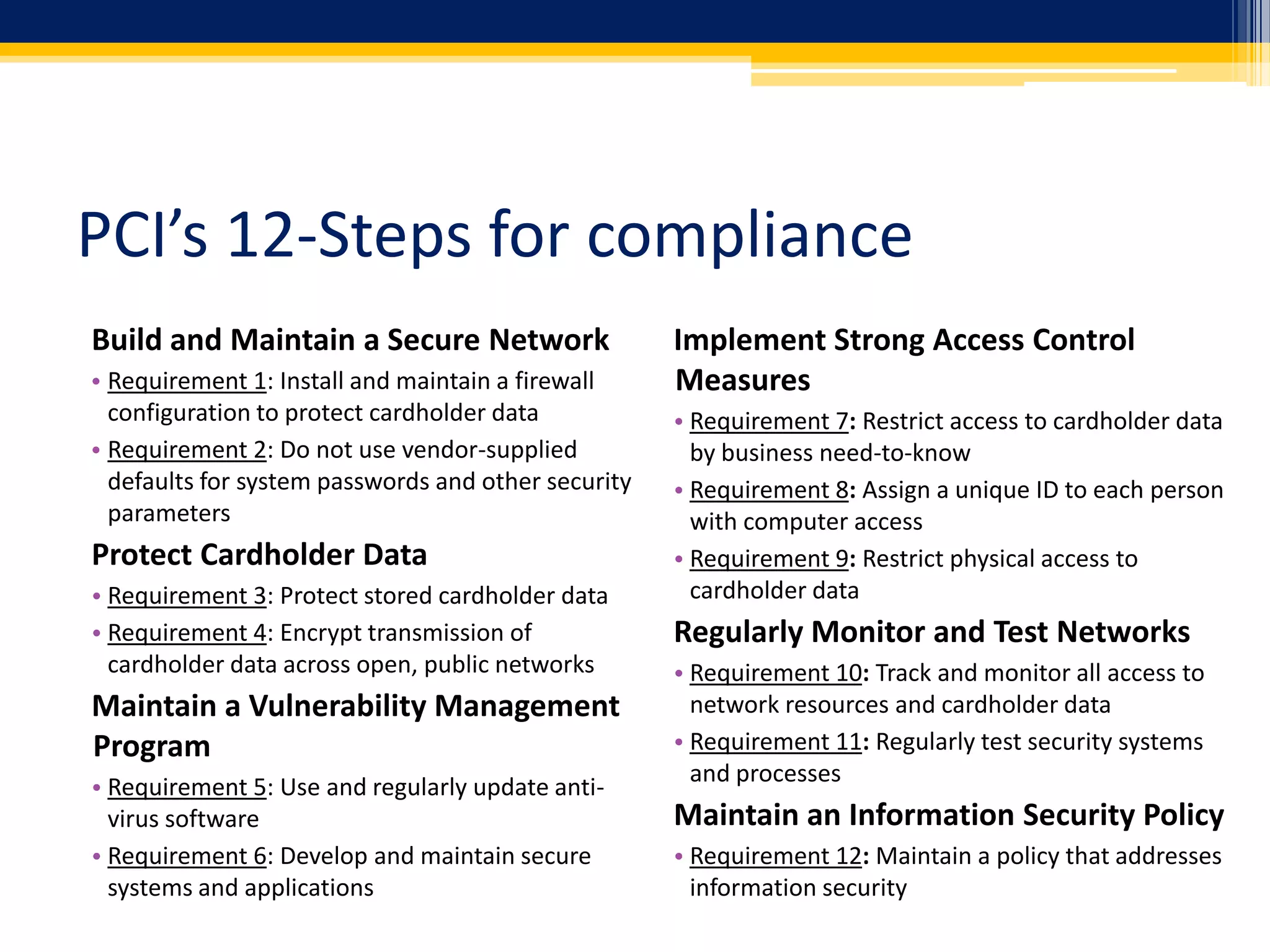

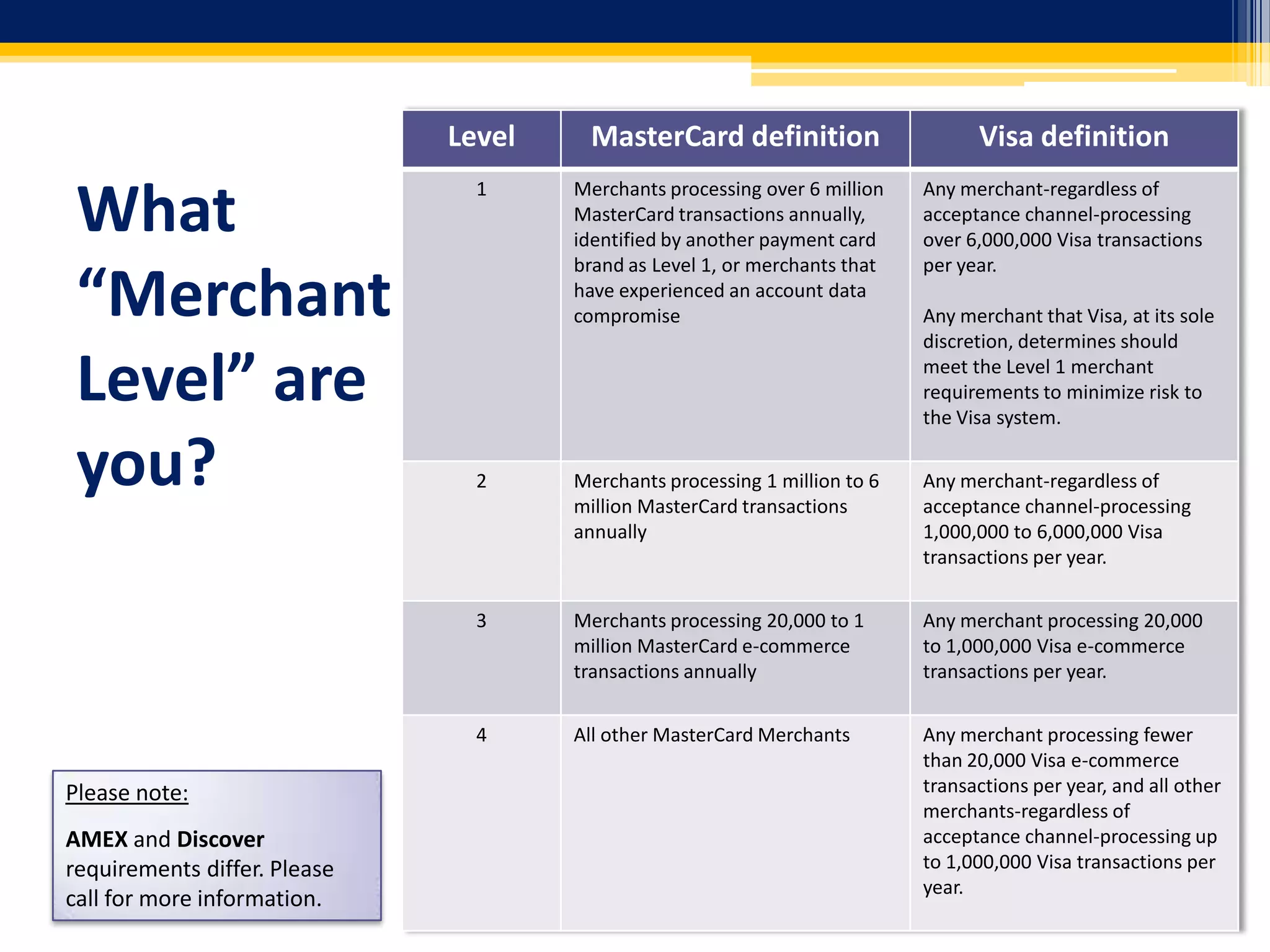

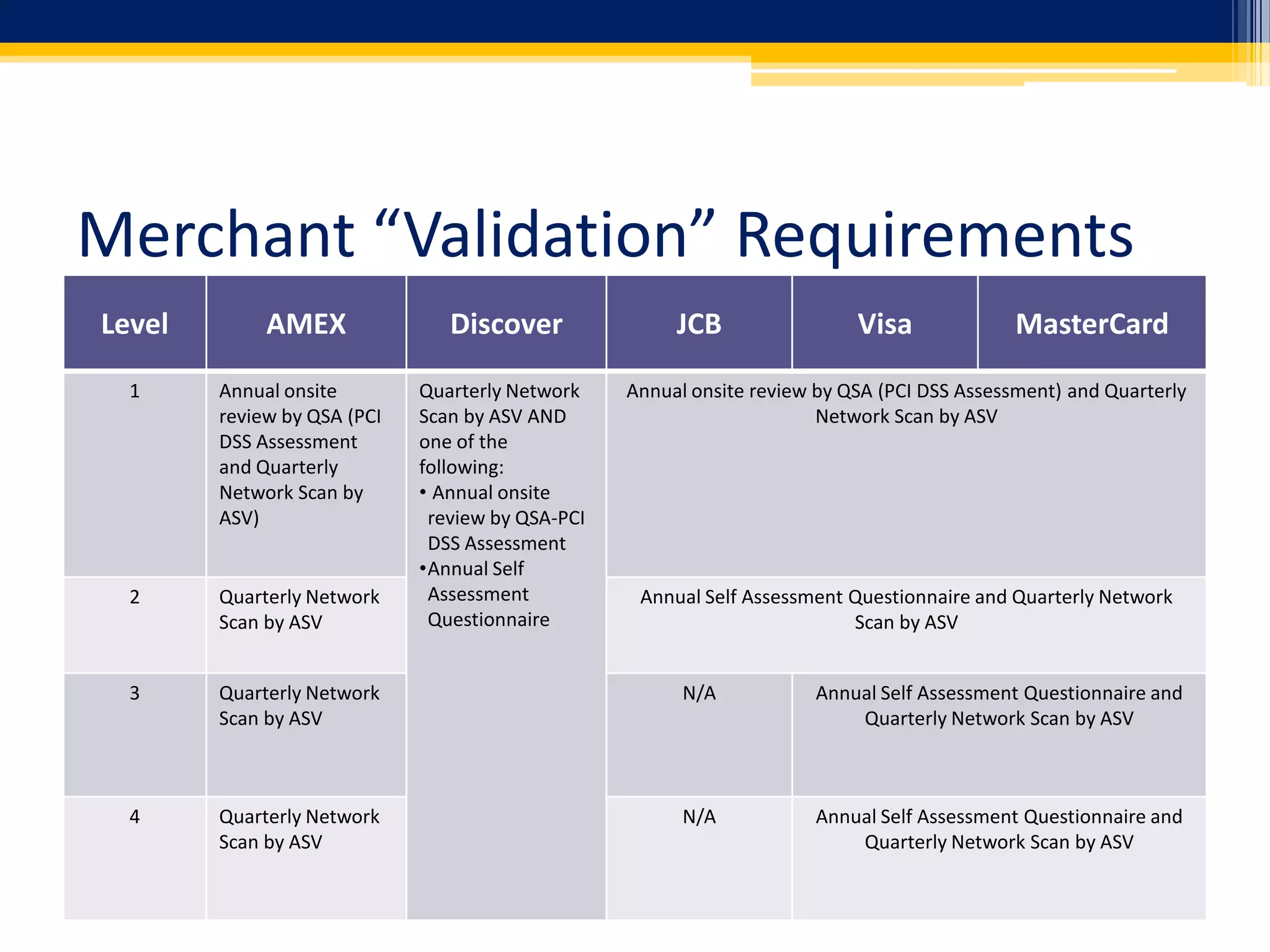

This document summarizes the services of SAQ 4 U, a company that helps small businesses comply with the PCI Data Security Standard (PCI-DSS) by completing the Self-Assessment Questionnaire (SAQ) on their behalf. SAQ 4 U determines the required SAQ form based on a business's transaction volume and payment card industry merchant level. They then complete the form, review the results, and guide the business through the validation process. Their services help businesses comply with PCI-DSS requirements without needing to hire a costly Qualified Security Assessor.