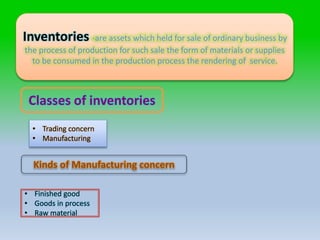

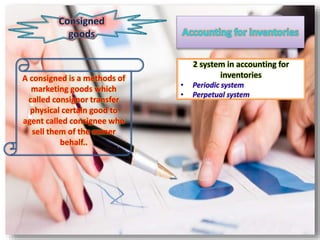

The document provides information about an inventory class including:

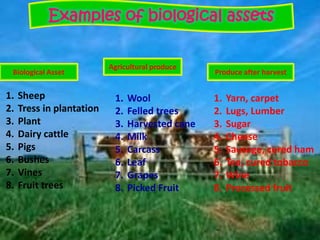

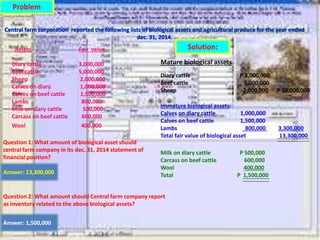

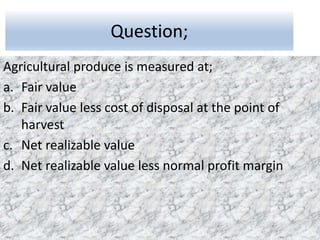

- Topics covered inventories, inventory valuation, biological assets, gross profit, and retail inventory method.

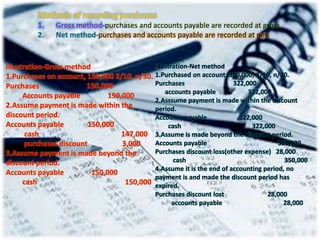

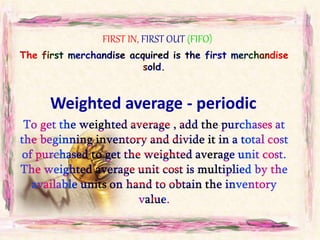

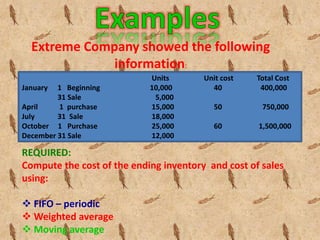

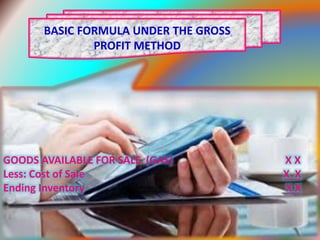

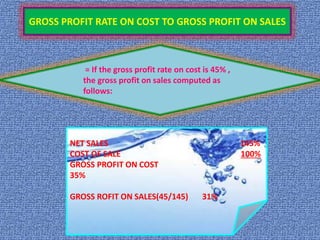

- Formulas and calculations for inventory costing methods like FIFO, weighted average, and retail inventory method are presented.

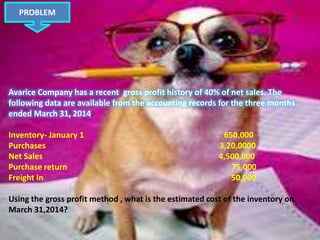

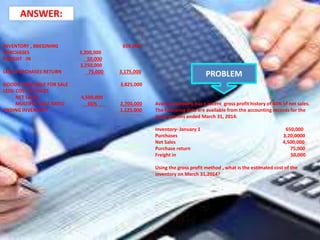

- An example problem demonstrates estimating ending inventory cost using the gross profit method.