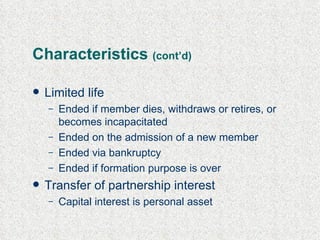

1. A partnership is a business owned by two or more people who share ownership and responsibility.

2. Partnerships have advantages like pooling resources and low costs but partners have unlimited liability for business debts.

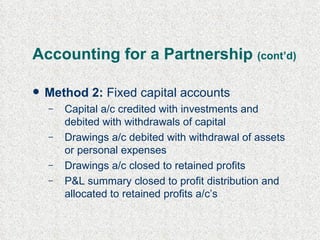

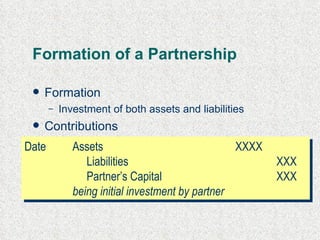

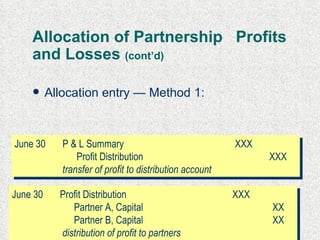

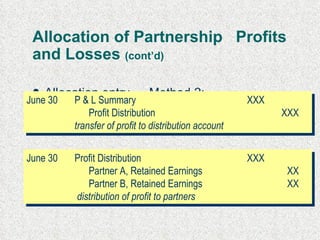

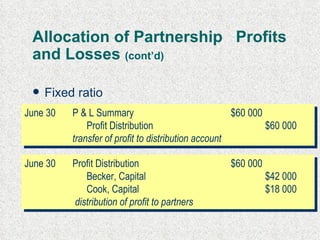

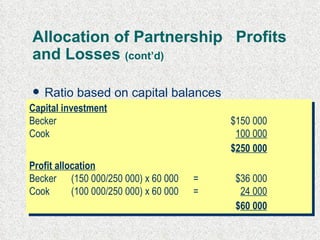

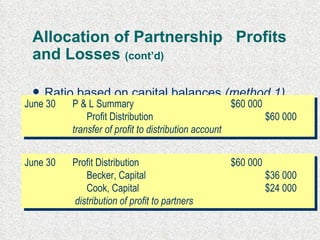

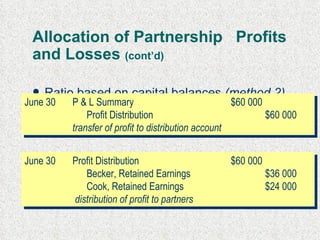

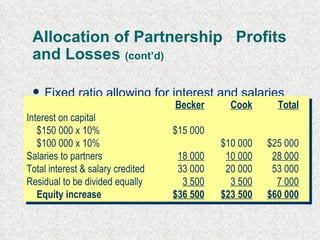

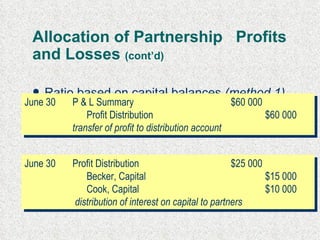

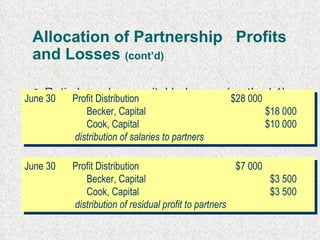

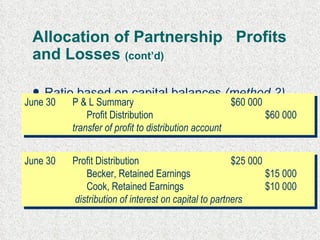

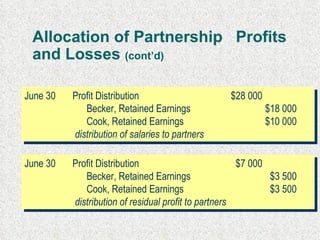

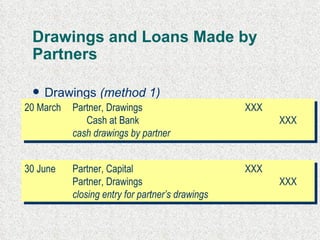

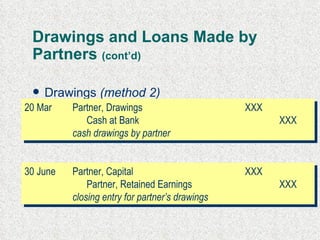

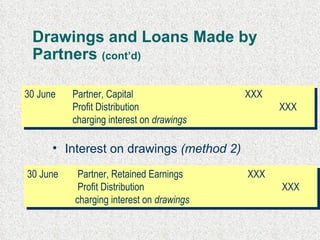

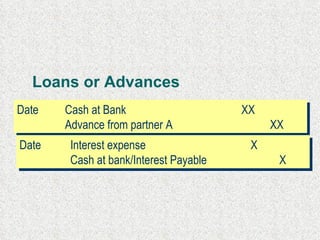

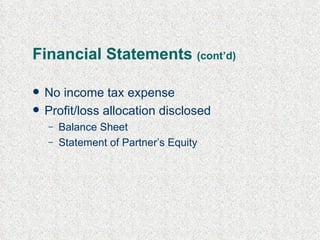

3. Accounting for partnerships involves recording partner investments, allocating profits/losses, and tracking partner drawings. Financial statements report each partner's equity separately.