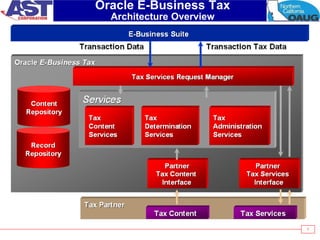

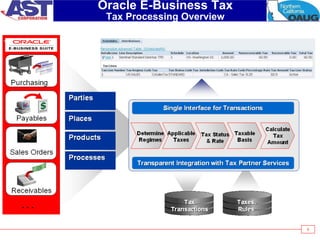

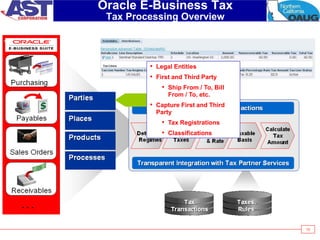

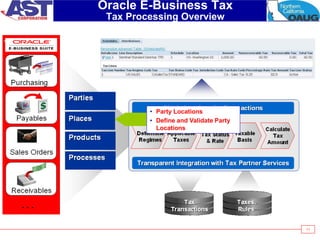

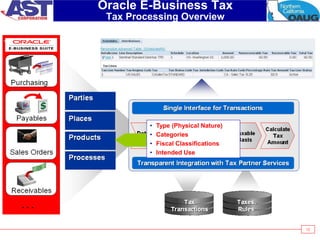

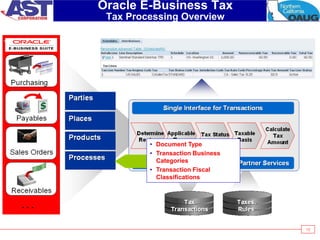

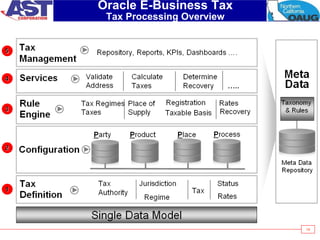

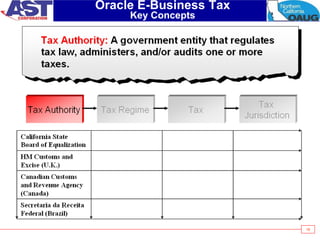

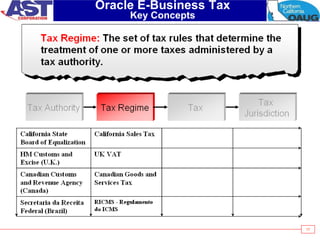

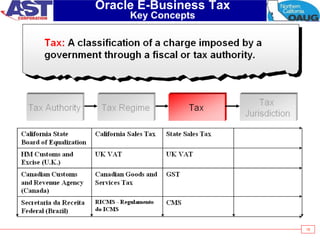

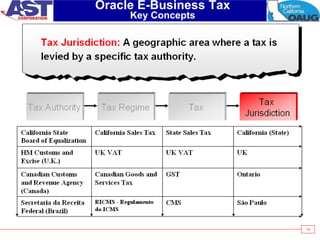

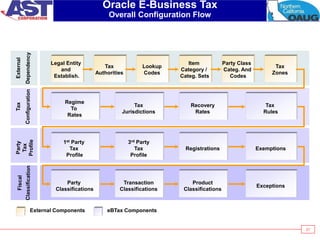

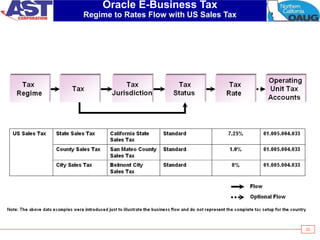

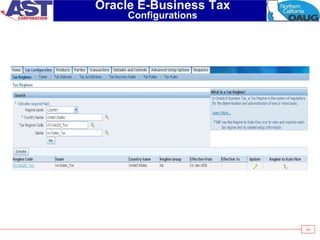

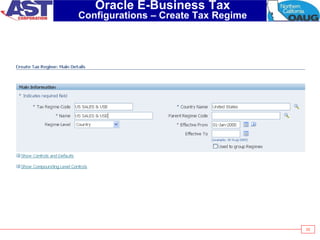

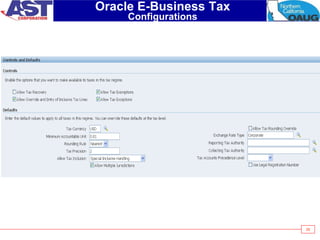

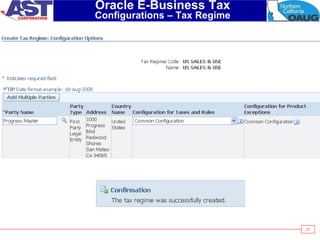

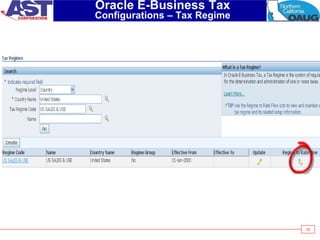

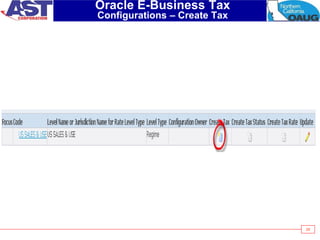

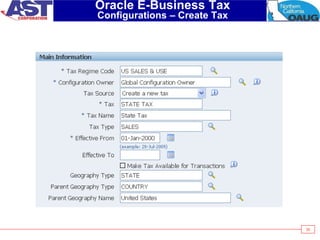

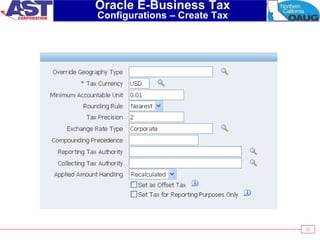

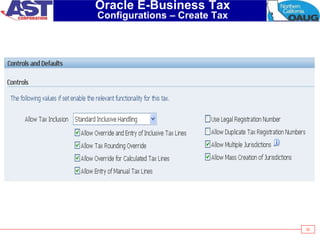

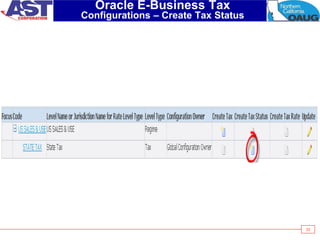

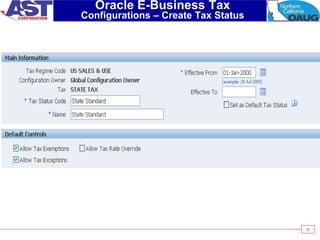

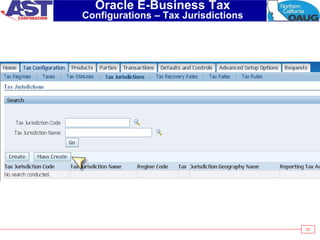

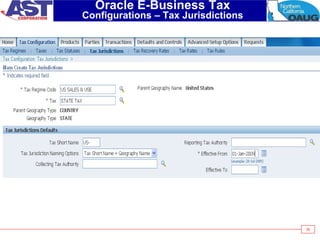

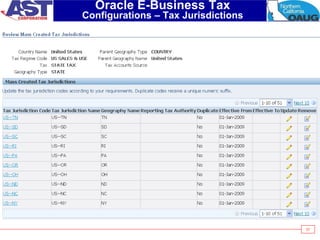

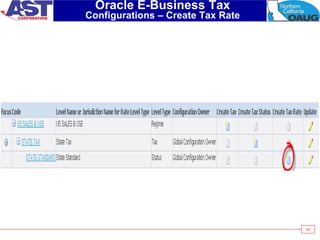

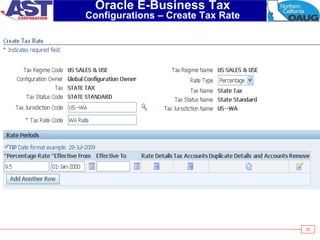

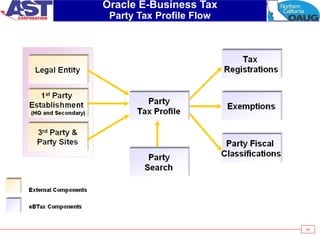

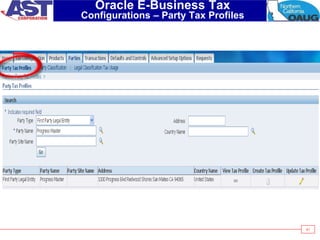

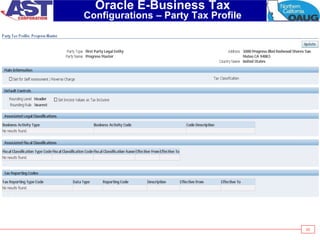

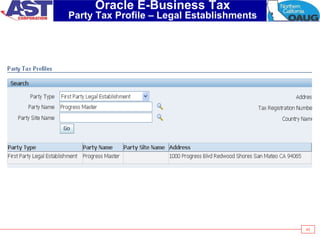

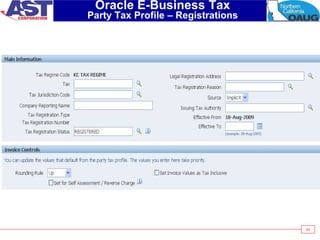

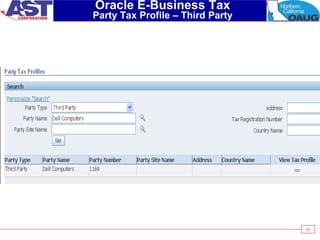

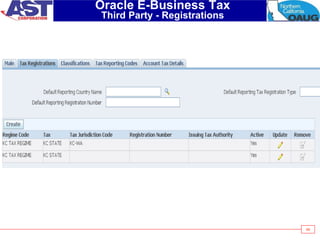

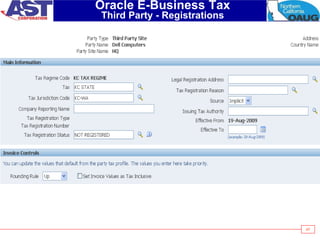

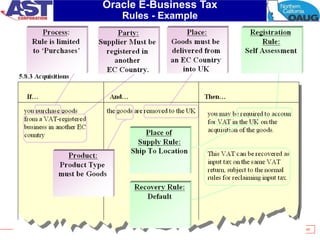

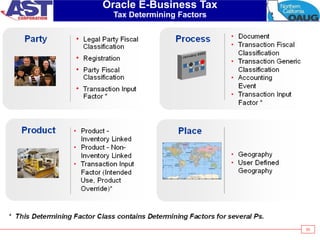

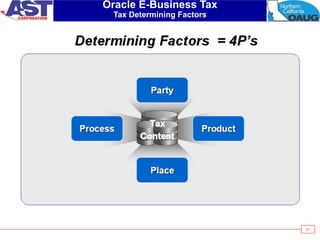

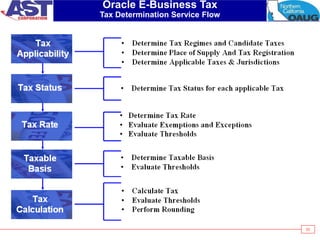

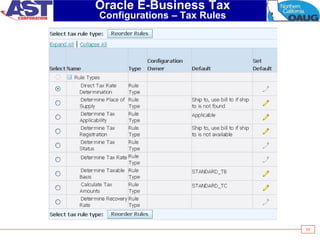

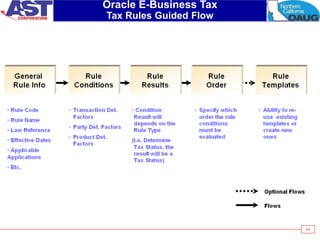

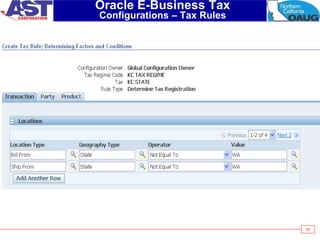

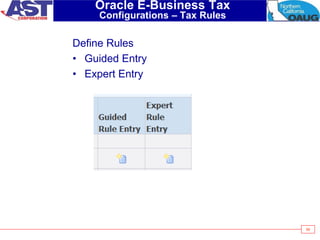

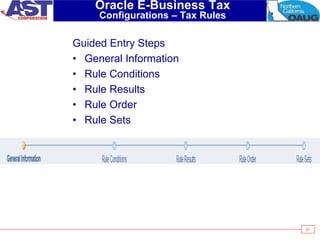

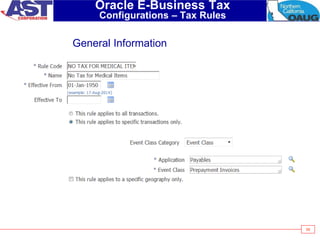

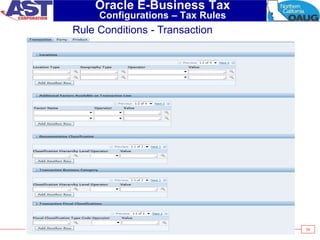

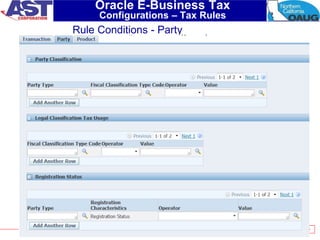

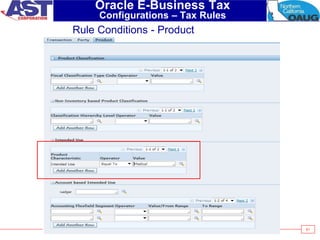

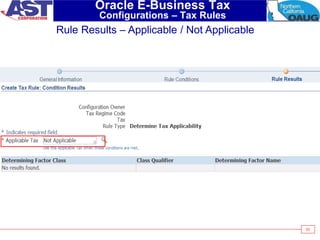

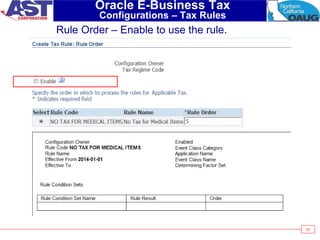

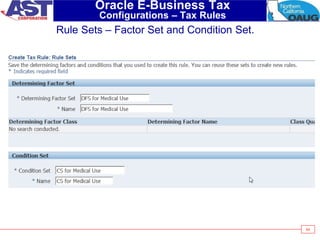

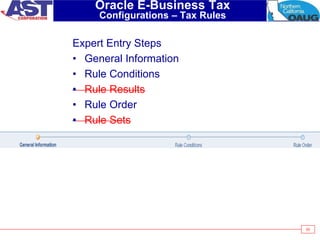

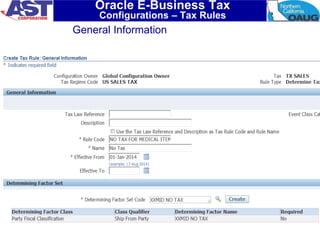

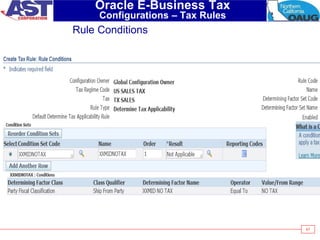

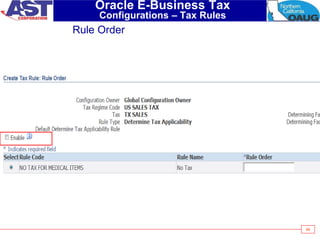

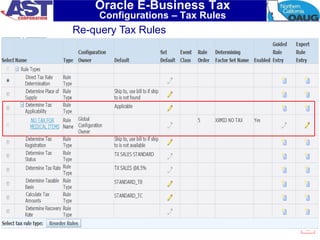

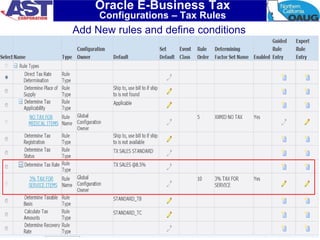

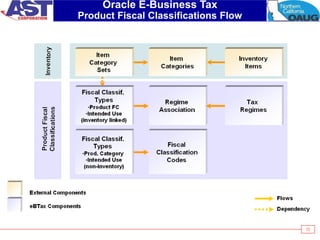

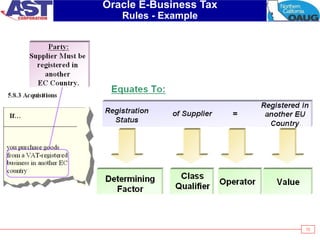

This document provides an overview of configuring complex rules in Oracle E-Business Tax. It begins with an agenda and introduction to E-Business Tax. It then covers the architecture, tax processing overview, key concepts, and overall configuration flow. The majority of the document focuses on specific configurations for tax regimes, rates, jurisdictions, profiles, and rules. It provides examples and screenshots for setting up rules using the guided and expert entry methods. The presentation aims to explain the end-to-end process for configuring rules in Oracle E-Business Tax.