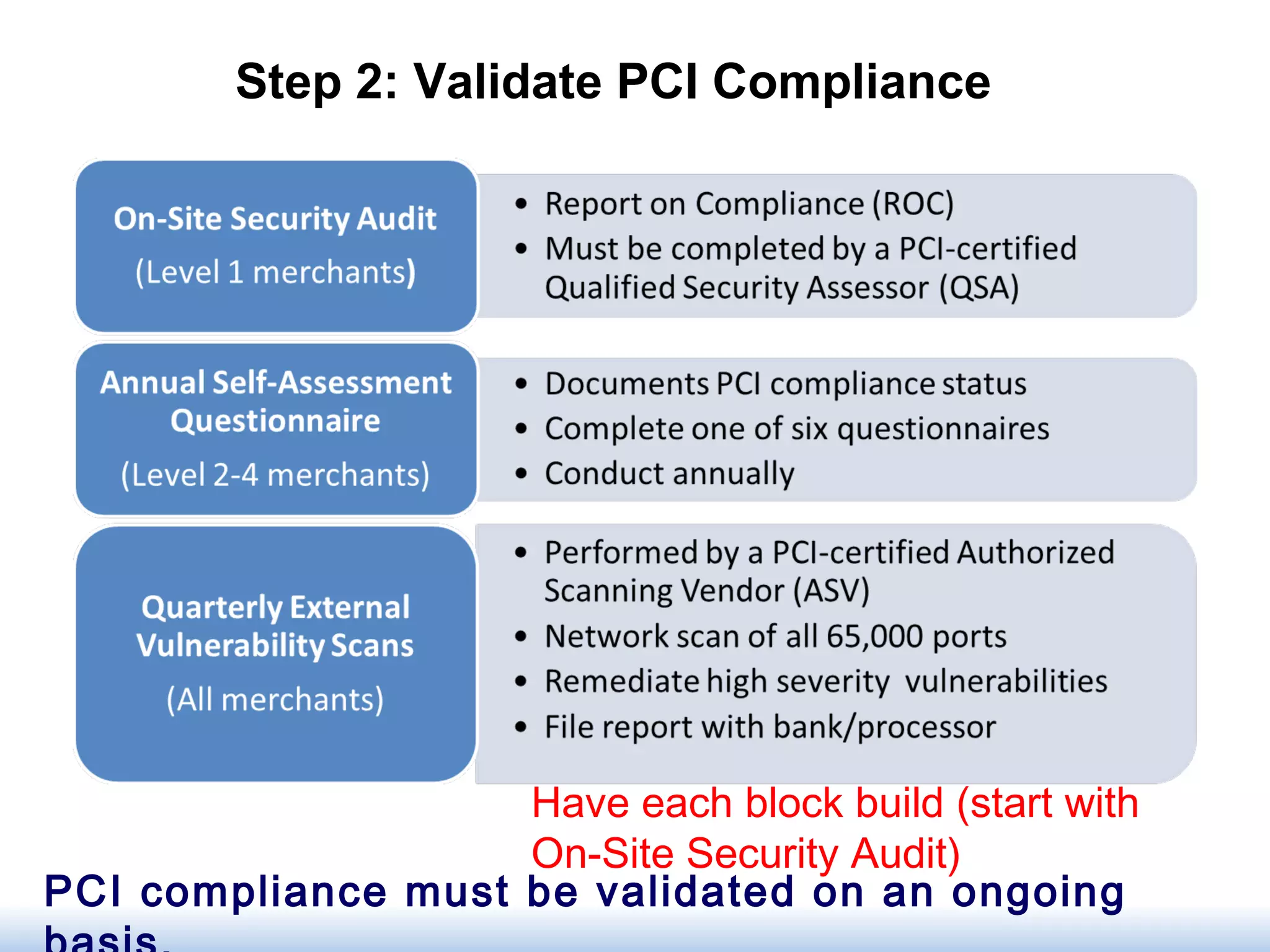

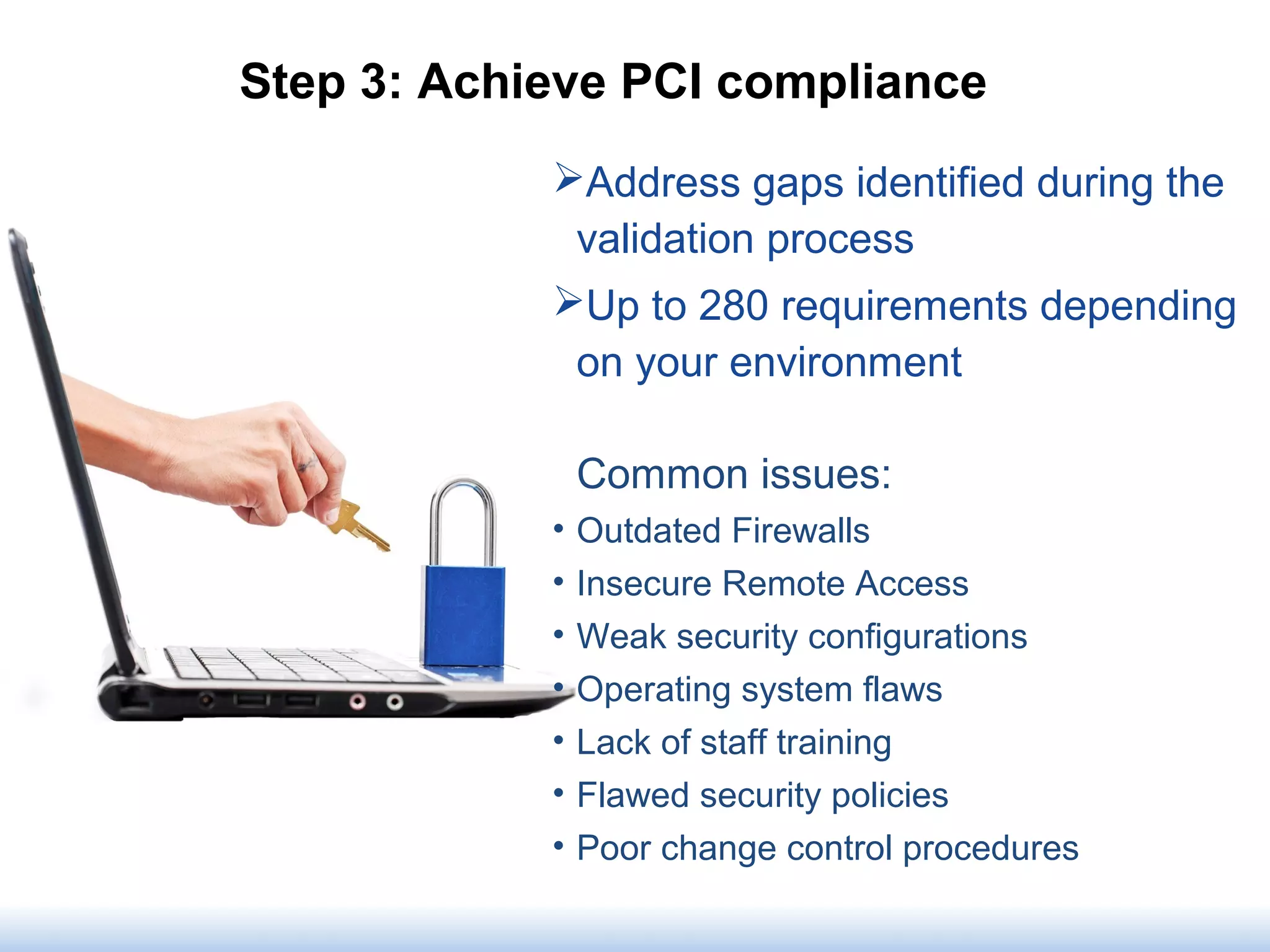

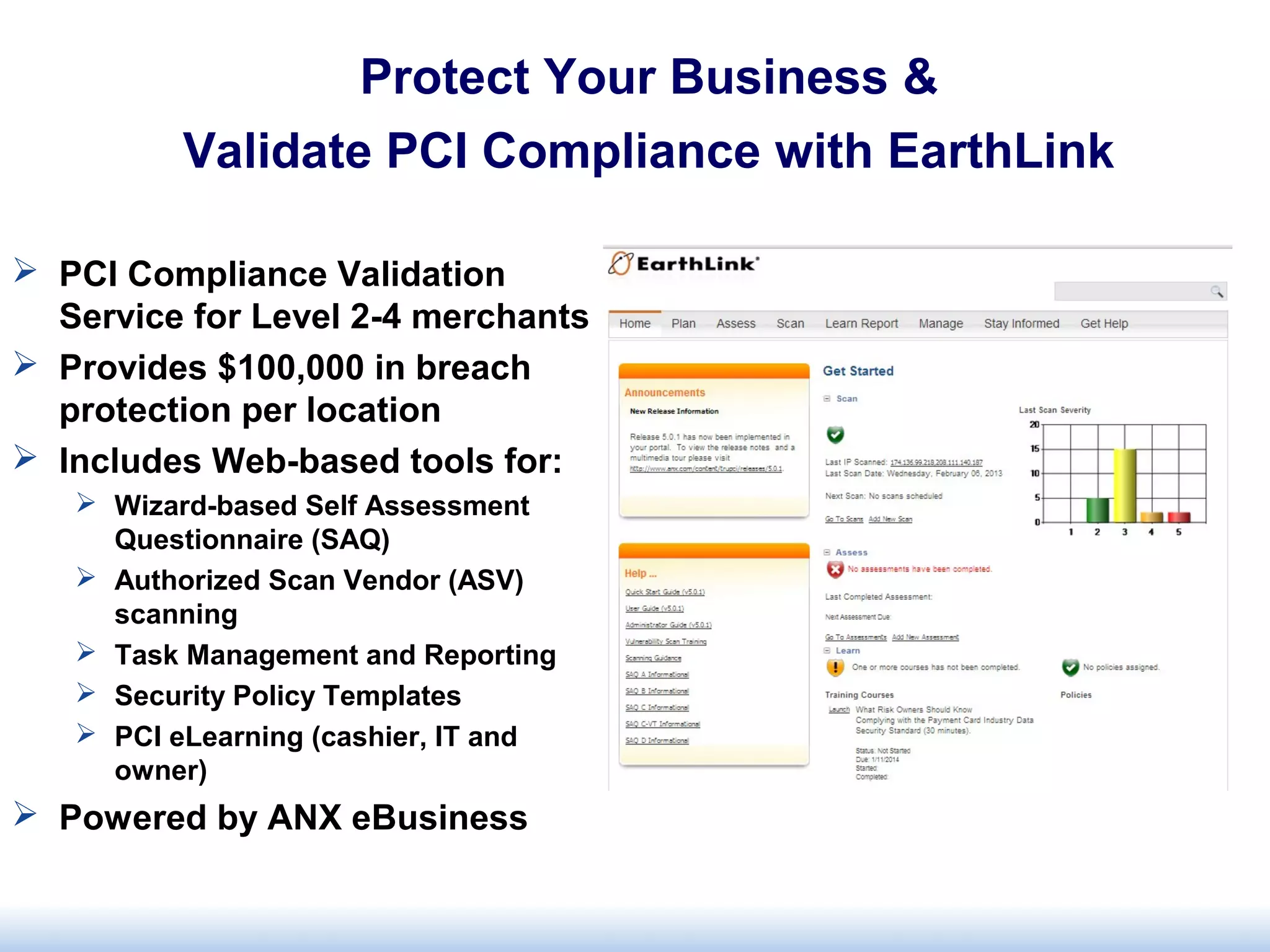

The document discusses Payment Card Industry Data Security Standard (PCI-DSS) compliance. It was established in 2004 to reduce credit card fraud and requires businesses that accept credit cards to follow security standards. There are six control objectives and over 280 audit procedures companies must pass to be compliant. Non-compliance can result in fines and loss of the ability to accept credit cards. The document outlines the steps businesses should take to achieve and maintain PCI compliance, including validating compliance through audits or scans, addressing security issues, ongoing employee training, and using a compliance partner.