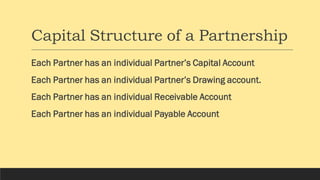

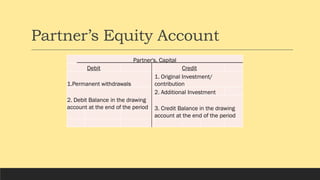

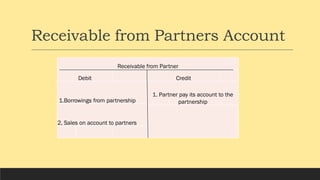

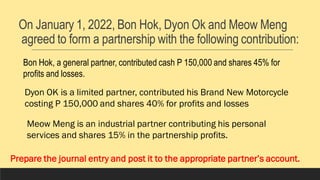

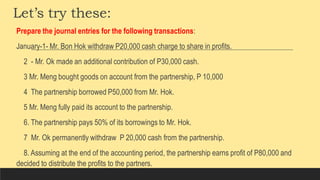

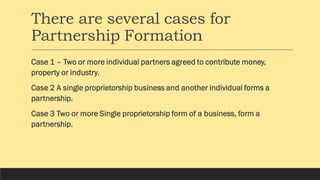

This document discusses accounting for partnership formation. It covers the capital structure of a partnership, including each partner having individual capital, drawing, receivable, and payable accounts. It provides an example of three partners - Bon Hok, Dyon Ok, and Meow Meng - forming a partnership by contributing cash and assets. The contributions and ownership percentages are listed. Journal entries are prepared for various partnership transactions, including partner contributions, withdrawals, purchases/payments, borrowings, and profit distributions. Finally, it briefly outlines three cases for partnership formation: two or more individuals forming a partnership, a sole proprietorship partnering with an individual, and two sole proprietorships forming a partnership.