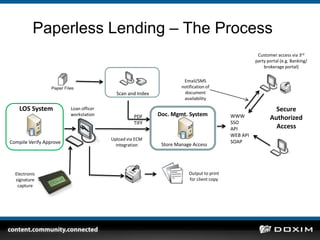

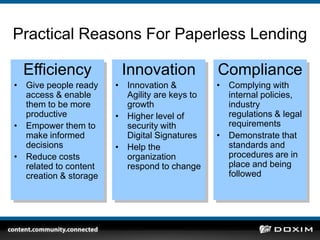

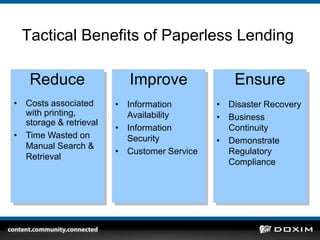

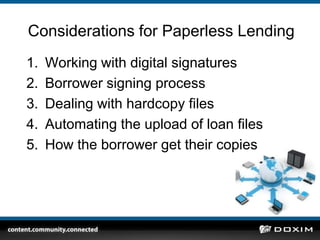

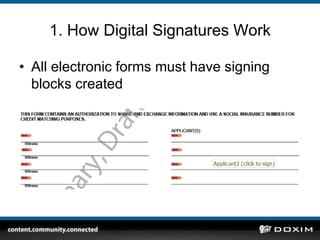

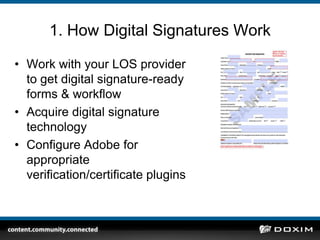

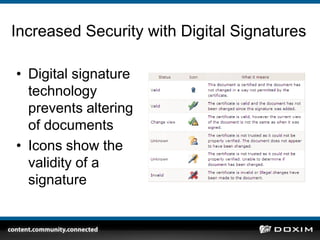

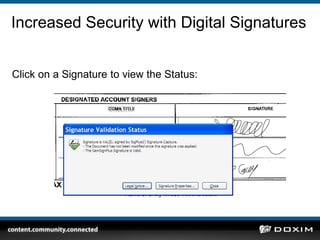

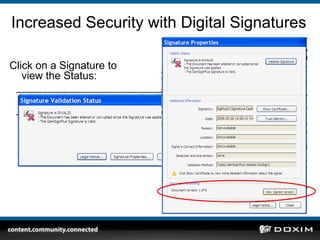

The document discusses the transition to paperless lending, highlighting its benefits such as streamlined processes, reduced costs, and improved operational efficiencies. It outlines the challenges posed by paper-based systems and provides practical steps for implementing a paperless environment, including the use of digital signatures and electronic workflows. Ultimately, it emphasizes that moving to a paperless system can enhance security, compliance, and customer service.