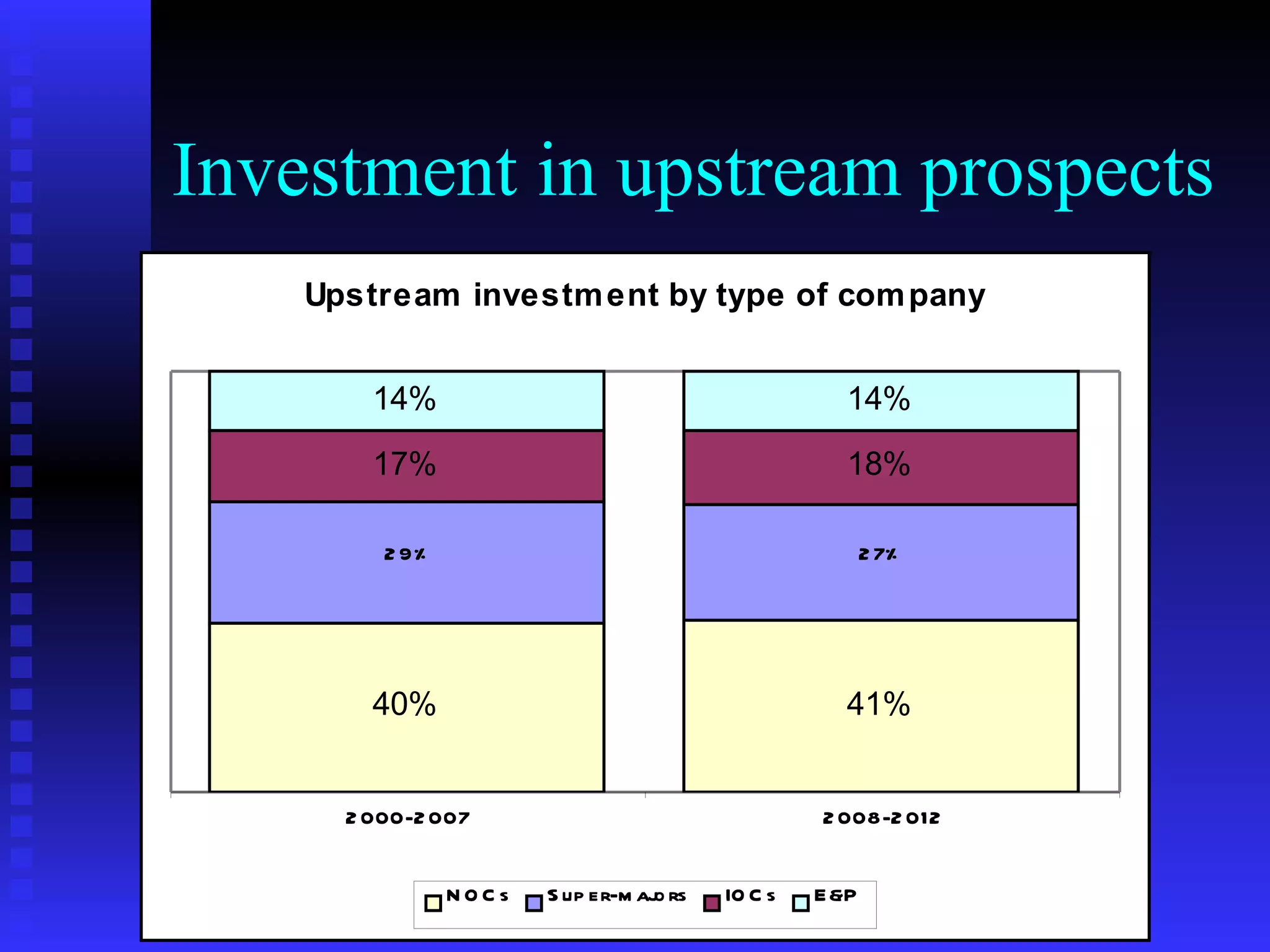

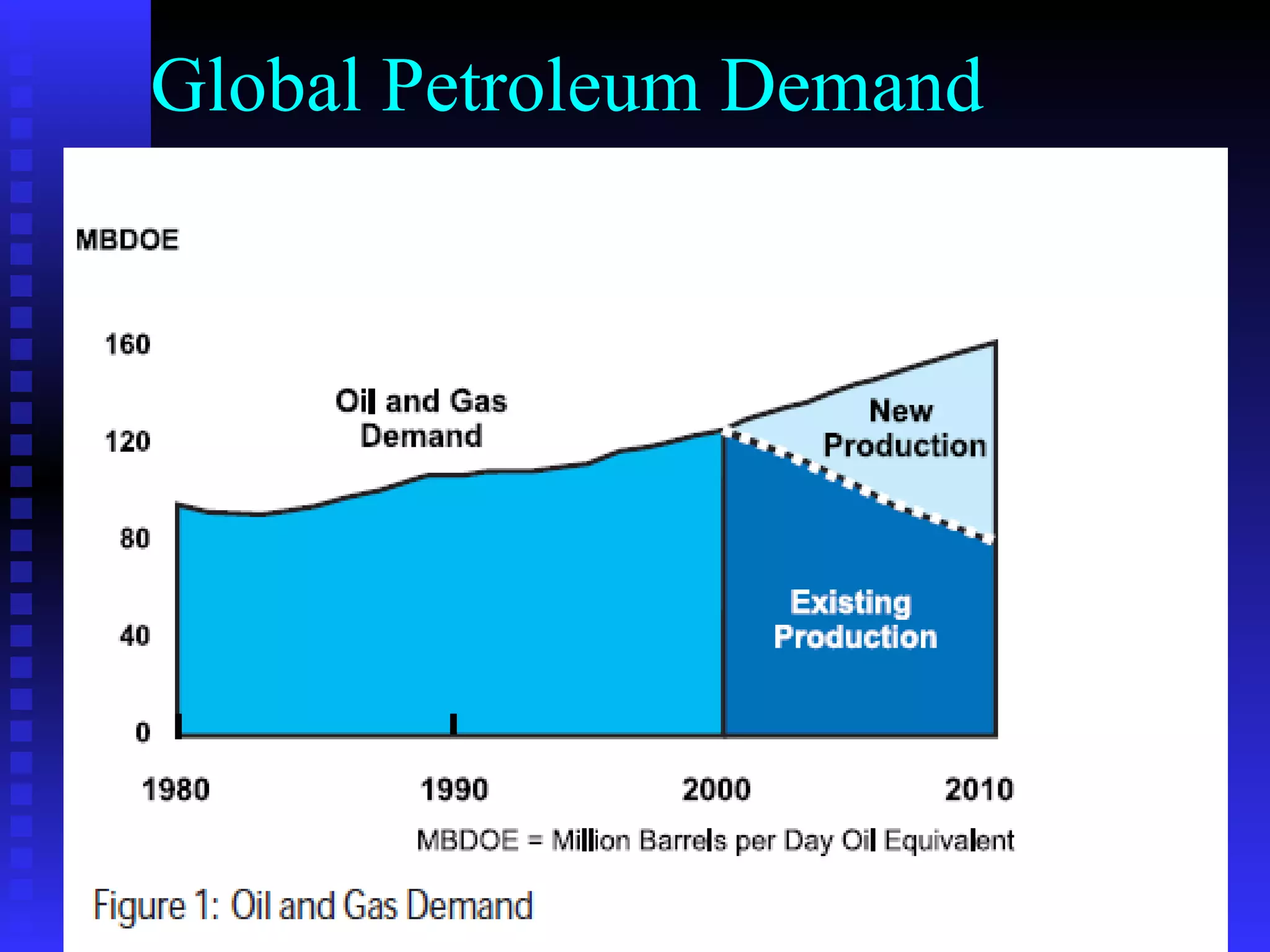

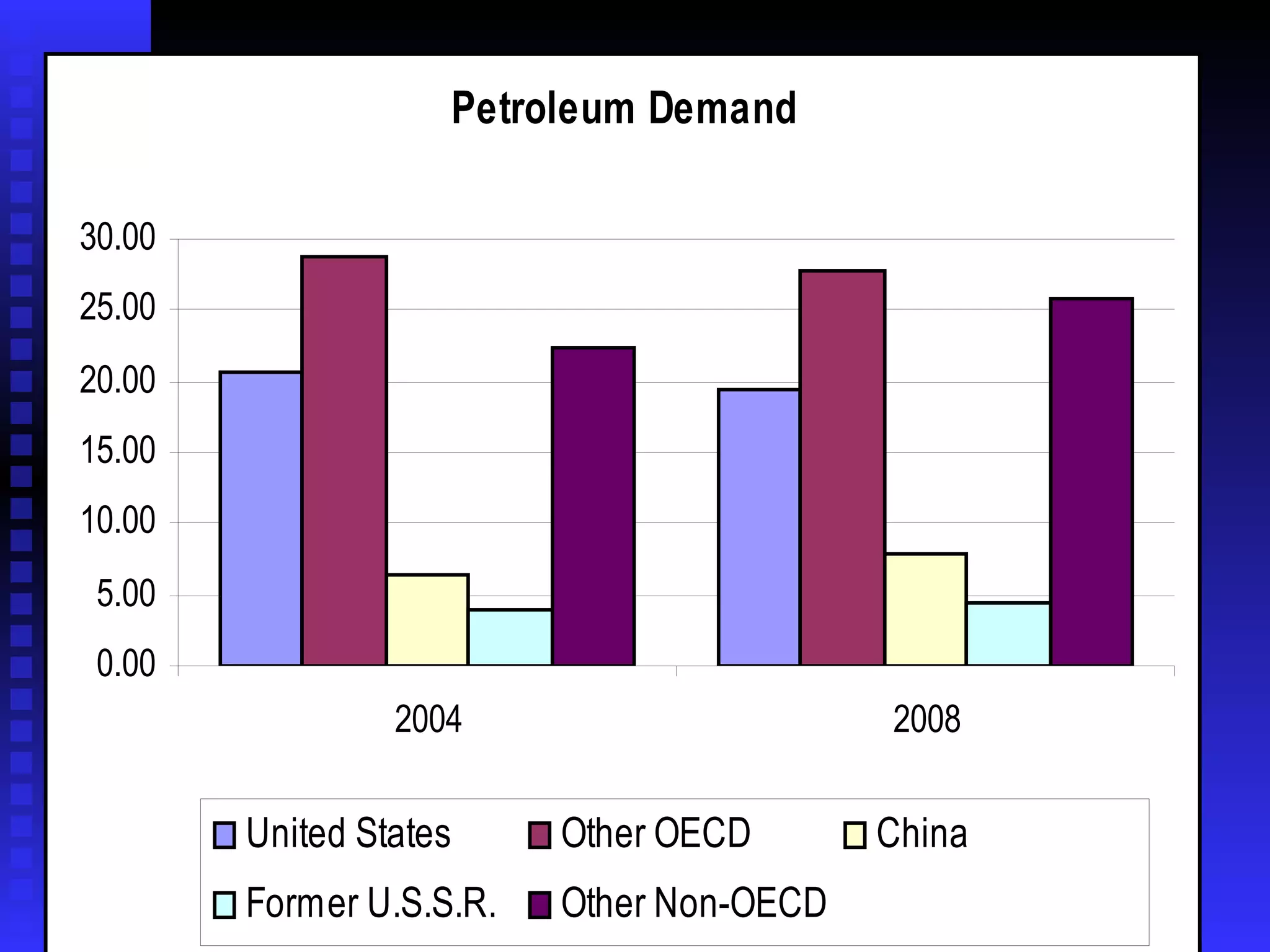

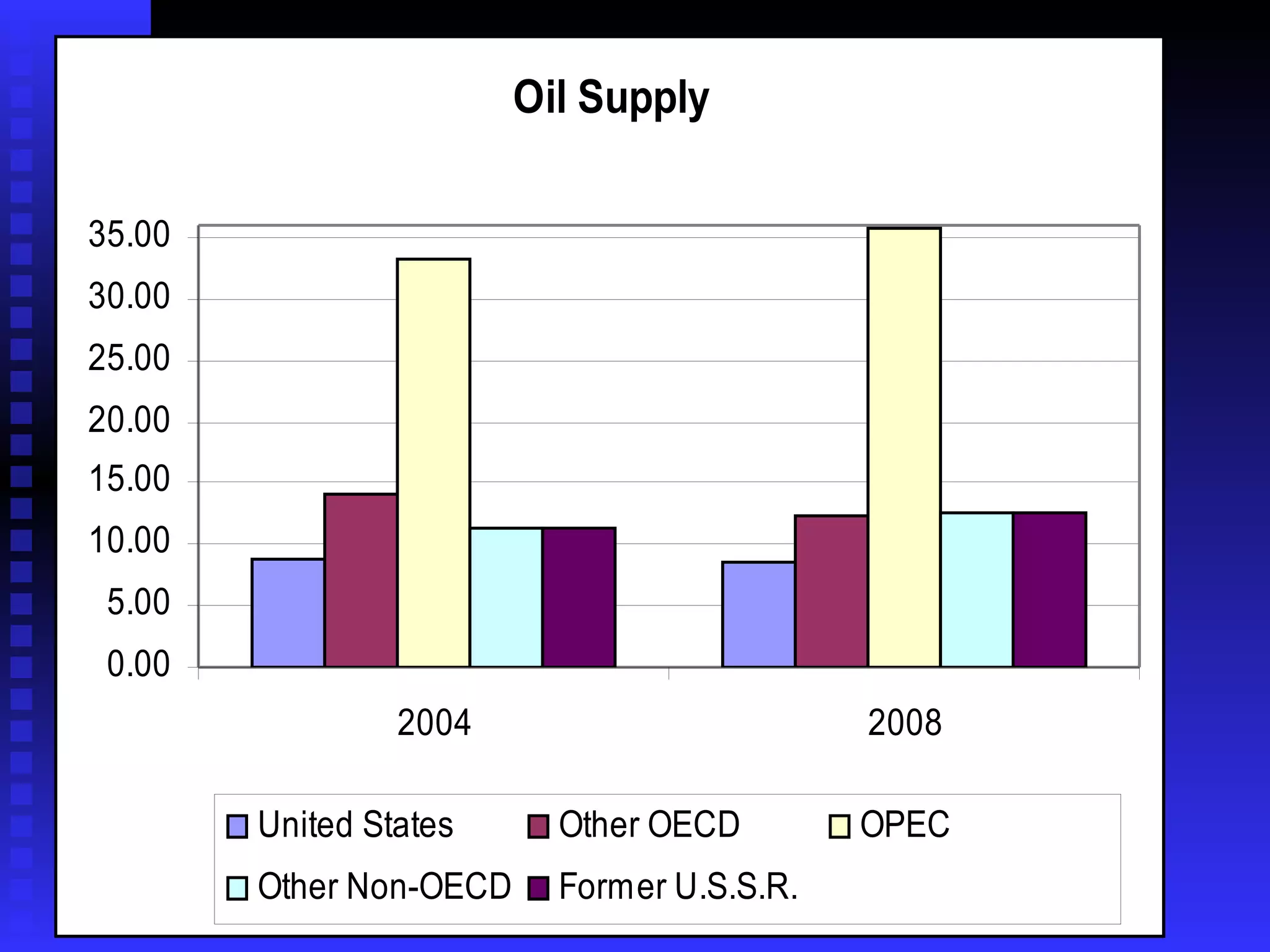

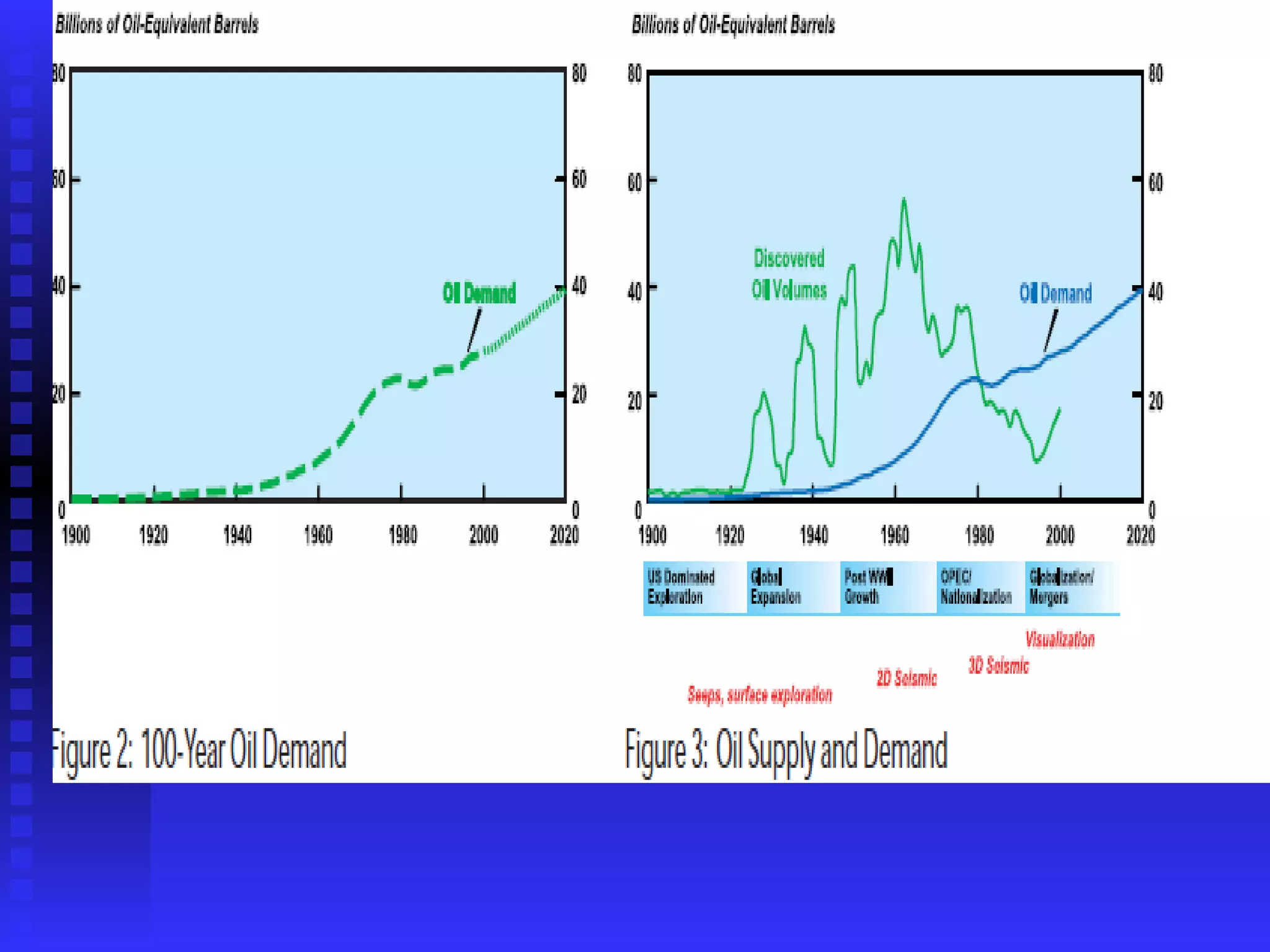

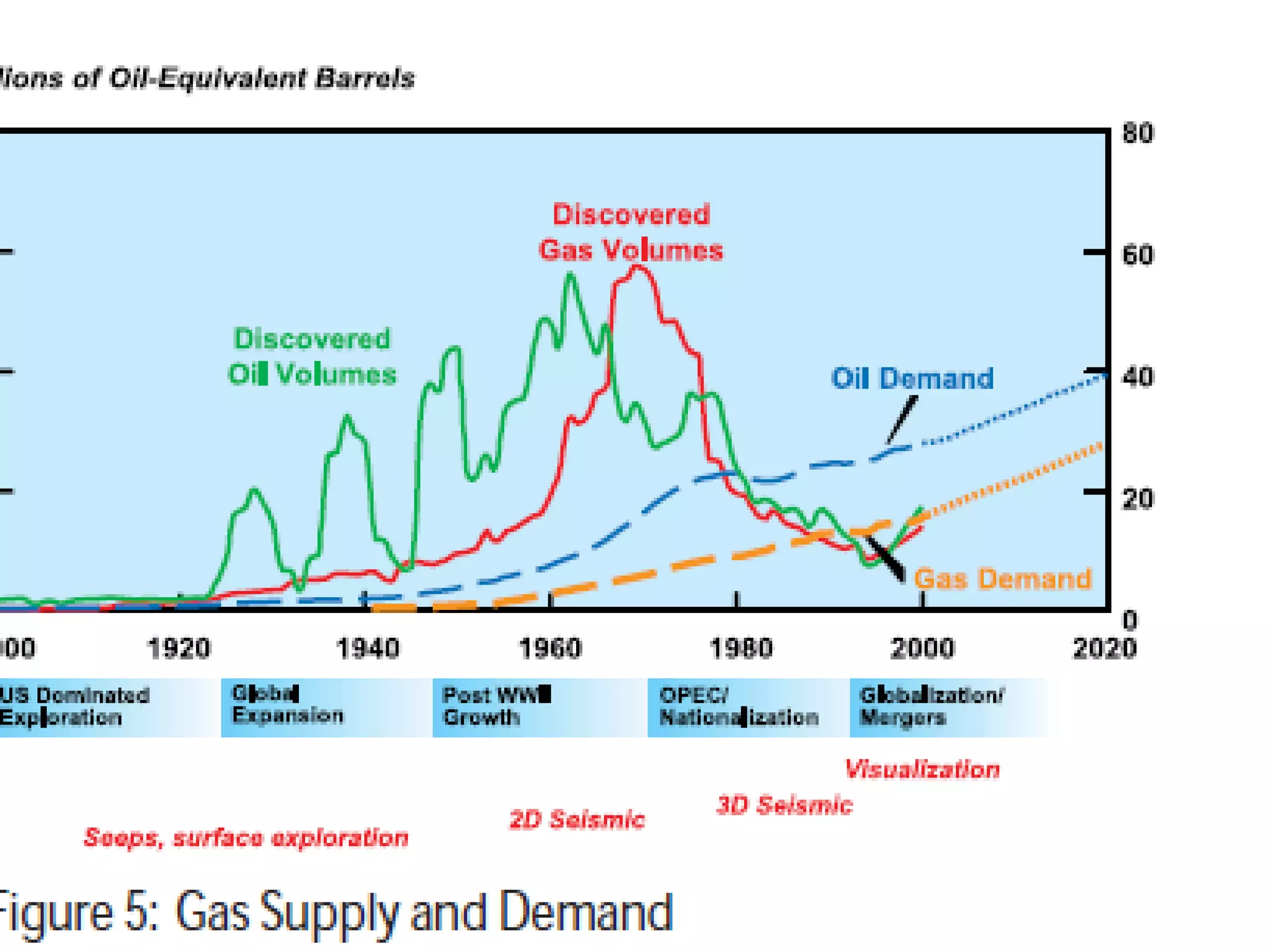

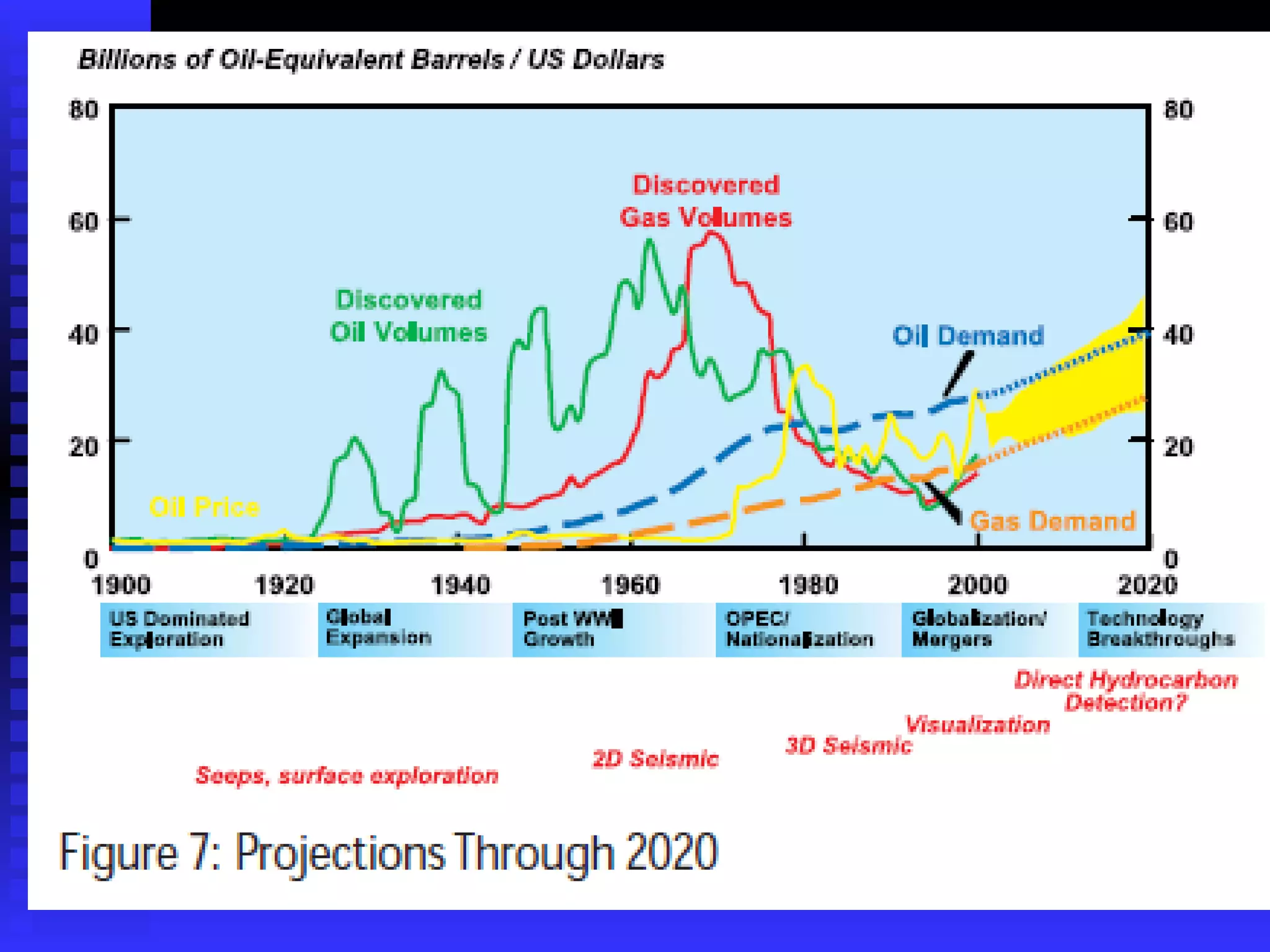

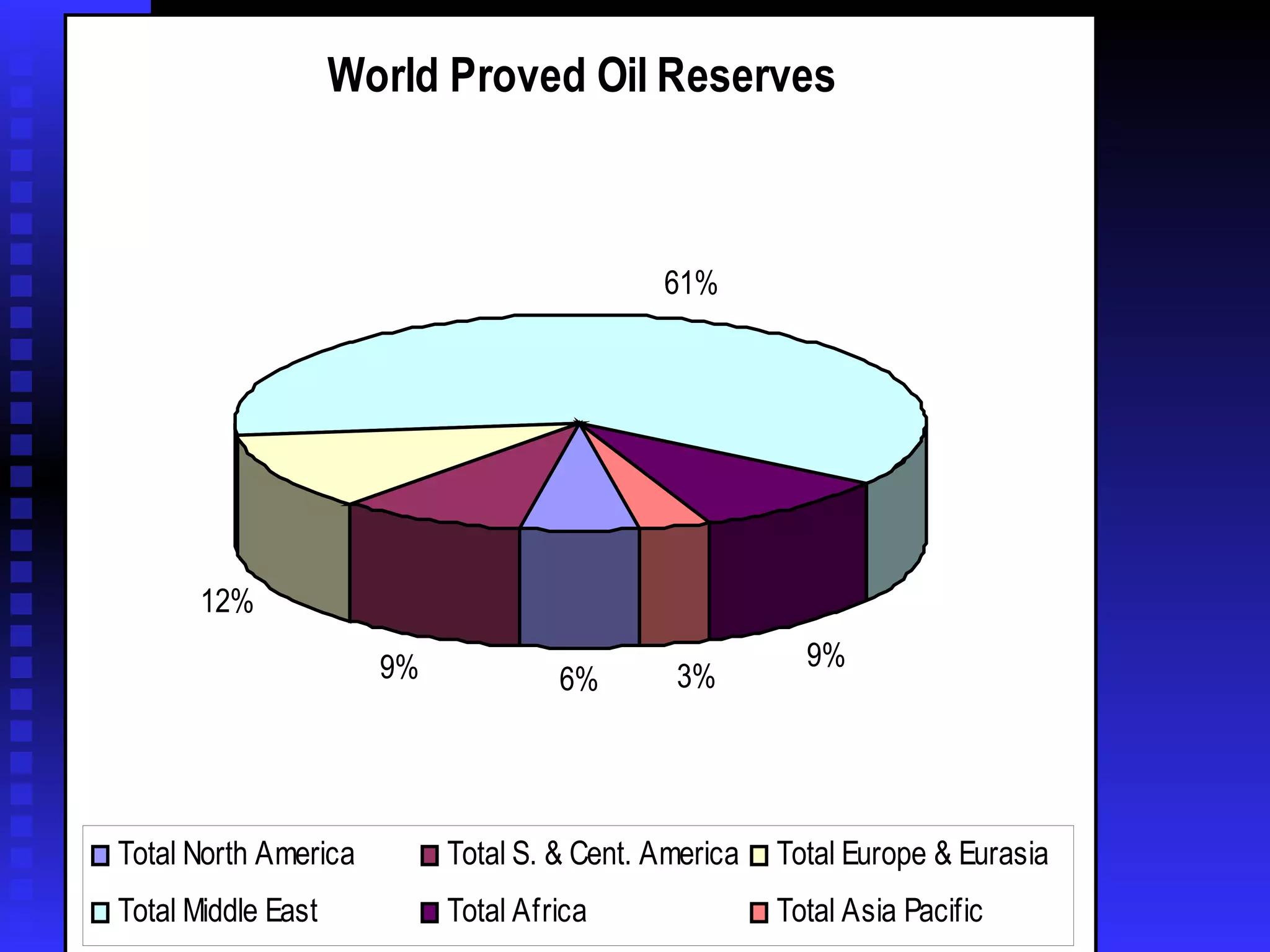

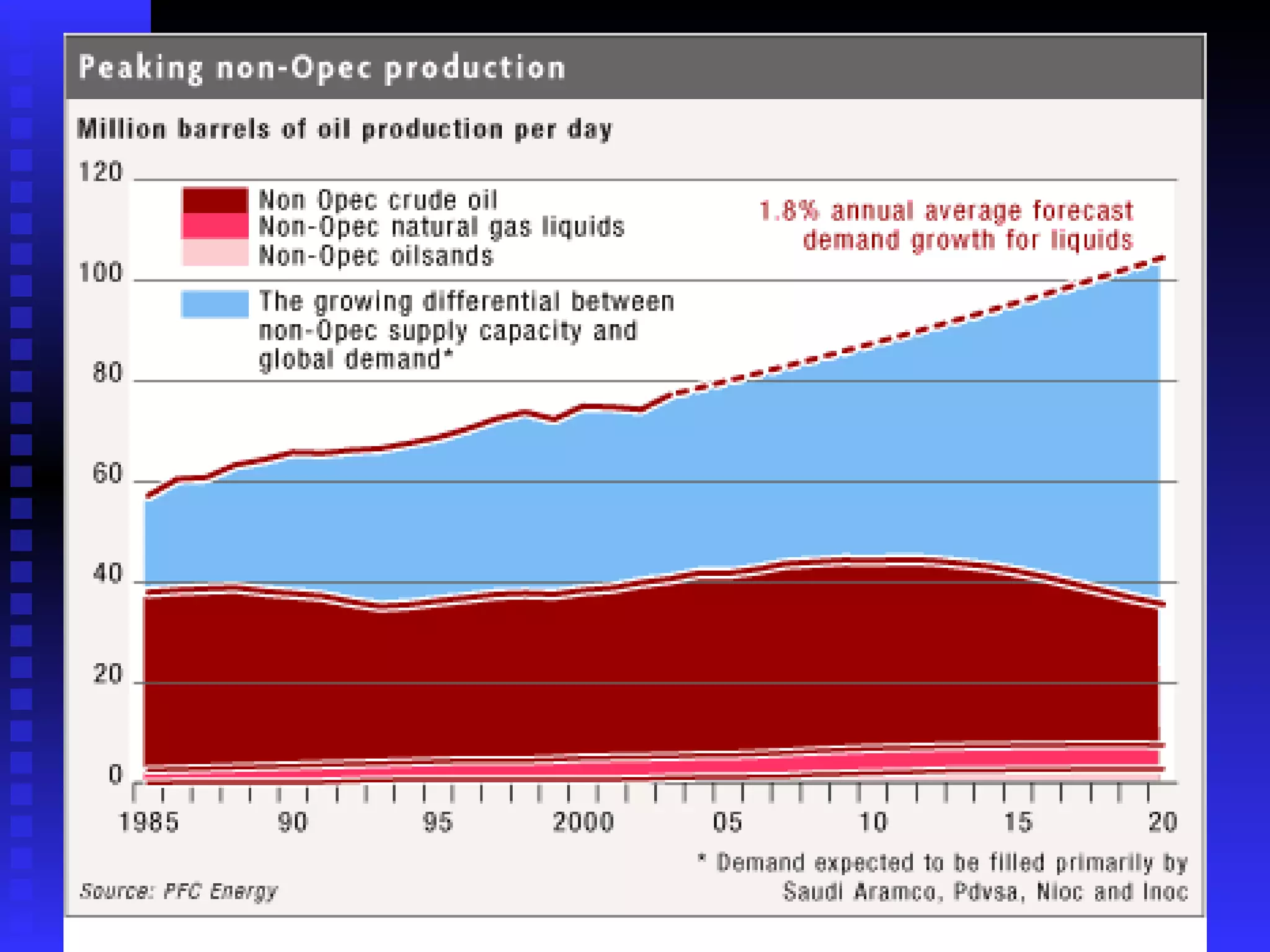

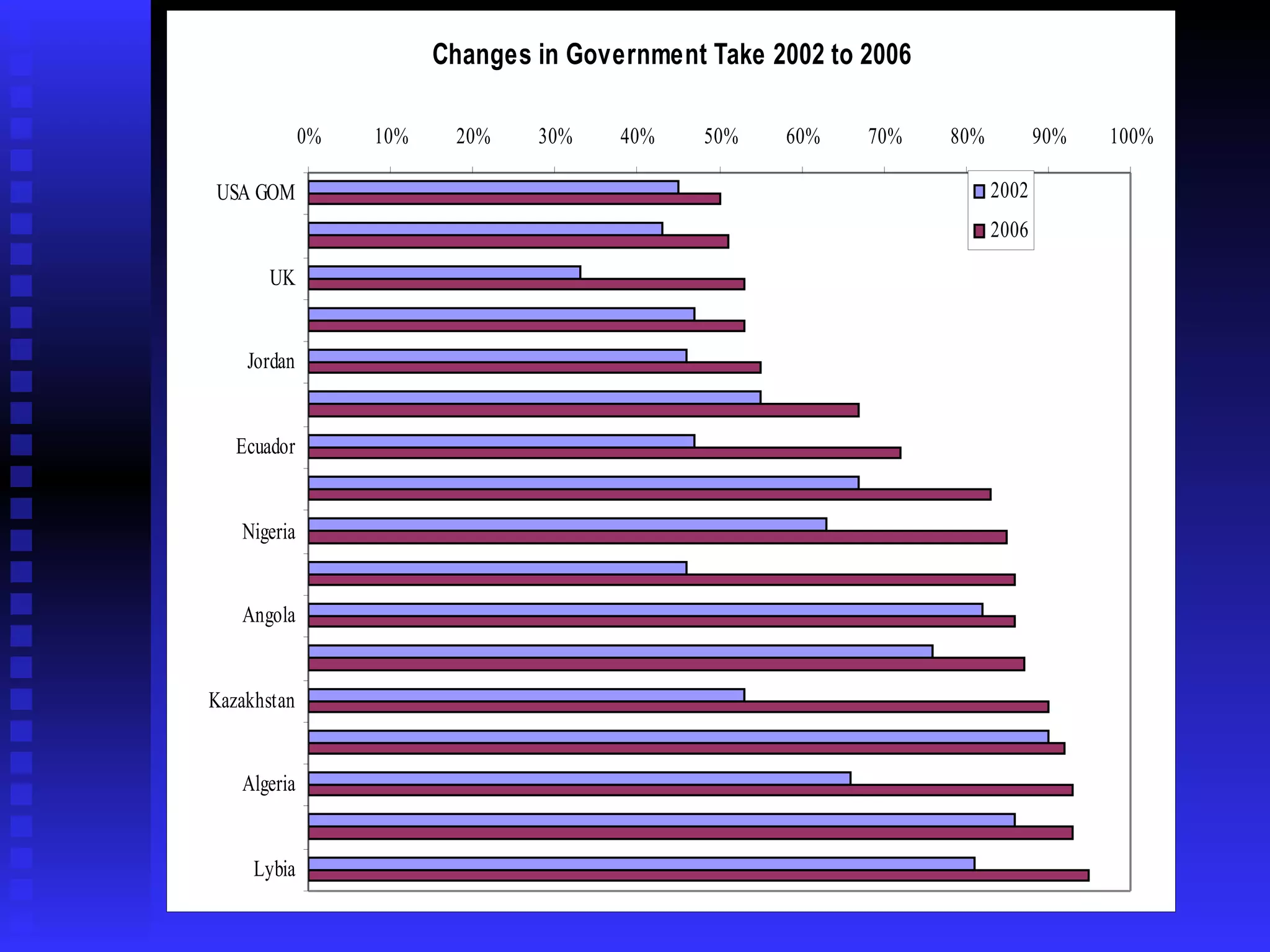

The oil and gas industry has undergone major global structural changes in recent decades. Major oil and gas producers include OPEC countries in the Middle East and Africa, while the US and other developed countries are the largest consumers. Future production is expected to increasingly come from countries like Saudi Arabia, Venezuela, Iran and Iraq as non-OPEC supplies decline. National oil companies now play a larger role alongside private companies and competition for resources has grown internationally.