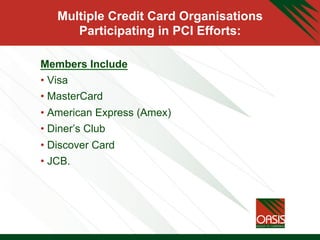

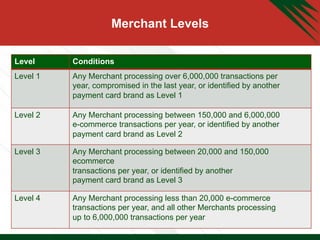

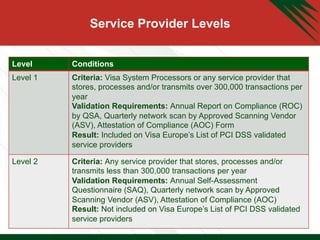

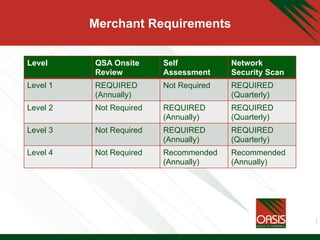

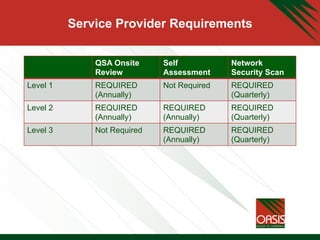

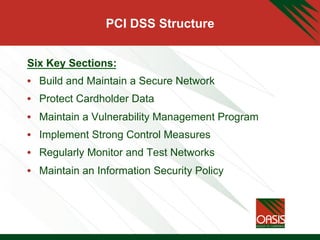

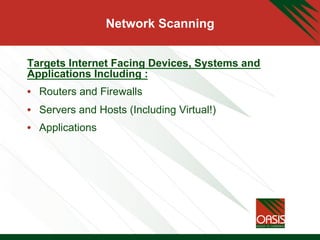

This document summarizes a presentation about Payment Card Industry Data Security Standards (PCI DSS) compliance. It discusses what PCI DSS is, the different compliance levels for merchants and service providers, validation requirements, and PCI DSS requirements. It also summarizes how the presenter's company achieved compliance, the benefits of compliance, and lessons learned. The overall presentation provided an overview of PCI DSS compliance for those processing, storing, or transporting payment card data.