- E-Business Tax was introduced in R12 to provide an improved tax solution and integrate tax determination across applications like Purchasing.

- Previously, tax was defined separately in Accounts Payable and could only be defaulted based on limited hierarchies. Country-specific requirements could not be easily incorporated.

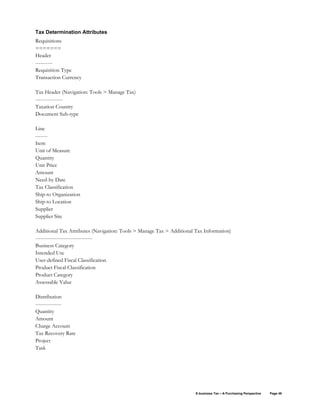

- E-Business Tax provides a centralized repository and common set of services to determine, manage, record, and report tax consistently across transactions and applications. It supports tax rules based on jurisdiction, products, parties, and other attributes to accurately calculate taxes.